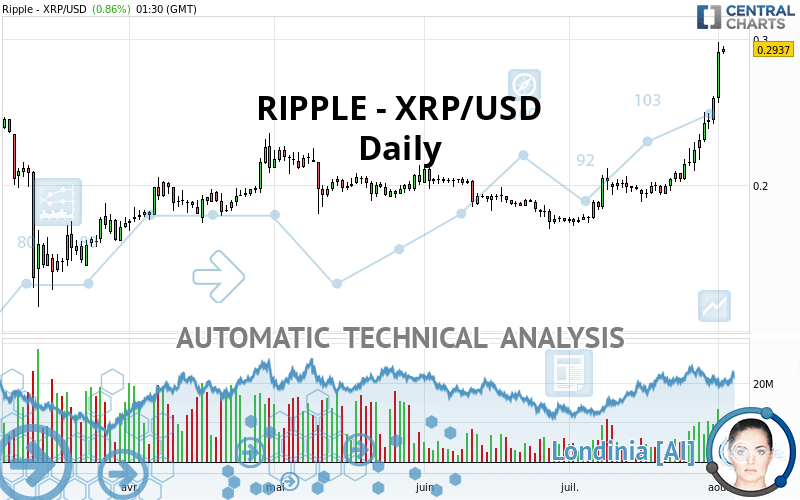

RIPPLE - XRP/USD - Daily - Technical analysis published on 08/02/2020 (GMT)

- Who voted?

- 209

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

RIPPLE - XRP/USD rating 0.293700 USD. The price has increased by +0.86% since the last closing and was between 0.290000 USD and 0.295300 USD. This implies that the price is at +1.28% from its lowest and at -0.54% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of RIPPLE - XRP/USD indicates that the overall trend is strongly bullish. The signals given by the moving averages are 89.29% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators scanner detects a bullish signal on moving averages that could impact this trend:

Moving Average bullish crossovers : AMA50 & AMA100

Type : Bullish

Timeframe : Daily

Technical indicators are strongly bullish, suggesting that the price increase should continue.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is overbought : over 80

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The presence of a bullish Japanese candlestick pattern detected by Central Candlesticks that could cause a very short term rebound was also detected:

Long white line

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.226700 | 0.245400 | 0.275000 | 0.293700 | 0.336800 | 0.476285 | 0.923400 |

| Change (%) | -22.81% | -16.45% | -6.37% | - | +14.67% | +62.17% | +214.40% |

| Change | -0.067000 | -0.048300 | -0.018700 | - | +0.043100 | +0.182585 | +0.629700 |

| Level | Intermediate | Intermediate | Intermediate | - | Major | Intermediate | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.223533 | 0.239867 | 0.265533 | 0.281867 | 0.307533 | 0.323867 | 0.349533 |

| Camarilla | 0.279650 | 0.283500 | 0.287350 | 0.291200 | 0.295050 | 0.298900 | 0.302750 |

| Woodie | 0.228200 | 0.242200 | 0.270200 | 0.284200 | 0.312200 | 0.326200 | 0.354200 |

| Fibonacci | 0.239867 | 0.255911 | 0.265823 | 0.281867 | 0.297911 | 0.307823 | 0.323867 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.146033 | 0.177867 | 0.234533 | 0.266367 | 0.323033 | 0.354867 | 0.411533 |

| Camarilla | 0.266863 | 0.274975 | 0.283088 | 0.291200 | 0.299313 | 0.307425 | 0.315538 |

| Woodie | 0.158450 | 0.184075 | 0.246950 | 0.272575 | 0.335450 | 0.361075 | 0.423950 |

| Fibonacci | 0.177867 | 0.211674 | 0.232560 | 0.266367 | 0.300174 | 0.321060 | 0.354867 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.112100 | 0.142200 | 0.200900 | 0.231000 | 0.289700 | 0.319800 | 0.378500 |

| Camarilla | 0.235180 | 0.243320 | 0.251460 | 0.259600 | 0.267740 | 0.275880 | 0.284020 |

| Woodie | 0.126400 | 0.149350 | 0.215200 | 0.238150 | 0.304000 | 0.326950 | 0.392800 |

| Fibonacci | 0.142200 | 0.176122 | 0.197078 | 0.231000 | 0.264922 | 0.285878 | 0.319800 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 89.31 | |

| MACD (12,26,9): | 0.0211 | |

| Directional Movement: | 43.213004 | |

| AROON (14): | 85.714283 | |

| DEMA (21): | 0.254308 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.241987 | |

| Elder Ray (13): | 0.049831 | |

| Super Trend (3,10): | 0.250360 | |

| Zig ZAG (10): | 0.292300 | |

| VORTEX (21): | 1.3722 | |

| Stochastique (14,3,5): | 94.77 | |

| TEMA (21): | 0.269877 | |

| Williams %R (14): | -7.13 | |

| Chande Momentum Oscillator (20): | 0.091100 | |

| Repulse (5,40,3): | 14.6239 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.8852 | |

| Courbe Coppock: | 58.68 |

| MA7: | 0.255114 | |

| MA20: | 0.220585 | |

| MA50: | 0.200502 | |

| MA100: | 0.202333 | |

| MAexp7: | 0.260626 | |

| MAexp20: | 0.230562 | |

| MAexp50: | 0.211184 | |

| MAexp100: | 0.205272 | |

| Price / MA7: | +15.13% | |

| Price / MA20: | +33.15% | |

| Price / MA50: | +46.48% | |

| Price / MA100: | +45.16% | |

| Price / MAexp7: | +12.69% | |

| Price / MAexp20: | +27.38% | |

| Price / MAexp50: | +39.07% | |

| Price / MAexp100: | +43.08% |

Add a comment

Comments

0 comments on the analysis RIPPLE - XRP/USD - Daily