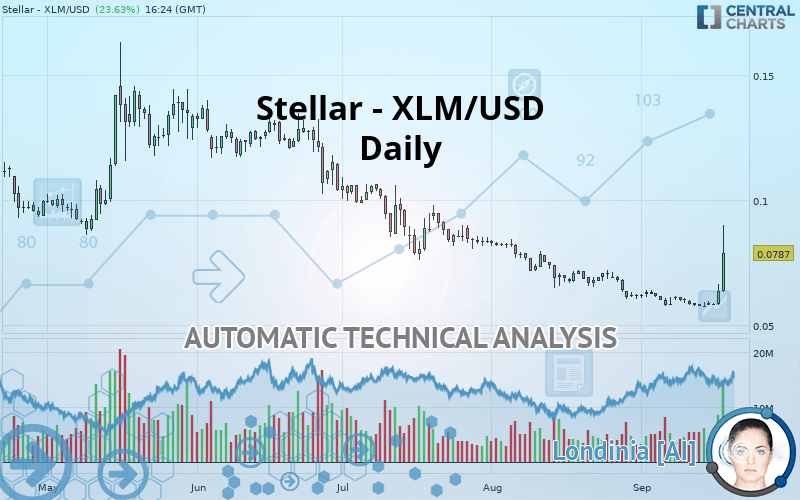

STELLAR - XLM/USD - Daily - Technical analysis published on 09/18/2019 (GMT)

- 159

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The Stellar - XLM/USD rating is 0.078700 USD. On the day, this instrument gained +23.63% with the lowest point at 0.063501 USD and the highest point at 0.089999 USD. The deviation from the price is +23.94% for the low point and -12.55% for the high point.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Technical

Technical analysis of this Daily chart of Stellar - XLM/USD indicates that the overall trend is slightly bearish. 57.14% of the signals given by moving averages are bearish. Caution: the strong bullish signals currently being given by short-term moving averages indicate that this slightly bearish trend could quickly be reversed. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

In fact, 13 technical indicators on 18 studied are currently positioned bullish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Long white line

Type : Bullish

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.057220 | 0.078700 | 0.088431 | 0.118551 | 0.143124 |

| Change (%) | -27.29% | - | +12.36% | +50.64% | +81.86% |

| Change | -0.021480 | - | +0.009731 | +0.039851 | +0.064424 |

| Level | Major | - | Minor | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.050419 | 0.054279 | 0.058967 | 0.062827 | 0.067515 | 0.071375 | 0.076063 |

| Camarilla | 0.061305 | 0.062089 | 0.062872 | 0.063656 | 0.064440 | 0.065223 | 0.066007 |

| Woodie | 0.050834 | 0.054486 | 0.059382 | 0.063034 | 0.067930 | 0.071582 | 0.076478 |

| Fibonacci | 0.054279 | 0.057544 | 0.059561 | 0.062827 | 0.066092 | 0.068109 | 0.071375 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.051631 | 0.054480 | 0.056103 | 0.058952 | 0.060575 | 0.063424 | 0.065047 |

| Camarilla | 0.056497 | 0.056907 | 0.057317 | 0.057727 | 0.058137 | 0.058547 | 0.058957 |

| Woodie | 0.051019 | 0.054174 | 0.055491 | 0.058646 | 0.059963 | 0.063118 | 0.064435 |

| Fibonacci | 0.054480 | 0.056188 | 0.057243 | 0.058952 | 0.060660 | 0.061715 | 0.063424 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.029433 | 0.044917 | 0.053449 | 0.068933 | 0.077465 | 0.092949 | 0.101481 |

| Camarilla | 0.055377 | 0.057578 | 0.059780 | 0.061981 | 0.064183 | 0.066384 | 0.068585 |

| Woodie | 0.025957 | 0.043179 | 0.049973 | 0.067195 | 0.073989 | 0.091211 | 0.098005 |

| Fibonacci | 0.044917 | 0.054091 | 0.059759 | 0.068933 | 0.078107 | 0.083775 | 0.092949 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 73.55 | |

| MACD (12,26,9): | -0.0010 | |

| Directional Movement: | 40.074951 | |

| AROON (14): | 28.571426 | |

| DEMA (21): | 0.060665 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.057515 | |

| Elder Ray (13): | 0.013944 | |

| Super Trend (3,10): | 0.061315 | |

| Zig ZAG (10): | 0.078517 | |

| VORTEX (21): | 0.9612 | |

| Stochastique (14,3,5): | 50.40 | |

| TEMA (21): | 0.063464 | |

| Williams %R (14): | -37.05 | |

| Chande Momentum Oscillator (20): | 0.019758 | |

| Repulse (5,40,3): | 18.0260 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.6519 | |

| Courbe Coppock: | 4.46 |

| MA7: | 0.061766 | |

| MA20: | 0.061172 | |

| MA50: | 0.068424 | |

| MA100: | 0.086328 | |

| MAexp7: | 0.064458 | |

| MAexp20: | 0.063012 | |

| MAexp50: | 0.069648 | |

| MAexp100: | 0.080836 | |

| Price / MA7: | +27.42% | |

| Price / MA20: | +28.65% | |

| Price / MA50: | +15.02% | |

| Price / MA100: | -8.84% | |

| Price / MAexp7: | +22.10% | |

| Price / MAexp20: | +24.90% | |

| Price / MAexp50: | +13.00% | |

| Price / MAexp100: | -2.64% |

Add a comment

Comments

0 comments on the analysis STELLAR - XLM/USD - Daily