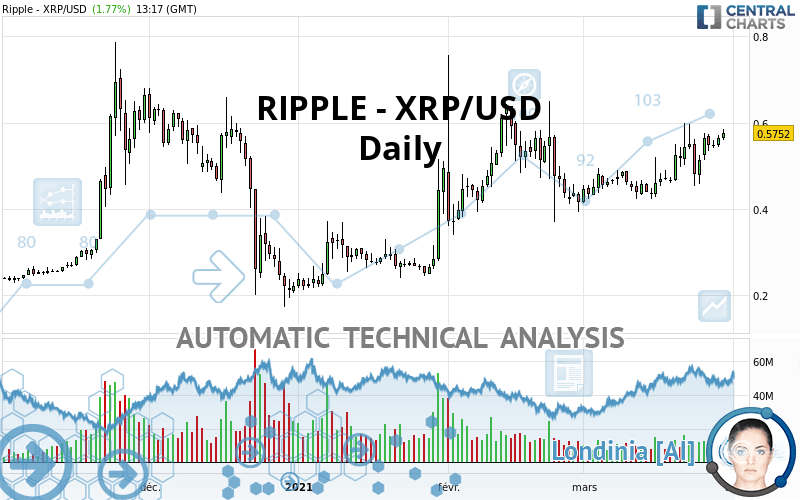

RIPPLE - XRP/USD - Daily - Technical analysis published on 03/30/2021 (GMT)

- 301

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The RIPPLE - XRP/USD rating is 0.575200 USD. On the day, this instrument gained +1.77% and was between 0.559400 USD and 0.586000 USD. This implies that the price is at +2.82% from its lowest and at -1.84% from its highest.Here is a more detailed summary of the historical variations registered by RIPPLE - XRP/USD:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of RIPPLE - XRP/USD in Daily shows a strongly overall bullish trend. The signals given by the moving averages are 92.86% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. An assessment of moving averages reveals a bullish signal that could impact this trend:

Moving Average bullish crossovers : AMA50 & AMA100

Type : Bullish

Timeframe : Daily

Technical indicators are strongly bullish, suggesting that the price increase should continue.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

MACD indicator: bearish divergence

Type : Bearish

Timeframe : Daily

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Near resistance of triangle

Type : Bearish

Timeframe : Daily

The presence of a bullish Japanese candlestick pattern detected by Central Candlesticks that could cause a very short term rebound was also detected:

Bullish engulfing lines

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.325700 | 0.416933 | 0.474100 | 0.575200 | 0.582300 | 0.634800 | 0.694500 |

| Change (%) | -43.38% | -27.52% | -17.58% | - | +1.23% | +10.36% | +20.74% |

| Change | -0.249500 | -0.158267 | -0.101100 | - | +0.007100 | +0.059600 | +0.119300 |

| Level | Minor | Intermediate | Major | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.521433 | 0.532467 | 0.548833 | 0.559867 | 0.576233 | 0.587267 | 0.603633 |

| Camarilla | 0.557665 | 0.560177 | 0.562688 | 0.565200 | 0.567712 | 0.570223 | 0.572735 |

| Woodie | 0.524100 | 0.533800 | 0.551500 | 0.561200 | 0.578900 | 0.588600 | 0.606300 |

| Fibonacci | 0.532467 | 0.542934 | 0.549400 | 0.559867 | 0.570334 | 0.576800 | 0.587267 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.320867 | 0.387033 | 0.467667 | 0.533833 | 0.614467 | 0.680633 | 0.761267 |

| Camarilla | 0.507930 | 0.521387 | 0.534843 | 0.548300 | 0.561757 | 0.575213 | 0.588670 |

| Woodie | 0.328100 | 0.390650 | 0.474900 | 0.537450 | 0.621700 | 0.684250 | 0.768500 |

| Fibonacci | 0.387033 | 0.443111 | 0.477756 | 0.533833 | 0.589911 | 0.624556 | 0.680633 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.028800 | 0.199400 | 0.308000 | 0.478600 | 0.587200 | 0.757800 | 0.866400 |

| Camarilla | 0.339820 | 0.365413 | 0.391007 | 0.416600 | 0.442193 | 0.467787 | 0.493380 |

| Woodie | -0.002200 | 0.183900 | 0.277000 | 0.463100 | 0.556200 | 0.742300 | 0.835400 |

| Fibonacci | 0.199400 | 0.306054 | 0.371946 | 0.478600 | 0.585254 | 0.651146 | 0.757800 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 62.87 | |

| MACD (12,26,9): | 0.0260 | |

| Directional Movement: | 14.258322 | |

| AROON (14): | 42.857143 | |

| DEMA (21): | 0.547223 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.474930 | |

| Elder Ray (13): | 0.041333 | |

| Super Trend (3,10): | 0.430869 | |

| Zig ZAG (10): | 0.576800 | |

| VORTEX (21): | 1.0895 | |

| Stochastique (14,3,5): | 77.97 | |

| TEMA (21): | 0.561612 | |

| Williams %R (14): | -16.35 | |

| Chande Momentum Oscillator (20): | 0.106900 | |

| Repulse (5,40,3): | 5.0555 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.5032 | |

| Courbe Coppock: | 41.51 |

| MA7: | 0.541871 | |

| MA20: | 0.501190 | |

| MA50: | 0.499610 | |

| MA100: | 0.406295 | |

| MAexp7: | 0.549543 | |

| MAexp20: | 0.517095 | |

| MAexp50: | 0.482299 | |

| MAexp100: | 0.444728 | |

| Price / MA7: | +6.15% | |

| Price / MA20: | +14.77% | |

| Price / MA50: | +15.13% | |

| Price / MA100: | +41.57% | |

| Price / MAexp7: | +4.67% | |

| Price / MAexp20: | +11.24% | |

| Price / MAexp50: | +19.26% | |

| Price / MAexp100: | +29.34% |

Add a comment

Comments

0 comments on the analysis RIPPLE - XRP/USD - Daily