AUD/JPY - Markets Swing as Global Growth Falters - 10/20/2014 (GMT)

- Who voted?

- 575

- 0

- Chart + Trading signal

- Signal : Buy signal

- |

- Entry price recommended : 93,73

- |

- Stop loss : 93,23

- |

- Take profit : 94,23

- Timeframe : Weekly

AUD/JPY Chart

In the month of October alone, more than USD3.2 trillion was wiped off from the value of world shares as the International Monetary Fund (IMF) cut its outlook for global growth in 2015.

The main areas of weakness extend from Europe to China. Even the Ebola threat in Africa has added to the panic selling in world markets. The risk-off sentiment spurred the fastest purchases of gold held through exchange-traded prodict (ETPs) since July this year.

The gain in the net-long position in New York gold futures and options snapped the longest run of reductions since 2010, causing prices to rise for a second week as global equities retreated to an eight-month low. Short holdings betting on a decline shrank 1.7 percent. Spot gold touched USD1,249.52 an ounce last week.

Japan

The Topix slipped 5.3 percent last week to leave it down 13 percent from a six-year high reached in September. The main reason for the drop was caused by news that Japan’s USD1.2 trillion Government Pension Investment Fund, or GPIF, will boost its holdings of foreign bonds and stocks to a combined level of about 30 percent from 23 percent, while reducing domestic notes to 40 percent from the current 60 percent. GPIF is currently the largest pension fund in the world.

China

China’s top Communist Party officials will gather in Beijing this week for their fourth plenum, with an update on gross domestic product for Asia’s largest economy due tomorrow. According to the median estimate of 47 economists compiled by Bloomberg, China’s economy probably grew 7.2 percent in the third quarter from a year earlier. That would be a retreat from the 7.5 percent expansion recorded for the second quarter and the slowest pace of growth since 2009.

China’s central bank is said to plan the injection of about 200 billion yuan into some national and regional lenders to help them prepare for year-end liquidity needs. The injection comes after the central bank provided 500 billion yuan of liquidity to China’s five biggest banks last month.

Europe

The European Union’s (EU) 28 leaders will meet for a 2 day summit in Brussels this week, as snapshots of the crisis that emerged in Greece five years back seem to reappear. Last week, yields on 10-year bonds from Greece, which has been considering ending its bailout program early, jumped to 8.656 per cent from 7.854 per cent. Stock markets in Europe have also fallen by more than 3 percent, contributing to the global stock market rout of more than USD3 trillion so far this month. The economy of the 18-nation euro area stagnated in the second quarter and inflation, at 0.3 percent last month, isn’t seen returning to the European Central Bank’s target of 2 percent before 2017. With the apparent slack in Europe, traders are expecting the European Central Bank (ECB) to start asset purchases within the next few days to support the economy.

While the Federal Reserve is on track to end its bond buying program this month amid the improving US economy, there is a slim chance that the remaining USD15 billion will not be totally removed after St Louis Fed Bank President James Bullard said that policy makers should consider delaying the end of this quantitative easing round given the global slowdown.

Should that happen, watch for the US dollar to weaken.

Top News This Week

Canada: Core retail sales m/m. Wednesday, 22nd October, 8.30pm.

I expect figures to come in at 0.3% (previous figure was -0.6%).

China: HSBC Flash Manufacturing PMI. Thursday, 23rd October, 9.45am.

I expect figures to remain at 50.2.

Trade Call

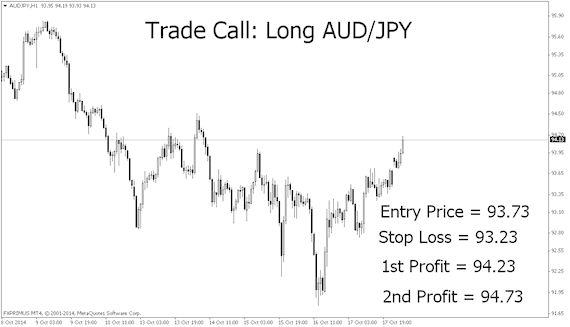

Long AUD/JPY at 93.73

On the H1 chart, AUD/JPY started a downtrend on 9th October and moved in excess of 400 pips. Today’s price action shows that the pair has broken out of the range and continues to climb with upward momentum. With a possible return to risk this week coupled with the weakening of the yen, I expect the AUD/JPY to continue to head up.

