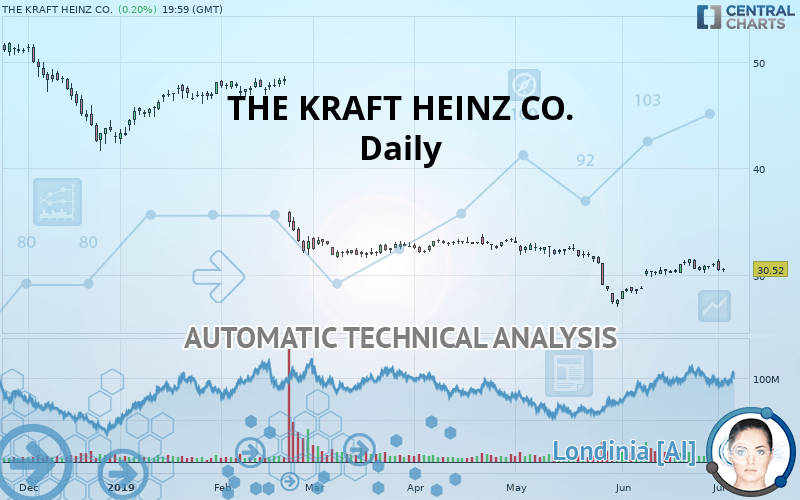

THE KRAFT HEINZ CO. - Daily - Technical analysis published on 07/03/2019 (GMT)

- 268

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The THE KRAFT HEINZ CO. price is 30.52 USD. The price registered an increase of +0.20% on the session with the lowest point at 30.23 USD and the highest point at 30.64 USD. The deviation from the price is +0.96% for the low point and -0.39% for the high point.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by THE KRAFT HEINZ CO.:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of THE KRAFT HEINZ CO. indicates that the overall trend is strongly bearish. 82.14% of the signals given by moving averages are bearish. Caution: as the signals currently given by short-term moving averages are rather neutral, the global trend is slowing down. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

The technical indicators are generally neutral. They do not provide relevant information on the direction of future price movements.

Central Indicators, the detector scanner for these technical indicators has recently detected several signals:

RSI indicator is back under 50

Type : Bearish

Timeframe : Daily

Parabolic SAR indicator bearish reversal

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Near horizontal support

Type : Bullish

Timeframe : Daily

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Bearish engulfing lines

Type : Bearish

Timeframe : Daily

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 27.40 | 30.48 | 30.52 | 33.27 | 42.54 | 48.23 |

| Change (%) | -10.22% | -0.13% | - | +9.01% | +39.38% | +58.03% |

| Change | -3.12 | -0.04 | - | +2.75 | +12.02 | +17.71 |

| Level | Major | Major | - | Intermediate | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.94 | 29.63 | 30.05 | 30.74 | 31.16 | 31.85 | 32.27 |

| Camarilla | 30.15 | 30.26 | 30.36 | 30.46 | 30.56 | 30.66 | 30.77 |

| Woodie | 28.80 | 29.56 | 29.91 | 30.67 | 31.01 | 31.78 | 32.12 |

| Fibonacci | 29.63 | 30.06 | 30.32 | 30.74 | 31.17 | 31.43 | 31.85 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.99 | 29.57 | 30.31 | 30.89 | 31.63 | 32.21 | 32.95 |

| Camarilla | 30.68 | 30.80 | 30.92 | 31.04 | 31.16 | 31.28 | 31.40 |

| Woodie | 29.06 | 29.61 | 30.38 | 30.93 | 31.70 | 32.25 | 33.02 |

| Fibonacci | 29.57 | 30.08 | 30.39 | 30.89 | 31.40 | 31.71 | 32.21 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 49.01 | |

| MACD (12,26,9): | 0.0100 | |

| Directional Movement: | 5.42 | |

| AROON (14): | 50.00 | |

| DEMA (21): | 30.47 | |

| Parabolic SAR (0,02-0,02-0,2): | 31.48 | |

| Elder Ray (13): | -0.16 | |

| Super Trend (3,10): | 29.23 | |

| Zig ZAG (10): | 30.52 | |

| VORTEX (21): | 1.1100 | |

| Stochastique (14,3,5): | 46.83 | |

| TEMA (21): | 30.91 | |

| Williams %R (14): | -64.47 | |

| Chande Momentum Oscillator (20): | 0.21 | |

| Repulse (5,40,3): | -0.8100 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0400 | |

| Courbe Coppock: | 7.58 |

| MA7: | 30.69 | |

| MA20: | 30.30 | |

| MA50: | 31.09 | |

| MA100: | 33.25 | |

| MAexp7: | 30.67 | |

| MAexp20: | 30.54 | |

| MAexp50: | 31.34 | |

| MAexp100: | 34.34 | |

| Price / MA7: | -0.55% | |

| Price / MA20: | +0.73% | |

| Price / MA50: | -1.83% | |

| Price / MA100: | -8.21% | |

| Price / MAexp7: | -0.49% | |

| Price / MAexp20: | -0.07% | |

| Price / MAexp50: | -2.62% | |

| Price / MAexp100: | -11.12% |

News

The last news published on THE KRAFT HEINZ CO. at the time of the generation of this analysis was as follows:

- Scott+Scott Attorneys at Law LLP Investigating Kraft Heinz's Directors and Officers for Breach of Fiduciary Duties - KHC

- Calling All “Rad Dads” of America: BAGEL BITES and Tony Hawk Want You to Join the #RadDadSquad

- Oscar Mayer and Ryan Newman Bring All-American Paint Scheme to Charlotte

- Maxwell House Becomes Official Coffee Partner of the United Service Organizations (USO) to Support the Hard Work of Service Members and Their Families

- Oscar Mayer, Rise Against Hunger and Roush Fenway Racing Team up to Fight Hunger

Add a comment

Comments

0 comments on the analysis THE KRAFT HEINZ CO. - Daily