GE AEROSPACE - Equities in Cautious Rally as Optimism Peak - 12/02/2020 (GMT)

- Who voted?

- 293

- 0

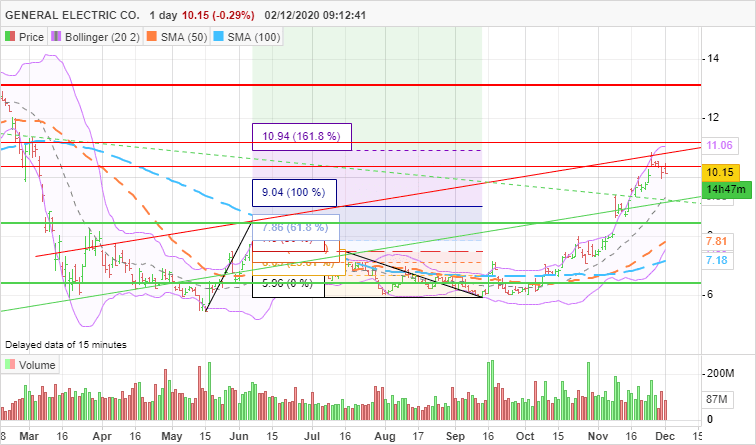

- Chart + Price target(s)

- Target : Upper

- |

- Target 1 : 13

- |

- Target 2 : 14,5

- |

- Target 3 : 16,5

- |

- Invalidation threshold : 8

- Timeframe : Daily

GE AEROSPACE Chart

STATE OF THE MARKETS

Equities in cautious rally as optimism peak. Europe and US equities staged another records Tuesday as vaccine deployment is coming to reality and Feds vowed to send more stimulus for small businesses. Nevertheless, Asian markets in early Wednesday trading, was lowered and full of hedging as investors remain cautious in the unchartered territory. US bonds were bid as the benchmark 10Y yield rise above 0.93% with more than $97b flows into the US treasury. Crude edged lower below $44.50 as investors worry that OPEC may not extend a production cut in full three months as earlier expected. Gold on the other hand, was bid higher to close above $1,800 as shorts was covered while the greenback remain suppressed to close below 91.20 mark for the first time in 32 months. Euro and Swiss were at the helm of demand in the short and medium term accounts as investors suspects optimism index may have peaked around 91 mark before Thanksgiving. Sentiments in the long term accounts remain unchanged. Hedging and swaps were seen abound as many institutional investors prepare to close their book in 2 weeks.

OUR PICK – GENERAL ELECTRIC (GE, NYSE)

It’s time to take profit and trim exposure. On October 29th we picked GE and since then price has moved in our favor. The stock hit as high as $10.85 last week, slightly below 55 weeks moving average and we expect more profit taking in the weeks to come before Christmas and New Year but should remain above $8.50 our new stop. 21 days VPOC is $8.75 and there was a weekend gap on on Nov 6th to 9th that might get filled. Barclays maintains overweight rating with up target from $11 to 12; while RBC Capital maintains outperform rating with up target from $10 to $13 on the expansion of the GE Healthcare Artificial Intelligence. On another note, UBS maintains a buy with $12 target.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Equities in cautious rally as optimism peak. Europe and US equities staged another records Tuesday as vaccine deployment is coming to reality and Feds vowed to send more stimulus for small businesses. Nevertheless, Asian markets in early Wednesday trading, was lowered and full of hedging as investors remain cautious in the unchartered territory. US bonds were bid as the benchmark 10Y yield rise above 0.93% with more than $97b flows into the US treasury. Crude edged lower below $44.50 as investors worry that OPEC may not extend a production cut in full three months as earlier expected. Gold on the other hand, was bid higher to close above $1,800 as shorts was covered while the greenback remain suppressed to close below 91.20 mark for the first time in 32 months. Euro and Swiss were at the helm of demand in the short and medium term accounts as investors suspects optimism index may have peaked around 91 mark before Thanksgiving. Sentiments in the long term accounts remain unchanged. Hedging and swaps were seen abound as many institutional investors prepare to close their book in 2 weeks.

OUR PICK – GENERAL ELECTRIC (GE, NYSE)

It’s time to take profit and trim exposure. On October 29th we picked GE and since then price has moved in our favor. The stock hit as high as $10.85 last week, slightly below 55 weeks moving average and we expect more profit taking in the weeks to come before Christmas and New Year but should remain above $8.50 our new stop. 21 days VPOC is $8.75 and there was a weekend gap on on Nov 6th to 9th that might get filled. Barclays maintains overweight rating with up target from $11 to 12; while RBC Capital maintains outperform rating with up target from $10 to $13 on the expansion of the GE Healthcare Artificial Intelligence. On another note, UBS maintains a buy with $12 target.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

This member declared having a buying position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis GE AEROSPACE - Daily