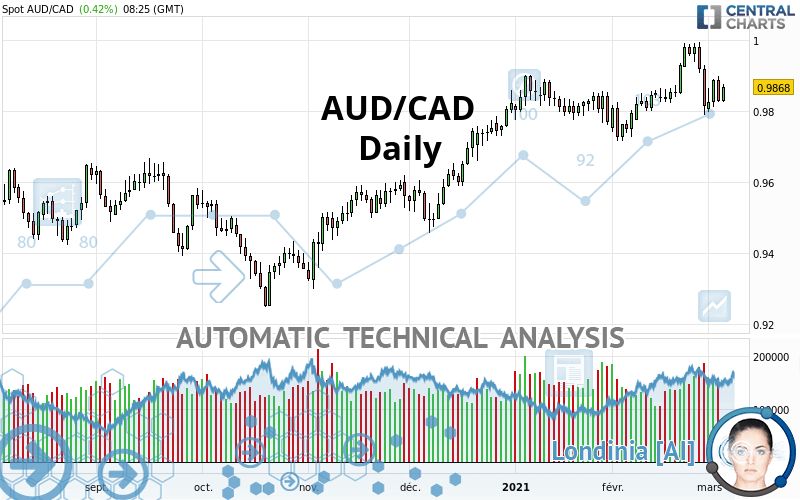

AUD/CAD - Daily - Technical analysis published on 03/04/2021 (GMT)

- 248

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

AUD/CAD rating 0.9868 CAD. On the day, this instrument gained +0.42% and was traded between 0.9826 CAD and 0.9875 CAD over the period. The price is currently at +0.43% from its lowest and -0.07% from its highest.A study of price movements over other periods shows the following variations:

Technical

Technical analysis of this Daily chart of AUD/CAD indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

On the 18 technical indicators analysed, 3 are bullish, 10 are neutral and 5 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

RSI indicator is back under 50

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found this result:

Near support of channel

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.9660 | 0.9726 | 0.9852 | 0.9868 | 0.9981 | 1.0337 | 1.0731 |

| Change (%) | -2.11% | -1.44% | -0.16% | - | +1.15% | +4.75% | +8.75% |

| Change | -0.0208 | -0.0142 | -0.0016 | - | +0.0113 | +0.0469 | +0.0863 |

| Level | Intermediate | Intermediate | Major | - | Major | Major | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.9726 | 0.9775 | 0.9801 | 0.9850 | 0.9876 | 0.9925 | 0.9951 |

| Camarilla | 0.9806 | 0.9813 | 0.9820 | 0.9827 | 0.9834 | 0.9841 | 0.9848 |

| Woodie | 0.9715 | 0.9769 | 0.9790 | 0.9844 | 0.9865 | 0.9919 | 0.9940 |

| Fibonacci | 0.9775 | 0.9804 | 0.9821 | 0.9850 | 0.9879 | 0.9896 | 0.9925 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.9533 | 0.9661 | 0.9738 | 0.9866 | 0.9943 | 1.0071 | 1.0148 |

| Camarilla | 0.9759 | 0.9777 | 0.9796 | 0.9815 | 0.9834 | 0.9853 | 0.9871 |

| Woodie | 0.9508 | 0.9648 | 0.9713 | 0.9853 | 0.9918 | 1.0058 | 1.0123 |

| Fibonacci | 0.9661 | 0.9739 | 0.9788 | 0.9866 | 0.9944 | 0.9993 | 1.0071 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.9410 | 0.9562 | 0.9689 | 0.9841 | 0.9968 | 1.0120 | 1.0247 |

| Camarilla | 0.9738 | 0.9764 | 0.9789 | 0.9815 | 0.9841 | 0.9866 | 0.9892 |

| Woodie | 0.9397 | 0.9556 | 0.9676 | 0.9835 | 0.9955 | 1.0114 | 1.0234 |

| Fibonacci | 0.9562 | 0.9669 | 0.9735 | 0.9841 | 0.9948 | 1.0014 | 1.0120 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 51.65 | |

| MACD (12,26,9): | 0.0017 | |

| Directional Movement: | -0.4655 | |

| AROON (14): | -7.1429 | |

| DEMA (21): | 0.9888 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.9982 | |

| Elder Ray (13): | -0.0019 | |

| Super Trend (3,10): | 0.9814 | |

| Zig ZAG (10): | 0.9867 | |

| VORTEX (21): | 1.0911 | |

| Stochastique (14,3,5): | 35.12 | |

| TEMA (21): | 0.9878 | |

| Williams %R (14): | -60.98 | |

| Chande Momentum Oscillator (20): | 0.0035 | |

| Repulse (5,40,3): | -0.0160 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.0363 | |

| Courbe Coppock: | 1.05 |

| MA7: | 0.9875 | |

| MA20: | 0.9865 | |

| MA50: | 0.9831 | |

| MA100: | 0.9668 | |

| MAexp7: | 0.9868 | |

| MAexp20: | 0.9862 | |

| MAexp50: | 0.9807 | |

| MAexp100: | 0.9712 | |

| Price / MA7: | -0.07% | |

| Price / MA20: | +0.03% | |

| Price / MA50: | +0.38% | |

| Price / MA100: | +2.07% | |

| Price / MAexp7: | -0% | |

| Price / MAexp20: | +0.06% | |

| Price / MAexp50: | +0.62% | |

| Price / MAexp100: | +1.61% |

News

Don"t forget to follow the news on AUD/CAD. At the time of publication of this analysis, the latest news was as follows:

-

Australian Dollar China GDP Analysis: AUD/USD, AUD/JPY, GBP/AUD, AUD/CAD

Australian Dollar China GDP Analysis: AUD/USD, AUD/JPY, GBP/AUD, AUD/CAD

-

Australian Dollar Analysis: AUD/USD, AUD/JPY, AUD/CAD Gain as RBA Holds in February

Australian Dollar Analysis: AUD/USD, AUD/JPY, AUD/CAD Gain as RBA Holds in February

-

AUD/USD, AUD/JPY, AUD/CAD, AUD/NZD Analysis - Australia Jobs Report Coverage

AUD/USD, AUD/JPY, AUD/CAD, AUD/NZD Analysis - Australia Jobs Report Coverage

-

RBA Coverage: AUD/USD, AUD/JPY, AUD/CAD, AUD/NZD Outlook with Daniel Dubrovsky

RBA Coverage: AUD/USD, AUD/JPY, AUD/CAD, AUD/NZD Outlook with Daniel Dubrovsky

-

AUDCAD Primed For Break with Fewer Thematic Restrictions (Quick Take Video)

AUDCAD Primed For Break with Fewer Thematic Restrictions (Quick Take Video)

Add a comment

Comments

0 comments on the analysis AUD/CAD - Daily