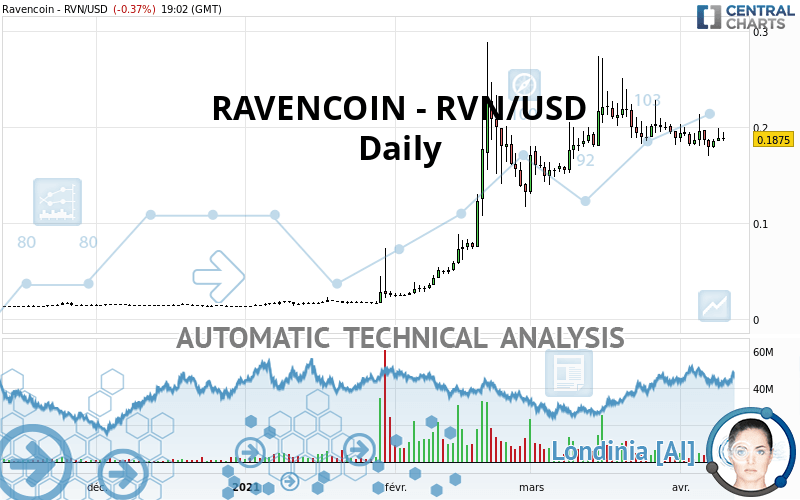

RAVENCOIN - RVN/USD - Daily - Technical analysis published on 04/10/2021 (GMT)

- 243

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The RAVENCOIN - RVN/USD price is 0.187500 USD. On the day, this instrument lost -0.37% with the lowest point at 0.185500 USD and the highest point at 0.194200 USD. The deviation from the price is +1.08% for the low point and -3.45% for the high point.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Abnormal volumes

Timeframe : 50 days

Technical

A technical analysis in Daily of this RAVENCOIN - RVN/USD chart shows a bullish trend. The signals given by moving averages are 71.43% bullish. This bullish trend could slow down given the neutral signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting a bullish signal that could impact this trend:

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

In fact, of the 18 technical indicators analysed by Central Analyzer, 5 are bullish, 9 are neutral and 4 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

RSI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Near horizontal support

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.131800 | 0.154300 | 0.181567 | 0.187500 | 0.202400 | 0.229200 |

| Change (%) | -29.71% | -17.71% | -3.16% | - | +7.95% | +22.24% |

| Change | -0.055700 | -0.033200 | -0.005933 | - | +0.014900 | +0.041700 |

| Level | Major | Minor | Intermediate | - | Minor | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.169200 | 0.173300 | 0.179400 | 0.183500 | 0.189600 | 0.193700 | 0.199800 |

| Camarilla | 0.182695 | 0.183630 | 0.184565 | 0.185500 | 0.186435 | 0.187370 | 0.188305 |

| Woodie | 0.170200 | 0.173800 | 0.180400 | 0.184000 | 0.190600 | 0.194200 | 0.200800 |

| Fibonacci | 0.173300 | 0.177196 | 0.179604 | 0.183500 | 0.187396 | 0.189804 | 0.193700 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.143100 | 0.161500 | 0.171800 | 0.190200 | 0.200500 | 0.218900 | 0.229200 |

| Camarilla | 0.174208 | 0.176838 | 0.179469 | 0.182100 | 0.184731 | 0.187362 | 0.189993 |

| Woodie | 0.139050 | 0.159475 | 0.167750 | 0.188175 | 0.196450 | 0.216875 | 0.225150 |

| Fibonacci | 0.161500 | 0.172463 | 0.179237 | 0.190200 | 0.201163 | 0.207937 | 0.218900 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.021800 | 0.054200 | 0.121200 | 0.197200 | 0.264200 | 0.340200 | 0.407200 |

| Camarilla | 0.148875 | 0.161983 | 0.175092 | 0.188200 | 0.201308 | 0.214417 | 0.227525 |

| Woodie | -0.026300 | 0.051950 | 0.116700 | 0.194950 | 0.259700 | 0.337950 | 0.402700 |

| Fibonacci | 0.054200 | 0.108826 | 0.142574 | 0.197200 | 0.251826 | 0.285574 | 0.340200 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 49.46 | |

| MACD (12,26,9): | 0.0012 | |

| Directional Movement: | 11.276453 | |

| AROON (14): | -78.571426 | |

| DEMA (21): | 0.193144 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.240094 | |

| Elder Ray (13): | 0.000930 | |

| Super Trend (3,10): | 0.136708 | |

| Zig ZAG (10): | 0.186300 | |

| VORTEX (21): | 0.9368 | |

| Stochastique (14,3,5): | 32.92 | |

| TEMA (21): | 0.182244 | |

| Williams %R (14): | -60.28 | |

| Chande Momentum Oscillator (20): | -0.013400 | |

| Repulse (5,40,3): | -3.7753 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.2580 | |

| Courbe Coppock: | 11.85 |

| MA7: | 0.186043 | |

| MA20: | 0.191640 | |

| MA50: | 0.185792 | |

| MA100: | 0.108970 | |

| MAexp7: | 0.187006 | |

| MAexp20: | 0.189330 | |

| MAexp50: | 0.169295 | |

| MAexp100: | 0.129684 | |

| Price / MA7: | +0.78% | |

| Price / MA20: | -2.16% | |

| Price / MA50: | +0.92% | |

| Price / MA100: | +72.07% | |

| Price / MAexp7: | +0.26% | |

| Price / MAexp20: | -0.97% | |

| Price / MAexp50: | +10.75% | |

| Price / MAexp100: | +44.58% |

Add a comment

Comments

0 comments on the analysis RAVENCOIN - RVN/USD - Daily