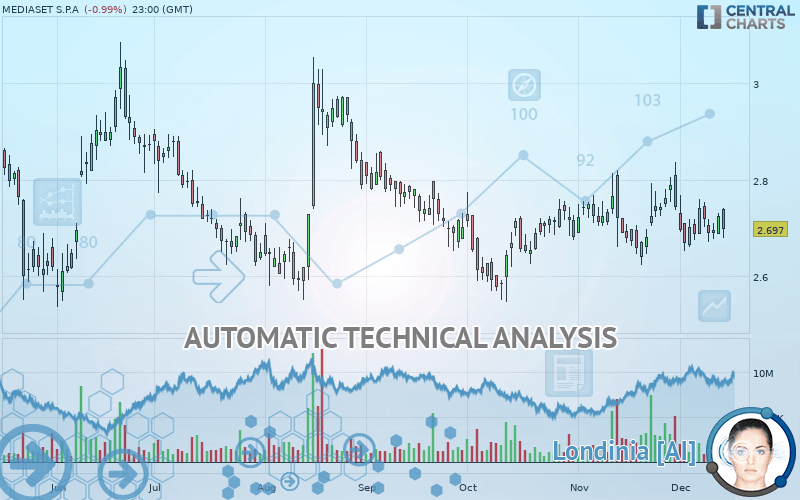

MFE-MEDIAFOREUROPE - Daily - Technical analysis published on 12/16/2019 (GMT)

- Who voted?

- 219

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

MEDIASET S.P.A rating 2.697 EUR. The price registered a decrease of -0.99% on the session and was traded between 2.680 EUR and 2.742 EUR over the period. The price is currently at +0.63% from its lowest and -1.64% from its highest.A study of price movements over other periods shows the following variations:

Technical

A technical analysis in Daily of this MEDIASET S.P.A chart shows a bearish trend. 64.29% of the signals given by moving averages are bearish. This bearish trend is slowing down slightly given the slightly bearish signals given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish trend reversal : adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish trend reversal : adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

In fact, Central Analyzer took into account 18 technical indicators and the result was as follows: 4 are bullish, 8 are neutral and 6 are bearish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

RSI indicator is back under 50

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near support of channel

Type : Bullish

Timeframe : Daily

Near support of triangle

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 2.581 | 2.630 | 2.667 | 2.697 | 2.713 | 2.789 | 2.967 |

| Change (%) | -4.30% | -2.48% | -1.11% | - | +0.59% | +3.41% | +10.01% |

| Change | -0.116 | -0.067 | -0.030 | - | +0.016 | +0.092 | +0.270 |

| Level | Major | Intermediate | Major | - | Intermediate | Intermediate | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.621 | 2.646 | 2.668 | 2.693 | 2.715 | 2.740 | 2.762 |

| Camarilla | 2.677 | 2.681 | 2.686 | 2.690 | 2.694 | 2.699 | 2.703 |

| Woodie | 2.620 | 2.645 | 2.667 | 2.692 | 2.714 | 2.739 | 2.761 |

| Fibonacci | 2.646 | 2.664 | 2.675 | 2.693 | 2.711 | 2.722 | 2.740 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.586 | 2.655 | 2.699 | 2.768 | 2.812 | 2.881 | 2.925 |

| Camarilla | 2.713 | 2.723 | 2.734 | 2.744 | 2.754 | 2.765 | 2.775 |

| Woodie | 2.575 | 2.649 | 2.688 | 2.762 | 2.801 | 2.875 | 2.914 |

| Fibonacci | 2.655 | 2.698 | 2.725 | 2.768 | 2.811 | 2.838 | 2.881 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.420 | 2.521 | 2.633 | 2.734 | 2.846 | 2.947 | 3.059 |

| Camarilla | 2.685 | 2.705 | 2.725 | 2.744 | 2.764 | 2.783 | 2.803 |

| Woodie | 2.425 | 2.524 | 2.638 | 2.737 | 2.851 | 2.950 | 3.064 |

| Fibonacci | 2.521 | 2.603 | 2.653 | 2.734 | 2.816 | 2.866 | 2.947 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 47.77 | |

| MACD (12,26,9): | -0.0010 | |

| Directional Movement: | 4.170 | |

| AROON (14): | 42.857 | |

| DEMA (21): | 2.711 | |

| Parabolic SAR (0,02-0,02-0,2): | 2.815 | |

| Elder Ray (13): | -0.016 | |

| Super Trend (3,10): | 2.615 | |

| Zig ZAG (10): | 2.696 | |

| VORTEX (21): | 0.9420 | |

| Stochastique (14,3,5): | 30.56 | |

| TEMA (21): | 2.708 | |

| Williams %R (14): | -76.09 | |

| Chande Momentum Oscillator (20): | -0.040 | |

| Repulse (5,40,3): | -0.4410 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0150 | |

| Courbe Coppock: | 0.76 |

| MA7: | 2.701 | |

| MA20: | 2.708 | |

| MA50: | 2.694 | |

| MA100: | 2.726 | |

| MAexp7: | 2.706 | |

| MAexp20: | 2.711 | |

| MAexp50: | 2.713 | |

| MAexp100: | 2.725 | |

| Price / MA7: | -0.15% | |

| Price / MA20: | -0.41% | |

| Price / MA50: | +0.11% | |

| Price / MA100: | -1.06% | |

| Price / MAexp7: | -0.33% | |

| Price / MAexp20: | -0.52% | |

| Price / MAexp50: | -0.59% | |

| Price / MAexp100: | -1.03% |

News

Don"t forget to follow the news on MEDIASET S.P.A. At the time of publication of this analysis, the latest news was as follows:

Mediaset

Mediaset

Add a comment

Comments

0 comments on the analysis MFE-MEDIAFOREUROPE - Daily