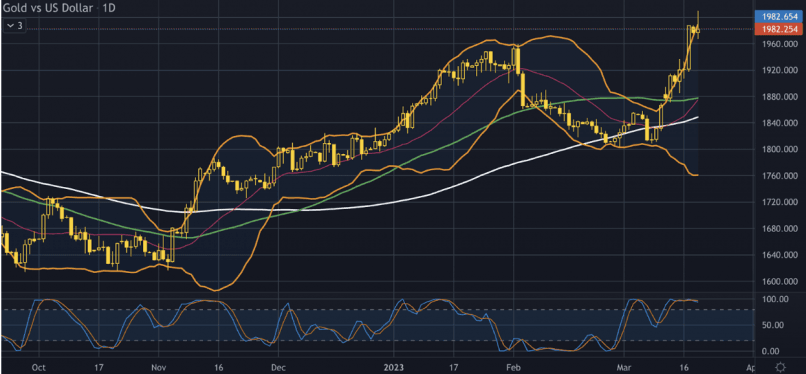

GOLD - USD - Gold-dollar, daily - 03/20/2023 (GMT)

- Who voted?

- 114

- 0

- Timeframe : Daily

GOLD - USD Chart

On Sunday, UBS agreed to buy Credit Suisse for $3.23 billion in a deal backed by a massive Swiss guarantee of around SFr9 billions but only after UBS has borne the first SFr5 billion of losses on certain portfolio of assets. Even after this event gold prices kept rising reaching the highest level since mid April of last year. Investors and traders don’t seem convinced that the recent moves by authorities can put a stop to the banking system fallouts, so it could take some time for gold to reverse its current bullish trend. The fragile environment will yet to be tested after economic data coming from the US about the FED’s interest rate decision later this week where there is a high probability of no hike in the horizon.

From the technical standpoint the price is still trading exactly on the upper band of the Bollinger bands indicating high volatility in the market for gold which would be boosted even more especially around the FED’s decision and the press conference after that. The Stochastic oscillator is recording extreme overbought levels but this is somewhat irrelevant in cases of high volatility. The 50 day moving average is trading above the 100 day moving average further validating the strong bullish momentum that has built up in the market. For the time being there are no signs of a correction to the downside but this can change rapidly depending of the developments of the banking environment in the following days.

In any case the next level of resistance seems to be laying around the $2,000 mark which consists of the psychological resistance of the round number and is also an inside resistance area since early March of last year. In the event of a correction to the downside in the following sessions we might see some support around the $1,950 price area which is the last area of price reaction since late January 2023.

From the technical standpoint the price is still trading exactly on the upper band of the Bollinger bands indicating high volatility in the market for gold which would be boosted even more especially around the FED’s decision and the press conference after that. The Stochastic oscillator is recording extreme overbought levels but this is somewhat irrelevant in cases of high volatility. The 50 day moving average is trading above the 100 day moving average further validating the strong bullish momentum that has built up in the market. For the time being there are no signs of a correction to the downside but this can change rapidly depending of the developments of the banking environment in the following days.

In any case the next level of resistance seems to be laying around the $2,000 mark which consists of the psychological resistance of the round number and is also an inside resistance area since early March of last year. In the event of a correction to the downside in the following sessions we might see some support around the $1,950 price area which is the last area of price reaction since late January 2023.

This member declared not having a position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis GOLD - USD - Daily