An entry is taken at 93.73 once prices retrace, and a 50 pip stop loss is placed just below the previous low. We will have two targets on this trade, exiting the first position at 94.23 and the second one at 94.73.

Entry Price = 93.73

Stop Loss = 93.23

1st Profit = 94.23

2nd Profit = 94.73

The main areas of weakness extend from Europe to China. Even the Ebola threat in Africa has added to the panic selling in world markets. The risk-off sentiment spurred the fastest purchases of gold held through exchange-traded prodict (ETPs) since July this year.

The gain in the net-long position in New York gold futures and options snapped the longest run of reductions since 2010, causing prices to rise for a second week as global equities retreated to an eight-month low. Short holdings betting on a decline shrank 1.7 percent. Spot gold touched USD1,249.52 an ounce last week.

Japan

The Topix slipped 5.3 percent last week to leave it down 13 percent from a six-year high reached in September. The main reason for the drop was caused by news that Japan’s USD1.2 trillion Government Pension Investment Fund, or GPIF, will boost its holdings of foreign bonds and stocks to a combined level of about 30 percent from 23 percent, while reducing domestic notes to 40 percent from the current 60 percent. GPIF is currently the largest pension fund in the world.

China

China’s top Communist Party officials will gather in Beijing this week for their fourth plenum, with an update on gross domestic product for Asia’s largest economy due tomorrow. According to the median estimate of 47 economists compiled by Bloomberg, China’s economy probably grew 7.2 percent in the third quarter from a year earlier. That would be a retreat from the 7.5 percent expansion recorded for the second quarter and the slowest pace of growth since 2009.

China’s central bank is said to plan the injection of about 200 billion yuan into some national and regional lenders to help them prepare for year-end liquidity needs. The injection comes after the central bank provided 500 billion yuan of liquidity to China’s five biggest banks last month.

Europe

The European Union’s (EU) 28 leaders will meet for a 2 day summit in Brussels this week, as snapshots of the crisis that emerged in Greece five years back seem to reappear. Last week, yields on 10-year bonds from Greece, which has been considering ending its bailout program early, jumped to 8.656 per cent from 7.854 per cent. Stock markets in Europe have also fallen by more than 3 percent, contributing to the global stock market rout of more than USD3 trillion so far this month. The economy of the 18-nation euro area stagnated in the second quarter and inflation, at 0.3 percent last month, isn’t seen returning to the European Central Bank’s target of 2 percent before 2017. With the apparent slack in Europe, traders are expecting the European Central Bank (ECB) to start asset purchases within the next few days to support the economy.

While the Federal Reserve is on track to end its bond buying program this month amid the improving US economy, there is a slim chance that the remaining USD15 billion will not be totally removed after St Louis Fed Bank President James Bullard said that policy makers should consider delaying the end of this quantitative easing round given the global slowdown.

Should that happen, watch for the US dollar to weaken.

Top News This Week

Canada: Core retail sales m/m. Wednesday, 22nd October, 8.30pm.

I expect figures to come in at 0.3% (previous figure was -0.6%).

China: HSBC Flash Manufacturing PMI. Thursday, 23rd October, 9.45am.

I expect figures to remain at 50.2.

Trade Call

Long AUD/JPY at 93.73

On the H1 chart, AUD/JPY started a downtrend on 9th October and moved in excess of 400 pips. Today’s price action shows that the pair has broken out of the range and continues to climb with upward momentum. With a possible return to risk this week coupled with the weakening of the yen, I expect the AUD/JPY to continue to head up.

An entry is taken at 93.73 once prices retrace, and a 50 pip stop loss is placed just below the previous low. We will have two targets on this trade, exiting the first position at 94.23 and the second one at 94.73.

Entry Price = 93.73

Stop Loss = 93.23

1st Profit = 94.23

2nd Profit = 94.73

This member did not declare if he had a position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis AUD/JPY - Weekly