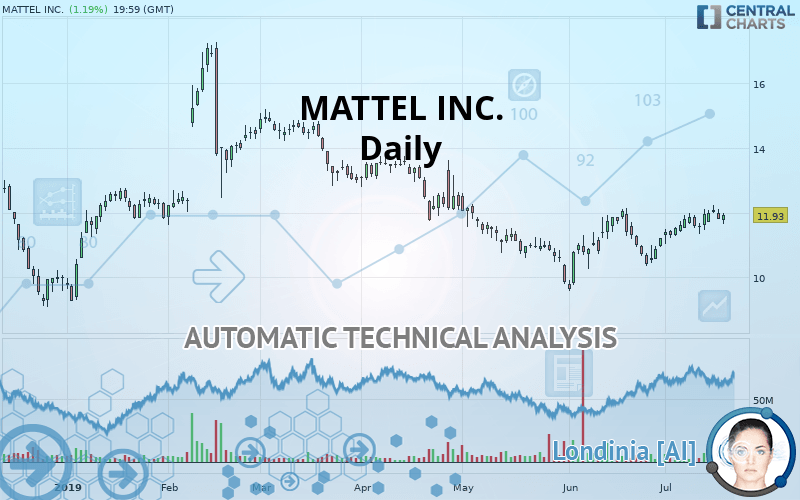

MATTEL INC. - Daily - Technical analysis published on 07/19/2019 (GMT)

- Who voted?

- 268

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The MATTEL INC. rating is 11.93 USD. The price has increased by +1.19% since the last closing and was between 11.64 USD and 11.99 USD. This implies that the price is at +2.49% from its lowest and at -0.50% from its highest.The Central Gaps scanner detects the formation of a bearish gap marking the strong presence of sellers ahead of buyers at the opening. This formed a quotation gap.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of MATTEL INC. in Daily shows a neutral overall trend. This indecision could turn into a bullish trend due to the strong bullish signals currently being given by short-term moving averages. The Central Indicators scanner detects a bearish signal on moving averages that could impact this trend:

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

In fact, 13 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Resistance of triangle is broken

Type : Bullish

Timeframe : Daily

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Black evening star

Type : Bearish

Timeframe : Daily

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 9.26 | 10.45 | 11.93 | 12.06 | 12.82 | 14.87 |

| Change (%) | -22.38% | -12.41% | - | +1.09% | +7.46% | +24.64% |

| Change | -2.67 | -1.48 | - | +0.13 | +0.89 | +2.94 |

| Level | Minor | Major | - | Intermediate | Intermediate | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 11.36 | 11.58 | 11.68 | 11.90 | 12.00 | 12.22 | 12.32 |

| Camarilla | 11.70 | 11.73 | 11.76 | 11.79 | 11.82 | 11.85 | 11.88 |

| Woodie | 11.31 | 11.55 | 11.63 | 11.87 | 11.95 | 12.19 | 12.27 |

| Fibonacci | 11.58 | 11.70 | 11.77 | 11.90 | 12.02 | 12.09 | 12.22 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 10.75 | 11.05 | 11.51 | 11.81 | 12.26 | 12.57 | 13.02 |

| Camarilla | 11.75 | 11.82 | 11.89 | 11.96 | 12.03 | 12.10 | 12.17 |

| Woodie | 10.83 | 11.09 | 11.58 | 11.85 | 12.34 | 12.60 | 13.09 |

| Fibonacci | 11.05 | 11.34 | 11.52 | 11.81 | 12.10 | 12.28 | 12.57 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 7.27 | 8.43 | 9.82 | 10.98 | 12.37 | 13.53 | 14.92 |

| Camarilla | 10.51 | 10.74 | 10.98 | 11.21 | 11.44 | 11.68 | 11.91 |

| Woodie | 7.39 | 8.49 | 9.94 | 11.04 | 12.49 | 13.59 | 15.04 |

| Fibonacci | 8.43 | 9.40 | 10.01 | 10.98 | 11.95 | 12.56 | 13.53 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 57.34 | |

| MACD (12,26,9): | 0.1900 | |

| Directional Movement: | 4.13 | |

| AROON (14): | 85.71 | |

| DEMA (21): | 11.82 | |

| Parabolic SAR (0,02-0,02-0,2): | 11.34 | |

| Elder Ray (13): | 0.10 | |

| Super Trend (3,10): | 10.90 | |

| Zig ZAG (10): | 11.93 | |

| VORTEX (21): | 0.9700 | |

| Stochastique (14,3,5): | 80.00 | |

| TEMA (21): | 12.04 | |

| Williams %R (14): | -23.75 | |

| Chande Momentum Oscillator (20): | 0.52 | |

| Repulse (5,40,3): | 1.7500 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.1900 | |

| Courbe Coppock: | 16.06 |

| MA7: | 11.84 | |

| MA20: | 11.43 | |

| MA50: | 11.22 | |

| MA100: | 12.32 | |

| MAexp7: | 11.85 | |

| MAexp20: | 11.60 | |

| MAexp50: | 11.59 | |

| MAexp100: | 12.01 | |

| Price / MA7: | +0.76% | |

| Price / MA20: | +4.37% | |

| Price / MA50: | +6.33% | |

| Price / MA100: | -3.17% | |

| Price / MAexp7: | +0.68% | |

| Price / MAexp20: | +2.84% | |

| Price / MAexp50: | +2.93% | |

| Price / MAexp100: | -0.67% |

News

Don"t forget to follow the news on MATTEL INC.. At the time of publication of this analysis, the latest news was as follows:

- Mattel Extends Global Licensing Partnership With Warner Bros. Consumer Products For DC

- Mattel Appoints Jamie Cygielman To Lead American Girl®

- Mattel Reports First Quarter 2019 Financial Results

-

Mattel's Fisher Price Recalls All 'Rock 'n Play' Models Due to Reports of Death

Mattel's Fisher Price Recalls All 'Rock 'n Play' Models Due to Reports of Death

- LEAD PLAINTIFF DEADLINE ALERT: Faruqi & Faruqi, LLP Encourages Investors Who Suffered Losses Exceeding $100,000 Investing In Mattel, Inc. To Contact The Firm

Add a comment

Comments

0 comments on the analysis MATTEL INC. - Daily