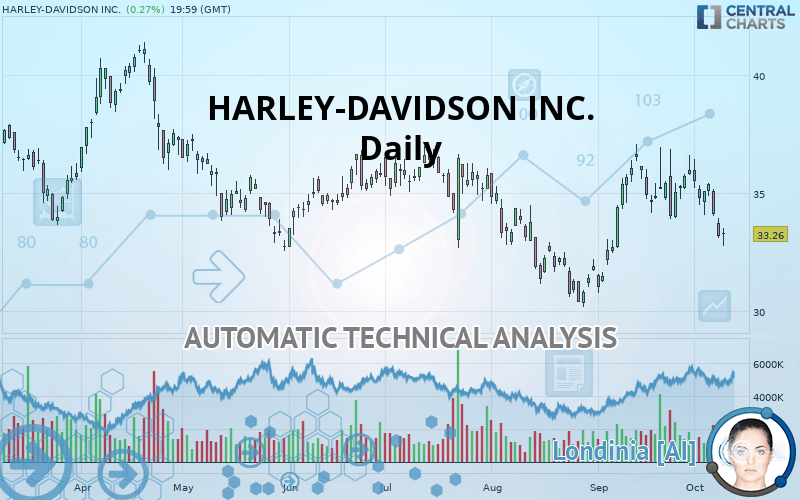

HARLEY-DAVIDSON INC. - Daily - Technical analysis published on 10/10/2019 (GMT)

- Who voted?

- 190

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The HARLEY-DAVIDSON INC. rating is 33.26 USD. On the day, this instrument gained +0.27% and was between 32.77 USD and 33.51 USD. This implies that the price is at +1.50% from its lowest and at -0.75% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by HARLEY-DAVIDSON INC.:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of HARLEY-DAVIDSON INC. indicates that the overall trend is bearish. The signals given by moving averages are 78.57% bearish. This bearish trend is reinforced by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

In fact, according to the parameters integrated into the Central Analyzer system, 13 technical indicators out of 18 analysed are currently bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

SuperTrend indicator bearish reversal

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Support of channel is broken

Type : Bearish

Timeframe : Daily

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Downside gap

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 21.51 | 30.39 | 31.98 | 33.26 | 34.01 | 36.64 | 38.81 |

| Change (%) | -35.33% | -8.63% | -3.85% | - | +2.25% | +10.16% | +16.69% |

| Change | -11.75 | -2.87 | -1.28 | - | +0.75 | +3.38 | +5.55 |

| Level | Minor | Major | Major | - | Major | Major | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 31.97 | 32.52 | 32.85 | 33.40 | 33.73 | 34.28 | 34.61 |

| Camarilla | 32.93 | 33.01 | 33.09 | 33.17 | 33.25 | 33.33 | 33.41 |

| Woodie | 31.85 | 32.47 | 32.73 | 33.35 | 33.61 | 34.23 | 34.49 |

| Fibonacci | 32.52 | 32.86 | 33.07 | 33.40 | 33.74 | 33.95 | 34.28 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 31.57 | 32.82 | 34.10 | 35.35 | 36.62 | 37.87 | 39.15 |

| Camarilla | 34.68 | 34.91 | 35.14 | 35.37 | 35.60 | 35.83 | 36.06 |

| Woodie | 31.58 | 32.83 | 34.11 | 35.35 | 36.63 | 37.88 | 39.16 |

| Fibonacci | 32.82 | 33.79 | 34.38 | 35.35 | 36.31 | 36.91 | 37.87 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 25.47 | 27.96 | 31.96 | 34.45 | 38.45 | 40.94 | 44.94 |

| Camarilla | 34.19 | 34.78 | 35.38 | 35.97 | 36.57 | 37.16 | 37.76 |

| Woodie | 26.23 | 28.34 | 32.73 | 34.83 | 39.22 | 41.32 | 45.71 |

| Fibonacci | 27.96 | 30.44 | 31.97 | 34.45 | 36.93 | 38.46 | 40.94 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 42.81 | |

| MACD (12,26,9): | 0.1200 | |

| Directional Movement: | -3.93 | |

| AROON (14): | -92.86 | |

| DEMA (21): | 34.74 | |

| Parabolic SAR (0,02-0,02-0,2): | 36.30 | |

| Elder Ray (13): | -1.34 | |

| Super Trend (3,10): | 36.30 | |

| Zig ZAG (10): | 33.26 | |

| VORTEX (21): | 0.8800 | |

| Stochastique (14,3,5): | 6.91 | |

| TEMA (21): | 34.61 | |

| Williams %R (14): | -88.22 | |

| Chande Momentum Oscillator (20): | -2.15 | |

| Repulse (5,40,3): | -2.3400 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.2100 | |

| Courbe Coppock: | 3.94 |

| MA7: | 34.47 | |

| MA20: | 35.02 | |

| MA50: | 33.49 | |

| MA100: | 34.13 | |

| MAexp7: | 34.20 | |

| MAexp20: | 34.44 | |

| MAexp50: | 34.16 | |

| MAexp100: | 34.38 | |

| Price / MA7: | -3.51% | |

| Price / MA20: | -5.03% | |

| Price / MA50: | -0.69% | |

| Price / MA100: | -2.55% | |

| Price / MAexp7: | -2.75% | |

| Price / MAexp20: | -3.43% | |

| Price / MAexp50: | -2.63% | |

| Price / MAexp100: | -3.26% |

News

The latest news and videos published on HARLEY-DAVIDSON INC. at the time of the analysis were as follows:

- Harley-Davidson To Amplify Brand Power To Attract Riders; Sharpens Long-Term Objectives To Support Building The Next Generation Of Riders

-

Harley-Davidson Laying Off 40 Employees

Harley-Davidson Laying Off 40 Employees

- Harley-Davidson Launches New Motorcycle Models And Technology For 2020

-

Harley-Davidson Is Facing New Challenges

Harley-Davidson Is Facing New Challenges

-

Harley-Davidson Forced To Cut Number Of Shipments After Falling Quarter

Harley-Davidson Forced To Cut Number Of Shipments After Falling Quarter

Add a comment

Comments

0 comments on the analysis HARLEY-DAVIDSON INC. - Daily