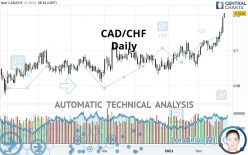

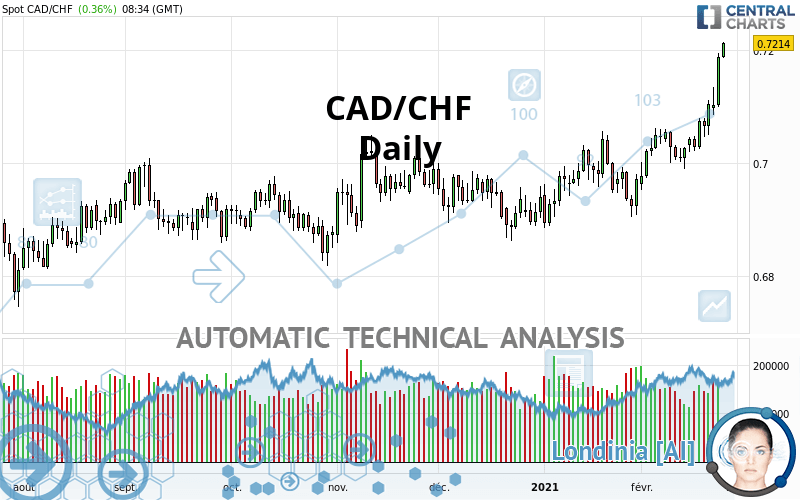

CAD/CHF - Daily - Technical analysis published on 02/24/2021 (GMT)

- 204

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The CAD/CHF price is 0.7214 CHF. On the day, this instrument gained +0.36% and was between 0.7187 CHF and 0.7215 CHF. This implies that the price is at +0.38% from its lowest and at -0.01% from its highest.A study of price movements over other periods shows the following variations:

New HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of CAD/CHF in Daily shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

An assessment of technical indicators shows a strong bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.6924 | 0.7021 | 0.7169 | 0.7214 | 0.7240 | 0.7424 | 0.7617 |

| Change (%) | -4.02% | -2.68% | -0.62% | - | +0.36% | +2.91% | +5.59% |

| Change | -0.0290 | -0.0193 | -0.0045 | - | +0.0026 | +0.0210 | +0.0403 |

| Level | Major | Major | Minor | - | Minor | Minor | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.7031 | 0.7065 | 0.7127 | 0.7161 | 0.7223 | 0.7257 | 0.7319 |

| Camarilla | 0.7162 | 0.7170 | 0.7179 | 0.7188 | 0.7197 | 0.7206 | 0.7214 |

| Woodie | 0.7044 | 0.7072 | 0.7140 | 0.7168 | 0.7236 | 0.7264 | 0.7332 |

| Fibonacci | 0.7065 | 0.7102 | 0.7125 | 0.7161 | 0.7198 | 0.7221 | 0.7257 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6956 | 0.6988 | 0.7047 | 0.7079 | 0.7138 | 0.7170 | 0.7229 |

| Camarilla | 0.7080 | 0.7088 | 0.7097 | 0.7105 | 0.7113 | 0.7122 | 0.7130 |

| Woodie | 0.6969 | 0.6995 | 0.7060 | 0.7086 | 0.7151 | 0.7177 | 0.7242 |

| Fibonacci | 0.6988 | 0.7023 | 0.7045 | 0.7079 | 0.7114 | 0.7136 | 0.7170 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6715 | 0.6801 | 0.6886 | 0.6972 | 0.7057 | 0.7143 | 0.7228 |

| Camarilla | 0.6925 | 0.6941 | 0.6956 | 0.6972 | 0.6988 | 0.7003 | 0.7019 |

| Woodie | 0.6716 | 0.6801 | 0.6887 | 0.6972 | 0.7058 | 0.7143 | 0.7229 |

| Fibonacci | 0.6801 | 0.6866 | 0.6906 | 0.6972 | 0.7037 | 0.7077 | 0.7143 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 74.46 | |

| MACD (12,26,9): | 0.0045 | |

| Directional Movement: | 25.1689 | |

| AROON (14): | 57.1429 | |

| DEMA (21): | 0.7118 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.7045 | |

| Elder Ray (13): | 0.0111 | |

| Super Trend (3,10): | 0.7064 | |

| Zig ZAG (10): | 0.7202 | |

| VORTEX (21): | 1.2564 | |

| Stochastique (14,3,5): | 89.58 | |

| TEMA (21): | 0.7145 | |

| Williams %R (14): | -4.93 | |

| Chande Momentum Oscillator (20): | 0.0149 | |

| Repulse (5,40,3): | 1.5464 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0592 | |

| Courbe Coppock: | 2.98 |

| MA7: | 0.7109 | |

| MA20: | 0.7048 | |

| MA50: | 0.6991 | |

| MA100: | 0.6966 | |

| MAexp7: | 0.7125 | |

| MAexp20: | 0.7065 | |

| MAexp50: | 0.7014 | |

| MAexp100: | 0.6983 | |

| Price / MA7: | +1.48% | |

| Price / MA20: | +2.36% | |

| Price / MA50: | +3.19% | |

| Price / MA100: | +3.56% | |

| Price / MAexp7: | +1.25% | |

| Price / MAexp20: | +2.11% | |

| Price / MAexp50: | +2.85% | |

| Price / MAexp100: | +3.31% |

News

The latest news and videos published on CAD/CHF at the time of the analysis were as follows:

CAD/CHF Finds the Proper Blend of Fuel and Clearance for Reversal

CAD/CHF Finds the Proper Blend of Fuel and Clearance for Reversal

Add a comment

Comments

0 comments on the analysis CAD/CHF - Daily