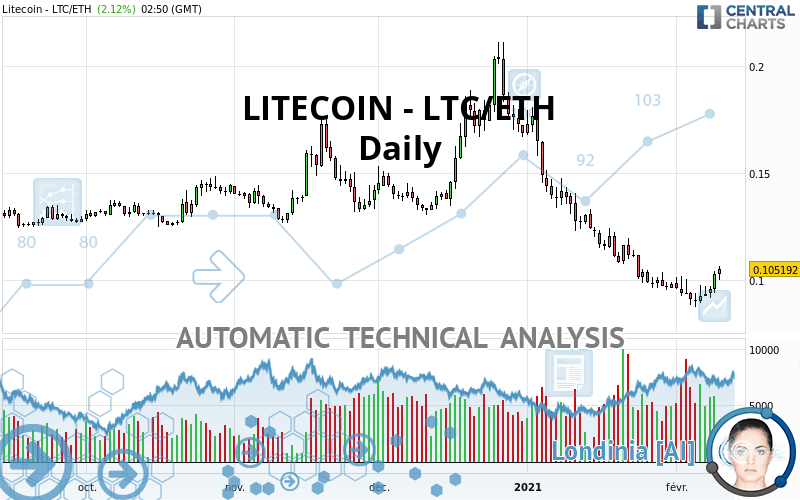

LITECOIN - LTC/ETH - Daily - Technical analysis published on 02/10/2021 (GMT)

- 164

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The LITECOIN - LTC/ETH price is 0.105192 ETH. The price registered an increase of +2.12% on the session with the lowest point at 0.099900 ETH and the highest point at 0.106806 ETH. The deviation from the price is +5.30% for the low point and -1.51% for the high point.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by LITECOIN - LTC/ETH:

Technical

A technical analysis in Daily of this LITECOIN - LTC/ETH chart shows a bearish trend. 78.57% of the signals given by moving averages are bearish. Caution: the neutral signals currently given by short-term moving averages show us that the global trend is losing momentum. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

In fact, 11 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| Price | R1 | R2 | R3 | |

|---|---|---|---|---|

| ProTrendLines | 0.105192 | 0.132852 | 0.155665 | 0.173011 |

| Change (%) | - | +26.29% | +47.98% | +64.47% |

| Change | - | +0.027660 | +0.050473 | +0.067819 |

| Level | - | Intermediate | Minor | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.086574 | 0.090372 | 0.096690 | 0.100488 | 0.106806 | 0.110604 | 0.116922 |

| Camarilla | 0.100225 | 0.101152 | 0.102080 | 0.103007 | 0.103934 | 0.104862 | 0.105789 |

| Woodie | 0.087833 | 0.091002 | 0.097949 | 0.101118 | 0.108065 | 0.111234 | 0.118181 |

| Fibonacci | 0.090372 | 0.094237 | 0.096624 | 0.100488 | 0.104353 | 0.106740 | 0.110604 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.071796 | 0.079623 | 0.086174 | 0.094001 | 0.100552 | 0.108379 | 0.114930 |

| Camarilla | 0.088771 | 0.090089 | 0.091407 | 0.092725 | 0.094043 | 0.095361 | 0.096679 |

| Woodie | 0.071158 | 0.079304 | 0.085536 | 0.093682 | 0.099914 | 0.108060 | 0.114292 |

| Fibonacci | 0.079623 | 0.085115 | 0.088509 | 0.094001 | 0.099493 | 0.102887 | 0.108379 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.023378 | 0.036089 | 0.067257 | 0.126724 | 0.157892 | 0.217359 | 0.248527 |

| Camarilla | 0.073500 | 0.081809 | 0.090117 | 0.098425 | 0.106733 | 0.115041 | 0.123350 |

| Woodie | -0.037528 | 0.029014 | 0.053108 | 0.119649 | 0.143743 | 0.210284 | 0.234378 |

| Fibonacci | 0.036089 | 0.070712 | 0.092101 | 0.126724 | 0.161347 | 0.182736 | 0.217359 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 44.34 | |

| MACD (12,26,9): | -0.0075 | |

| Directional Movement: | -2.912537 | |

| AROON (14): | 28.571427 | |

| DEMA (21): | 0.090176 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.087787 | |

| Elder Ray (13): | 0.003390 | |

| Super Trend (3,10): | 0.111578 | |

| Zig ZAG (10): | 0.101569 | |

| VORTEX (21): | 0.9401 | |

| Stochastique (14,3,5): | 74.70 | |

| TEMA (21): | 0.092562 | |

| Williams %R (14): | -13.16 | |

| Chande Momentum Oscillator (20): | 0.004525 | |

| Repulse (5,40,3): | 6.3561 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -1.2988 | |

| Courbe Coppock: | 11.00 |

| MA7: | 0.095757 | |

| MA20: | 0.098517 | |

| MA50: | 0.128831 | |

| MA100: | 0.137128 | |

| MAexp7: | 0.098382 | |

| MAexp20: | 0.101727 | |

| MAexp50: | 0.117818 | |

| MAexp100: | 0.129688 | |

| Price / MA7: | +9.85% | |

| Price / MA20: | +6.78% | |

| Price / MA50: | -18.35% | |

| Price / MA100: | -23.29% | |

| Price / MAexp7: | +6.92% | |

| Price / MAexp20: | +3.41% | |

| Price / MAexp50: | -10.72% | |

| Price / MAexp100: | -18.89% |

Add a comment

Comments

0 comments on the analysis LITECOIN - LTC/ETH - Daily