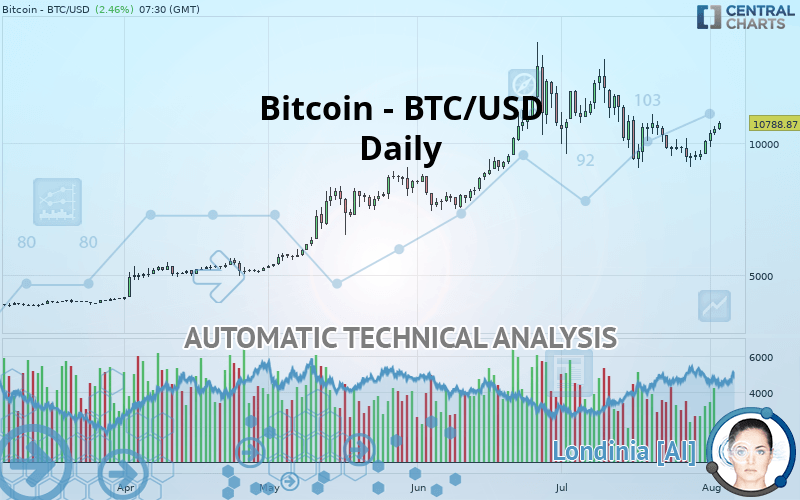

BITCOIN - BTC/USD - Daily - Technical analysis published on 08/03/2019 (GMT)

- Who voted?

- 324

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The Bitcoin - BTC/USD price is 10,788.87 USD. On the day, this instrument gained +2.46% with the lowest point at 10,506.21 USD and the highest point at 10,860.13 USD. The deviation from the price is +2.69% for the low point and -0.66% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Technical

Technical analysis of Bitcoin - BTC/USD in Daily shows a strongly overall bullish trend. 85.71% of the signals given by moving averages are bullish. The slightly bullish signals given by the short-term moving averages show a weakening of the global trend. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

An assessment of technical indicators shows a moderate bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bearish trend

Type : Bearish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Resistance of triangle is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 5,875.21 | 8,397.92 | 9,844.73 | 10,788.87 | 11,504.60 | 12,932.90 | 19,345.50 |

| Change (%) | -45.54% | -22.16% | -8.75% | - | +6.63% | +19.87% | +79.31% |

| Change | -4,913.66 | -2,390.95 | -944.14 | - | +715.73 | +2,144.03 | +8,556.63 |

| Level | Intermediate | Intermediate | Major | - | Intermediate | Intermediate | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 9,404.67 | 9,641.99 | 10,022.58 | 10,259.90 | 10,640.49 | 10,877.81 | 11,258.40 |

| Camarilla | 10,233.24 | 10,289.88 | 10,346.52 | 10,403.16 | 10,459.80 | 10,516.44 | 10,573.09 |

| Woodie | 9,476.30 | 9,677.81 | 10,094.21 | 10,295.72 | 10,712.12 | 10,913.63 | 11,330.03 |

| Fibonacci | 9,641.99 | 9,878.04 | 10,023.86 | 10,259.90 | 10,495.95 | 10,641.77 | 10,877.81 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 7,332.29 | 8,307.56 | 8,891.15 | 9,866.42 | 10,450.01 | 11,425.28 | 12,008.87 |

| Camarilla | 9,046.04 | 9,188.94 | 9,331.84 | 9,474.73 | 9,617.63 | 9,760.52 | 9,903.42 |

| Woodie | 7,136.44 | 8,209.64 | 8,695.30 | 9,768.50 | 10,254.16 | 11,327.36 | 11,813.02 |

| Fibonacci | 8,307.56 | 8,903.05 | 9,270.94 | 9,866.42 | 10,461.91 | 10,829.80 | 11,425.28 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,250.42 | 6,661.91 | 8,373.93 | 10,785.42 | 12,497.44 | 14,908.93 | 16,620.96 |

| Camarilla | 8,952.00 | 9,329.98 | 9,707.97 | 10,085.96 | 10,463.95 | 10,841.94 | 11,219.93 |

| Woodie | 3,900.69 | 6,487.04 | 8,024.21 | 10,610.55 | 12,147.72 | 14,734.06 | 16,271.23 |

| Fibonacci | 6,661.91 | 8,237.09 | 9,210.24 | 10,785.42 | 12,360.60 | 13,333.75 | 14,908.93 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 52.26 | |

| MACD (12,26,9): | -166.2300 | |

| Directional Movement: | 2.91 | |

| AROON (14): | -57.15 | |

| DEMA (21): | 9,977.08 | |

| Parabolic SAR (0,02-0,02-0,2): | 9,101.87 | |

| Elder Ray (13): | 409.82 | |

| Super Trend (3,10): | 11,643.10 | |

| Zig ZAG (10): | 10,437.62 | |

| VORTEX (21): | 0.9500 | |

| Stochastique (14,3,5): | 59.78 | |

| TEMA (21): | 9,715.19 | |

| Williams %R (14): | -33.36 | |

| Chande Momentum Oscillator (20): | -140.80 | |

| Repulse (5,40,3): | 5.4900 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.3300 | |

| Courbe Coppock: | 8.90 |

| MA7: | 9,862.36 | |

| MA20: | 10,069.32 | |

| MA50: | 10,568.81 | |

| MA100: | 8,899.25 | |

| MAexp7: | 10,071.67 | |

| MAexp20: | 10,187.35 | |

| MAexp50: | 10,028.20 | |

| MAexp100: | 8,991.23 | |

| Price / MA7: | +9.39% | |

| Price / MA20: | +7.15% | |

| Price / MA50: | +2.08% | |

| Price / MA100: | +21.23% | |

| Price / MAexp7: | +7.12% | |

| Price / MAexp20: | +5.90% | |

| Price / MAexp50: | +7.59% | |

| Price / MAexp100: | +19.99% |

Add a comment

Comments

0 comments on the analysis BITCOIN - BTC/USD - Daily