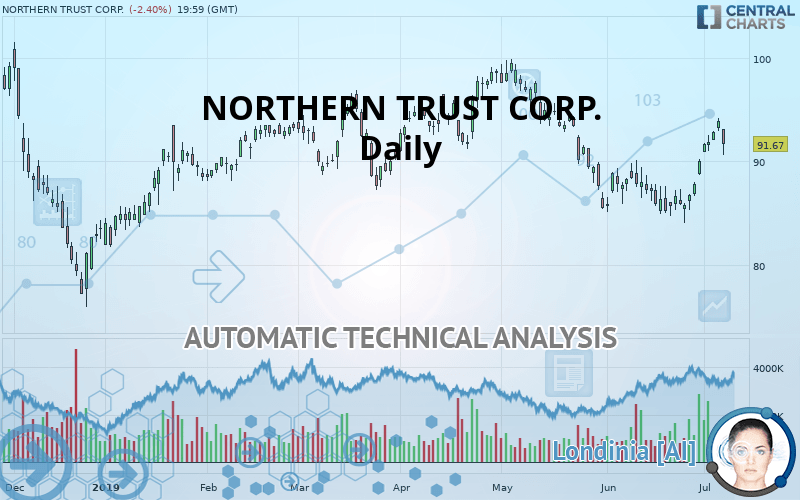

NORTHERN TRUST CORP. - Daily - Technical analysis published on 07/09/2019 (GMT)

- 281

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

NORTHERN TRUST CORP. rating 91.67 USD. The price registered a decrease of -2.40% on the session and was between 90.63 USD and 93.12 USD. This implies that the price is at +1.15% from its lowest and at -1.56% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by NORTHERN TRUST CORP.:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of NORTHERN TRUST CORP. indicates that the overall trend is not clearly defined. The strong bullish signals currently being given by short-term moving averages could allow the overall trend to return to bullish. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 12 technical indicators on 18 studied are currently bullish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Near resistance of triangle

Type : Bearish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 77.26 | 81.89 | 87.12 | 91.67 | 91.72 | 96.11 | 98.98 |

| Change (%) | -15.72% | -10.67% | -4.96% | - | +0.05% | +4.84% | +7.97% |

| Change | -14.41 | -9.78 | -4.55 | - | +0.05 | +4.44 | +7.31 |

| Level | Major | Minor | Major | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 91.97 | 92.46 | 93.19 | 93.68 | 94.41 | 94.90 | 95.63 |

| Camarilla | 93.58 | 93.70 | 93.81 | 93.92 | 94.03 | 94.14 | 94.26 |

| Woodie | 92.09 | 92.52 | 93.31 | 93.74 | 94.53 | 94.96 | 95.75 |

| Fibonacci | 92.46 | 92.93 | 93.21 | 93.68 | 94.15 | 94.43 | 94.90 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 88.52 | 89.70 | 91.81 | 92.99 | 95.10 | 96.28 | 98.39 |

| Camarilla | 93.02 | 93.32 | 93.62 | 93.92 | 94.22 | 94.52 | 94.82 |

| Woodie | 88.99 | 89.93 | 92.28 | 93.22 | 95.57 | 96.51 | 98.86 |

| Fibonacci | 89.70 | 90.96 | 91.73 | 92.99 | 94.25 | 95.02 | 96.28 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 57.37 | |

| MACD (12,26,9): | 0.5900 | |

| Directional Movement: | 5.08 | |

| AROON (14): | 50.00 | |

| DEMA (21): | 89.84 | |

| Parabolic SAR (0,02-0,02-0,2): | 87.14 | |

| Elder Ray (13): | 1.79 | |

| Super Trend (3,10): | 88.24 | |

| Zig ZAG (10): | 91.67 | |

| VORTEX (21): | 1.0500 | |

| Stochastique (14,3,5): | 90.32 | |

| TEMA (21): | 91.47 | |

| Williams %R (14): | -24.68 | |

| Chande Momentum Oscillator (20): | 6.42 | |

| Repulse (5,40,3): | 0.5100 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0800 | |

| Courbe Coppock: | 9.88 |

| MA7: | 91.39 | |

| MA20: | 88.33 | |

| MA50: | 91.39 | |

| MA100: | 92.09 | |

| MAexp7: | 91.28 | |

| MAexp20: | 89.62 | |

| MAexp50: | 90.34 | |

| MAexp100: | 91.39 | |

| Price / MA7: | +0.31% | |

| Price / MA20: | +3.78% | |

| Price / MA50: | +0.31% | |

| Price / MA100: | -0.46% | |

| Price / MAexp7: | +0.43% | |

| Price / MAexp20: | +2.29% | |

| Price / MAexp50: | +1.47% | |

| Price / MAexp100: | +0.31% |

News

The latest news and videos published on NORTHERN TRUST CORP. at the time of the analysis were as follows:

- Northern Trust Asset Management Expands Sustainable Investing Team in Europe, Middle East and Africa

Add a comment

Comments

0 comments on the analysis NORTHERN TRUST CORP. - Daily