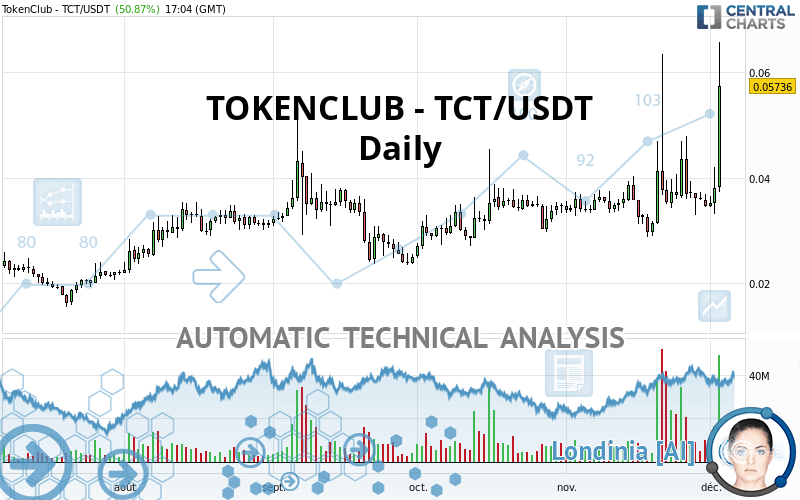

TOKENCLUB - TCT/USDT - Daily - Technical analysis published on 12/03/2021 (GMT)

- 188

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The TOKENCLUB - TCT/USDT rating is 0.057360 USDT. The price has increased by +50.87% since the last closing with the lowest point at 0.037290 USDT and the highest point at 0.065690 USDT. The deviation from the price is +53.82% for the low point and -12.68% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Technical

Technical analysis of TOKENCLUB - TCT/USDT in Daily shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

An assessment of technical indicators shows a moderate bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near resistance of triangle

Type : Bearish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.038560 | 0.043120 | 0.054200 | 0.057360 | 0.073940 | 0.096170 |

| Change (%) | -32.78% | -24.83% | -5.51% | - | +28.91% | +67.66% |

| Change | -0.018800 | -0.014240 | -0.003160 | - | +0.016580 | +0.038810 |

| Level | Intermediate | Major | Minor | - | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.024610 | 0.028880 | 0.033450 | 0.037720 | 0.042290 | 0.046560 | 0.051130 |

| Camarilla | 0.035589 | 0.036399 | 0.037210 | 0.038020 | 0.038830 | 0.039641 | 0.040451 |

| Woodie | 0.024760 | 0.028955 | 0.033600 | 0.037795 | 0.042440 | 0.046635 | 0.051280 |

| Fibonacci | 0.028880 | 0.032257 | 0.034343 | 0.037720 | 0.041097 | 0.043183 | 0.046560 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.002897 | 0.015657 | 0.026333 | 0.044887 | 0.055563 | 0.074117 | 0.084793 |

| Camarilla | 0.028972 | 0.031651 | 0.034331 | 0.037010 | 0.039689 | 0.042369 | 0.045048 |

| Woodie | -0.006835 | 0.013688 | 0.022395 | 0.042918 | 0.051625 | 0.072148 | 0.080855 |

| Fibonacci | 0.015657 | 0.026823 | 0.033721 | 0.044887 | 0.056053 | 0.062951 | 0.074117 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.013430 | 0.007700 | 0.021180 | 0.042310 | 0.055790 | 0.076920 | 0.090400 |

| Camarilla | 0.025142 | 0.028315 | 0.031487 | 0.034660 | 0.037833 | 0.041005 | 0.044178 |

| Woodie | -0.017255 | 0.005788 | 0.017355 | 0.040398 | 0.051965 | 0.075008 | 0.086575 |

| Fibonacci | 0.007700 | 0.020921 | 0.029089 | 0.042310 | 0.055531 | 0.063699 | 0.076920 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 66.53 | |

| MACD (12,26,9): | 0.0015 | |

| Directional Movement: | 40.282750 | |

| AROON (14): | 14.285714 | |

| DEMA (21): | 0.038952 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.032940 | |

| Elder Ray (13): | 0.012261 | |

| Super Trend (3,10): | 0.030266 | |

| Zig ZAG (10): | 0.047730 | |

| VORTEX (21): | 1.0238 | |

| Stochastique (14,3,5): | 31.52 | |

| TEMA (21): | 0.039495 | |

| Williams %R (14): | -50.85 | |

| Chande Momentum Oscillator (20): | 0.009410 | |

| Repulse (5,40,3): | 3.2232 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.3282 | |

| Courbe Coppock: | 26.23 |

| MA7: | 0.037609 | |

| MA20: | 0.036826 | |

| MA50: | 0.035470 | |

| MA100: | 0.033487 | |

| MAexp7: | 0.038981 | |

| MAexp20: | 0.037355 | |

| MAexp50: | 0.035449 | |

| MAexp100: | 0.034039 | |

| Price / MA7: | +52.52% | |

| Price / MA20: | +55.76% | |

| Price / MA50: | +61.71% | |

| Price / MA100: | +71.29% | |

| Price / MAexp7: | +47.15% | |

| Price / MAexp20: | +53.55% | |

| Price / MAexp50: | +61.81% | |

| Price / MAexp100: | +68.51% |

Add a comment

Comments

0 comments on the analysis TOKENCLUB - TCT/USDT - Daily