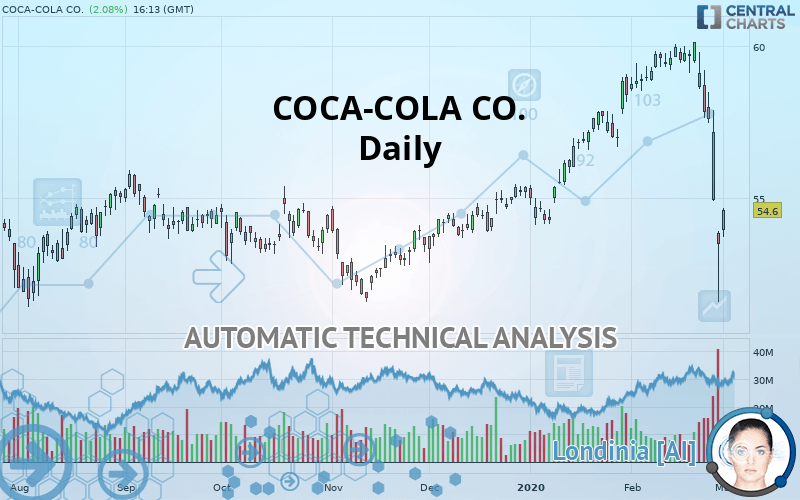

COCA-COLA CO. - Daily - Technical analysis published on 03/02/2020 (GMT)

- Who voted?

- 370

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The COCA-COLA CO. price is 54.60 USD. The price is lower by +2.08% since the last closing and was traded between 53.70 USD and 54.66 USD over the period. The price is currently at +1.68% from its lowest and -0.11% from its highest.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by COCA-COLA CO.:

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of COCA-COLA CO. indicates that the overall trend is slightly bearish. 60.71% of the signals given by moving averages are bearish. This slightly bearish trend could be reinforced by the strong bearish signals given by short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Bearish trend reversal : Moving Average 50

Type : Bearish

Timeframe : Daily

Moving Average bearish crossovers : AMA20 & AMA50

Type : Bearish

Timeframe : Daily

In fact, of the 18 technical indicators analysed by Central Analyzer, 4 are bullish, 5 are neutral and 9 are bearish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : Daily

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Horizontal support is broken

Type : Bearish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

From the Japanese candlestick perspective, the Central Candlesticks scanner notes the presence of these results that could impact the short-term trend:

Black hanging man / hammer

Type : Neutral

Timeframe : Daily

Downside gap

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 51.71 | 53.05 | 54.38 | 54.60 | 55.77 | 57.01 | 58.86 |

| Change (%) | -5.29% | -2.84% | -0.40% | - | +2.14% | +4.41% | +7.80% |

| Change | -2.89 | -1.55 | -0.22 | - | +1.17 | +2.41 | +4.26 |

| Level | Major | Minor | Intermediate | - | Major | Major | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 49.77 | 50.68 | 52.08 | 52.99 | 54.39 | 55.30 | 56.70 |

| Camarilla | 52.86 | 53.07 | 53.28 | 53.49 | 53.70 | 53.91 | 54.13 |

| Woodie | 50.03 | 50.80 | 52.34 | 53.11 | 54.65 | 55.42 | 56.96 |

| Fibonacci | 50.68 | 51.56 | 52.10 | 52.99 | 53.87 | 54.41 | 55.30 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 41.89 | 46.74 | 50.11 | 54.96 | 58.33 | 63.18 | 66.55 |

| Camarilla | 51.23 | 51.98 | 52.74 | 53.49 | 54.24 | 55.00 | 55.75 |

| Woodie | 41.16 | 46.37 | 49.38 | 54.59 | 57.60 | 62.81 | 65.82 |

| Fibonacci | 46.74 | 49.88 | 51.82 | 54.96 | 58.10 | 60.04 | 63.18 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 41.45 | 46.52 | 50.00 | 55.07 | 58.55 | 63.62 | 67.10 |

| Camarilla | 51.14 | 51.92 | 52.71 | 53.49 | 54.27 | 55.06 | 55.84 |

| Woodie | 40.67 | 46.12 | 49.22 | 54.67 | 57.77 | 63.22 | 66.32 |

| Fibonacci | 46.52 | 49.78 | 51.80 | 55.07 | 58.33 | 60.35 | 63.62 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 30.18 | |

| MACD (12,26,9): | -0.5100 | |

| Directional Movement: | -33.61 | |

| AROON (14): | -35.72 | |

| DEMA (21): | 57.26 | |

| Parabolic SAR (0,02-0,02-0,2): | 58.69 | |

| Elder Ray (13): | -2.99 | |

| Super Trend (3,10): | 56.55 | |

| Zig ZAG (10): | 54.29 | |

| VORTEX (21): | 0.8100 | |

| Stochastique (14,3,5): | 18.37 | |

| TEMA (21): | 56.07 | |

| Williams %R (14): | -68.07 | |

| Chande Momentum Oscillator (20): | -5.07 | |

| Repulse (5,40,3): | -1.7800 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0900 | |

| Courbe Coppock: | 8.95 |

| MA7: | 56.70 | |

| MA20: | 58.43 | |

| MA50: | 56.96 | |

| MA100: | 55.10 | |

| MAexp7: | 56.08 | |

| MAexp20: | 57.51 | |

| MAexp50: | 56.95 | |

| MAexp100: | 55.62 | |

| Price / MA7: | -3.70% | |

| Price / MA20: | -6.55% | |

| Price / MA50: | -4.14% | |

| Price / MA100: | -0.91% | |

| Price / MAexp7: | -2.64% | |

| Price / MAexp20: | -5.06% | |

| Price / MAexp50: | -4.13% | |

| Price / MAexp100: | -1.83% |

News

The latest news and videos published on COCA-COLA CO. at the time of the analysis were as follows:

- Thinking about trading options or stock in Forty Seven, Intel Corp, Coca-Cola, Shopify, or UnitedHealth Group?

- Coca-Cola FEMSA Announces Initial Tender Results, Consent Solicitation Termination And Initial Settlement For Its Previously Announced Tender Offer And Consent Solicitation

- Coca-Cola FEMSA Announces Consideration For Its Previously Announced Tender Offer and Consent Solicitation

- Benioff Ocean Initiative and The Coca-Cola Foundation Announce $11 Million in Funding to Clean Up Rivers and Stem Flow of Waste to Oceans

- The Coca-Cola Company Announces Retirement of Ronald W. Allen from Board of Directors

Add a comment

Comments

0 comments on the analysis COCA-COLA CO. - Daily