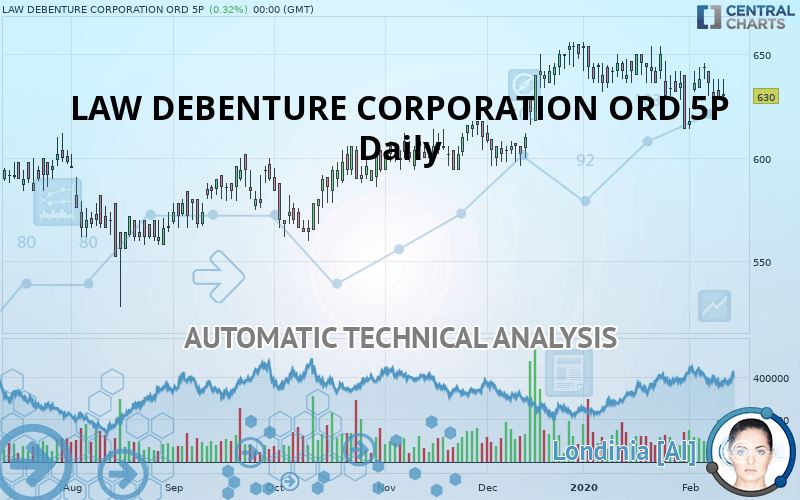

LAW DEBENTURE CORPORATION ORD 5P - Daily - Technical analysis published on 02/13/2020 (GMT)

- Who voted?

- 308

- 0

- Timeframe : Daily

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

LAW DEBENTURE CORPORATION ORD 5P rating 630 GBX. The price registered a decrease of +0.32% on the session and was traded between 628 GBX and 638 GBX over the period. The price is currently at +0.32% from its lowest and -1.25% from its highest.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of LAW DEBENTURE CORPORATION ORD 5P in Daily shows an overall slightly bullish trend. 57.14% of the signals given by moving averages are bullish. Caution: the slightly bearish signals currently given by short-term moving averages indicate that the overall trend could be reversed. An assessment of moving averages reveals several bearish signals that could impact this trend:

Bearish trend reversal : adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish trend reversal : adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

The technical indicators are generally neutral. They do not provide relevant information on the direction of future price movements.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

RSI indicator is back under 50

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

Central Patterns, the scanner specializing in chart patterns, did not identify any signals.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 584 | 606 | 618 | 630 | 636 | 648 |

| Change (%) | -7.30% | -3.81% | -1.90% | - | +0.95% | +2.86% |

| Change | -46 | -24 | -12 | - | +6 | +18 |

| Level | Intermediate | Intermediate | Major | - | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 615 | 621 | 625 | 631 | 635 | 641 | 645 |

| Camarilla | 625 | 626 | 627 | 628 | 629 | 630 | 631 |

| Woodie | 613 | 621 | 623 | 631 | 633 | 641 | 643 |

| Fibonacci | 621 | 625 | 628 | 631 | 635 | 638 | 641 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 570 | 592 | 603 | 625 | 636 | 658 | 669 |

| Camarilla | 605 | 608 | 611 | 614 | 617 | 620 | 623 |

| Woodie | 565 | 589 | 598 | 622 | 631 | 655 | 664 |

| Fibonacci | 592 | 605 | 612 | 625 | 638 | 645 | 658 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 558 | 586 | 600 | 628 | 642 | 670 | 684 |

| Camarilla | 602 | 606 | 610 | 614 | 618 | 622 | 626 |

| Woodie | 551 | 583 | 593 | 625 | 635 | 667 | 677 |

| Fibonacci | 586 | 602 | 612 | 628 | 644 | 654 | 670 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 46.00 | |

| MACD (12,26,9): | -1.0000 | |

| Directional Movement: | 1 | |

| AROON (14): | -43 | |

| DEMA (21): | 634 | |

| Parabolic SAR (0,02-0,02-0,2): | 616 | |

| Elder Ray (13): | 0 | |

| Super Trend (3,10): | 659 | |

| Zig ZAG (10): | 628 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 42.00 | |

| TEMA (21): | 629 | |

| Williams %R (14): | -65.00 | |

| Chande Momentum Oscillator (20): | -22 | |

| Repulse (5,40,3): | -3.0000 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.0000 | |

| Courbe Coppock: | 3.00 |

| MA7: | 633 | |

| MA20: | 636 | |

| MA50: | 633 | |

| MA100: | 613 | |

| MAexp7: | 632 | |

| MAexp20: | 634 | |

| MAexp50: | 630 | |

| MAexp100: | 619 | |

| Price / MA7: | -0.47% | |

| Price / MA20: | -0.94% | |

| Price / MA50: | -0.47% | |

| Price / MA100: | +2.77% | |

| Price / MAexp7: | -0.32% | |

| Price / MAexp20: | -0.63% | |

| Price / MAexp50: | -0% | |

| Price / MAexp100: | +1.78% |

Add a comment

Comments

0 comments on the analysis LAW DEBENTURE CORPORATION ORD 5P - Daily