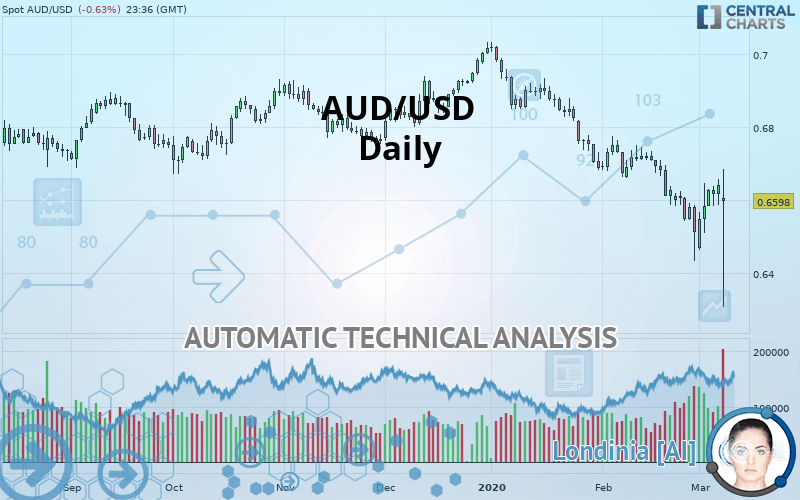

AUD/USD - Daily - Technical analysis published on 03/09/2020 (GMT)

- Who voted?

- 223

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The AUD/USD rating is 0.6598 USD. On the day, this instrument gained -0.63% and was between 0.6307 USD and 0.6685 USD. This implies that the price is at +4.61% from its lowest and at -1.30% from its highest.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New LOW record (5 years)

Type : Bearish

Timeframe : Weekly

New LOW record (1 year)

Type : Bearish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this AUD/USD chart shows a sharp bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting a bullish signal that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

In fact, Central Analyzer took into account 18 technical indicators and the result was as follows: 9 are bullish, 4 are neutral and 5 are bearish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Horizontal support is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.6053 | 0.6511 | 0.6598 | 0.6708 | 0.6762 | 0.6874 |

| Change (%) | -8.26% | -1.32% | - | +1.67% | +2.49% | +4.18% |

| Change | -0.0545 | -0.0087 | - | +0.0110 | +0.0164 | +0.0276 |

| Level | Intermediate | Intermediate | - | Intermediate | Minor | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6526 | 0.6555 | 0.6598 | 0.6627 | 0.6670 | 0.6699 | 0.6742 |

| Camarilla | 0.6620 | 0.6627 | 0.6633 | 0.6640 | 0.6647 | 0.6653 | 0.6660 |

| Woodie | 0.6532 | 0.6559 | 0.6604 | 0.6631 | 0.6676 | 0.6703 | 0.6748 |

| Fibonacci | 0.6555 | 0.6583 | 0.6600 | 0.6627 | 0.6655 | 0.6672 | 0.6699 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6324 | 0.6394 | 0.6517 | 0.6587 | 0.6710 | 0.6780 | 0.6903 |

| Camarilla | 0.6587 | 0.6605 | 0.6622 | 0.6640 | 0.6658 | 0.6675 | 0.6693 |

| Woodie | 0.6351 | 0.6407 | 0.6544 | 0.6600 | 0.6737 | 0.6793 | 0.6930 |

| Fibonacci | 0.6394 | 0.6468 | 0.6513 | 0.6587 | 0.6661 | 0.6706 | 0.6780 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6032 | 0.6233 | 0.6372 | 0.6573 | 0.6712 | 0.6913 | 0.7052 |

| Camarilla | 0.6418 | 0.6449 | 0.6480 | 0.6511 | 0.6542 | 0.6573 | 0.6605 |

| Woodie | 0.6001 | 0.6218 | 0.6341 | 0.6558 | 0.6681 | 0.6898 | 0.7021 |

| Fibonacci | 0.6233 | 0.6363 | 0.6443 | 0.6573 | 0.6703 | 0.6783 | 0.6913 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 42.64 | |

| MACD (12,26,9): | -0.0042 | |

| Directional Movement: | -29.4263 | |

| AROON (14): | -100.0000 | |

| DEMA (21): | 0.6573 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.6657 | |

| Elder Ray (13): | -0.0118 | |

| Super Trend (3,10): | 0.6683 | |

| Zig ZAG (10): | 0.6602 | |

| VORTEX (21): | 0.7718 | |

| Stochastique (14,3,5): | 69.52 | |

| TEMA (21): | 0.6574 | |

| Williams %R (14): | -26.93 | |

| Chande Momentum Oscillator (20): | -0.0012 | |

| Repulse (5,40,3): | 2.9406 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.1141 | |

| Courbe Coppock: | 2.81 |

| MA7: | 0.6590 | |

| MA20: | 0.6633 | |

| MA50: | 0.6754 | |

| MA100: | 0.6804 | |

| MAexp7: | 0.6605 | |

| MAexp20: | 0.6634 | |

| MAexp50: | 0.6712 | |

| MAexp100: | 0.6770 | |

| Price / MA7: | +0.12% | |

| Price / MA20: | -0.53% | |

| Price / MA50: | -2.31% | |

| Price / MA100: | -3.03% | |

| Price / MAexp7: | -0.11% | |

| Price / MAexp20: | -0.54% | |

| Price / MAexp50: | -1.70% | |

| Price / MAexp100: | -2.54% |

News

The last news published on AUD/USD at the time of the generation of this analysis was as follows:

-

USD/JPY and AUD/USD Forecast March 10, 2020

USD/JPY and AUD/USD Forecast March 10, 2020

-

AUD/USD Technical Analysis for March 10, 2020 by FXEmpire

AUD/USD Technical Analysis for March 10, 2020 by FXEmpire

-

USD/JPY and AUD/USD Forecast March 9, 2020

USD/JPY and AUD/USD Forecast March 9, 2020

-

AUD/USD Technical Analysis for the Week of March 9, 2020 by FXEmpire

AUD/USD Technical Analysis for the Week of March 9, 2020 by FXEmpire

-

AUD/USD Technical Analysis for March 9, 2020 by FXEmpire

AUD/USD Technical Analysis for March 9, 2020 by FXEmpire

Add a comment

Comments

0 comments on the analysis AUD/USD - Daily