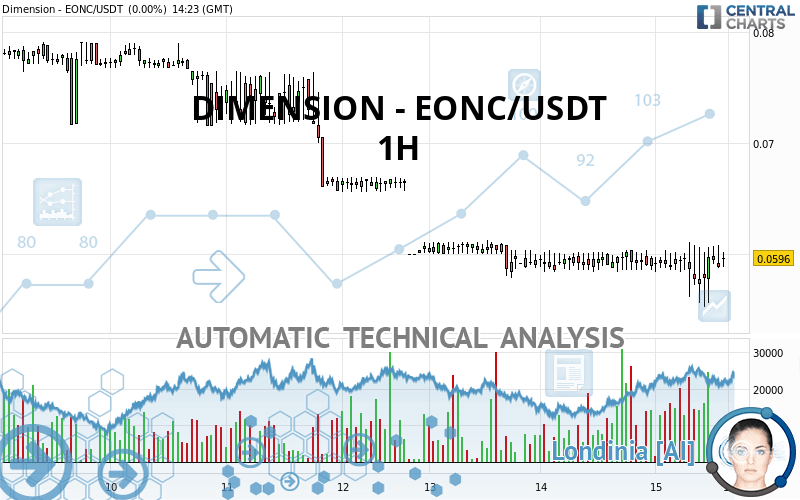

DIMENSION - EONC/USDT - 1H - Technical analysis published on 08/15/2020 (GMT)

- 187

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The DIMENSION - EONC/USDT rating is 0.059600 USDT. The price has increased by +0.00% since the last closing and was traded between 0.055200 USDT and 0.061100 USDT over the period. The price is currently at +7.97% from its lowest and -2.45% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Technical

A technical analysis in 1H of this DIMENSION - EONC/USDT chart shows a bearish trend. 75.00% of the signals given by moving averages are bearish. Caution: as the signals currently given by short-term moving averages are rather neutral, the bearish trend could slow down. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : 1 hour

An assessment of technical indicators shows a moderate bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

RSI indicator is back under 50

Type : Bearish

Timeframe : 1 hour

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : 1 hour

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

There is also a Japanese candlestick pattern detected by Central Candlesticks that could mark the end of the current short-term trend:

Black hanging man / hammer

Type : Neutral

Timeframe : 1 hour

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.035144 | 0.058450 | 0.059600 | 0.060142 | 0.066900 | 0.071557 |

| Change (%) | -41.03% | -1.93% | - | +0.91% | +12.25% | +20.06% |

| Change | -0.024456 | -0.001150 | - | +0.000542 | +0.007300 | +0.011957 |

| Level | Intermediate | Intermediate | - | Intermediate | Minor | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.056667 | 0.057533 | 0.058567 | 0.059433 | 0.060467 | 0.061333 | 0.062367 |

| Camarilla | 0.059078 | 0.059252 | 0.059426 | 0.059600 | 0.059774 | 0.059948 | 0.060123 |

| Woodie | 0.056750 | 0.057575 | 0.058650 | 0.059475 | 0.060550 | 0.061375 | 0.062450 |

| Fibonacci | 0.057533 | 0.058259 | 0.058708 | 0.059433 | 0.060159 | 0.060608 | 0.061333 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.049900 | 0.056400 | 0.066300 | 0.072800 | 0.082700 | 0.089200 | 0.099100 |

| Camarilla | 0.071690 | 0.073193 | 0.074697 | 0.076200 | 0.077703 | 0.079207 | 0.080710 |

| Woodie | 0.051600 | 0.057250 | 0.068000 | 0.073650 | 0.084400 | 0.090050 | 0.100800 |

| Fibonacci | 0.056400 | 0.062665 | 0.066535 | 0.072800 | 0.079065 | 0.082935 | 0.089200 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.018067 | 0.007867 | 0.042533 | 0.068467 | 0.103133 | 0.129067 | 0.163733 |

| Camarilla | 0.060535 | 0.066090 | 0.071645 | 0.077200 | 0.082755 | 0.088310 | 0.093865 |

| Woodie | -0.013700 | 0.010050 | 0.046900 | 0.070650 | 0.107500 | 0.131250 | 0.168100 |

| Fibonacci | 0.007867 | 0.031016 | 0.045318 | 0.068467 | 0.091616 | 0.105918 | 0.129067 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 50.53 | |

| MACD (12,26,9): | -0.0002 | |

| Directional Movement: | -9.487012 | |

| AROON (14): | -21.428574 | |

| DEMA (21): | 0.058758 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.055530 | |

| Elder Ray (13): | 0.000205 | |

| Super Trend (3,10): | 0.062909 | |

| Zig ZAG (10): | 0.059600 | |

| VORTEX (21): | 1.0043 | |

| Stochastique (14,3,5): | 69.49 | |

| TEMA (21): | 0.059033 | |

| Williams %R (14): | -23.73 | |

| Chande Momentum Oscillator (20): | 0.000600 | |

| Repulse (5,40,3): | 0.0758 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.0521 | |

| Courbe Coppock: | 1.47 |

| MA7: | 0.064814 | |

| MA20: | 0.067650 | |

| MA50: | 0.050190 | |

| MA100: | 0.045102 | |

| MAexp7: | 0.058960 | |

| MAexp20: | 0.058988 | |

| MAexp50: | 0.059939 | |

| MAexp100: | 0.062583 | |

| Price / MA7: | -8.04% | |

| Price / MA20: | -11.90% | |

| Price / MA50: | +18.75% | |

| Price / MA100: | +32.14% | |

| Price / MAexp7: | +1.09% | |

| Price / MAexp20: | +1.04% | |

| Price / MAexp50: | -0.57% | |

| Price / MAexp100: | -4.77% |

Add a comment

Comments

0 comments on the analysis DIMENSION - EONC/USDT - 1H