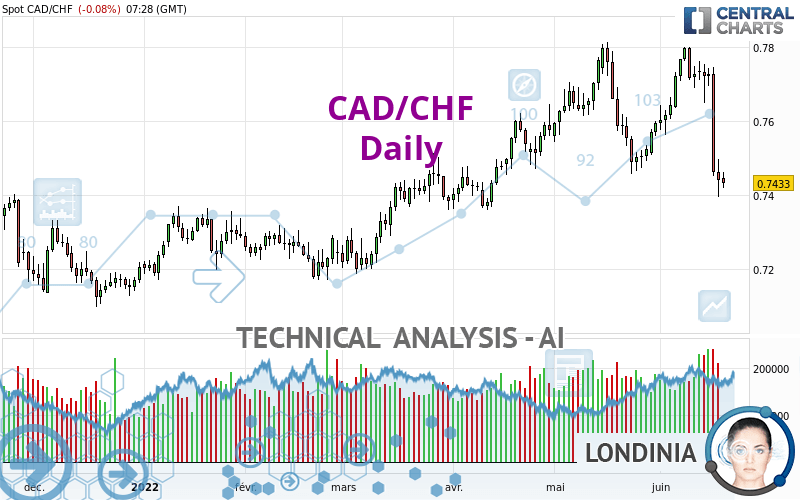

CAD/CHF - Daily - Technical analysis published on 06/20/2022 (GMT)

- 175

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The CAD/CHF price is 0.7433 CHF. The price is lower by -0.08% since the last closing and was traded between 0.7419 CHF and 0.7463 CHF over the period. The price is currently at +0.19% from its lowest and -0.40% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Daily of this CAD/CHF chart shows a slightly bearish trend. 53.57% of the signals given by moving averages are bearish. The overall trend could accelerate as a result of the strong bearish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 12 technical indicators on 18 studied are currently bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

CCI indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal support

Type : Bullish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.7161 | 0.7242 | 0.7370 | 0.7433 | 0.7489 | 0.7617 | 0.7717 |

| Change (%) | -3.66% | -2.57% | -0.85% | - | +0.75% | +2.48% | +3.82% |

| Change | -0.0272 | -0.0191 | -0.0063 | - | +0.0056 | +0.0184 | +0.0284 |

| Level | Major | Minor | Major | - | Major | Major | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.7287 | 0.7341 | 0.7390 | 0.7444 | 0.7493 | 0.7547 | 0.7596 |

| Camarilla | 0.7411 | 0.7420 | 0.7430 | 0.7439 | 0.7448 | 0.7458 | 0.7467 |

| Woodie | 0.7285 | 0.7340 | 0.7388 | 0.7443 | 0.7491 | 0.7546 | 0.7594 |

| Fibonacci | 0.7341 | 0.7380 | 0.7405 | 0.7444 | 0.7483 | 0.7508 | 0.7547 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.6935 | 0.7165 | 0.7302 | 0.7532 | 0.7669 | 0.7899 | 0.8036 |

| Camarilla | 0.7338 | 0.7372 | 0.7405 | 0.7439 | 0.7473 | 0.7506 | 0.7540 |

| Woodie | 0.6889 | 0.7142 | 0.7256 | 0.7509 | 0.7623 | 0.7876 | 0.7990 |

| Fibonacci | 0.7165 | 0.7305 | 0.7392 | 0.7532 | 0.7672 | 0.7759 | 0.7899 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.7074 | 0.7265 | 0.7430 | 0.7621 | 0.7786 | 0.7977 | 0.8142 |

| Camarilla | 0.7496 | 0.7529 | 0.7561 | 0.7594 | 0.7627 | 0.7659 | 0.7692 |

| Woodie | 0.7060 | 0.7259 | 0.7416 | 0.7615 | 0.7772 | 0.7971 | 0.8128 |

| Fibonacci | 0.7265 | 0.7401 | 0.7485 | 0.7621 | 0.7757 | 0.7841 | 0.7977 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 33.66 | |

| MACD (12,26,9): | -0.0015 | |

| Directional Movement: | -20.3779 | |

| AROON (14): | -50.0000 | |

| DEMA (21): | 0.7608 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.7777 | |

| Elder Ray (13): | -0.0160 | |

| Super Trend (3,10): | 0.7702 | |

| Zig ZAG (10): | 0.7434 | |

| VORTEX (21): | 0.9114 | |

| Stochastique (14,3,5): | 7.98 | |

| TEMA (21): | 0.7565 | |

| Williams %R (14): | -90.86 | |

| Chande Momentum Oscillator (20): | -0.0185 | |

| Repulse (5,40,3): | -2.5371 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0322 | |

| Courbe Coppock: | 0.69 |

| MA7: | 0.7605 | |

| MA20: | 0.7614 | |

| MA50: | 0.7602 | |

| MA100: | 0.7460 | |

| MAexp7: | 0.7558 | |

| MAexp20: | 0.7613 | |

| MAexp50: | 0.7580 | |

| MAexp100: | 0.7502 | |

| Price / MA7: | -2.26% | |

| Price / MA20: | -2.38% | |

| Price / MA50: | -2.22% | |

| Price / MA100: | -0.36% | |

| Price / MAexp7: | -1.65% | |

| Price / MAexp20: | -2.36% | |

| Price / MAexp50: | -1.94% | |

| Price / MAexp100: | -0.92% |

News

Don't forget to follow the news on CAD/CHF. At the time of publication of this analysis, the latest news was as follows:

Add a comment

Comments

0 comments on the analysis CAD/CHF - Daily