EUR/AUD - Stocks Dip, Profit Taking Continues - 12/01/2020 (GMT)

- Who voted?

- 197

- 0

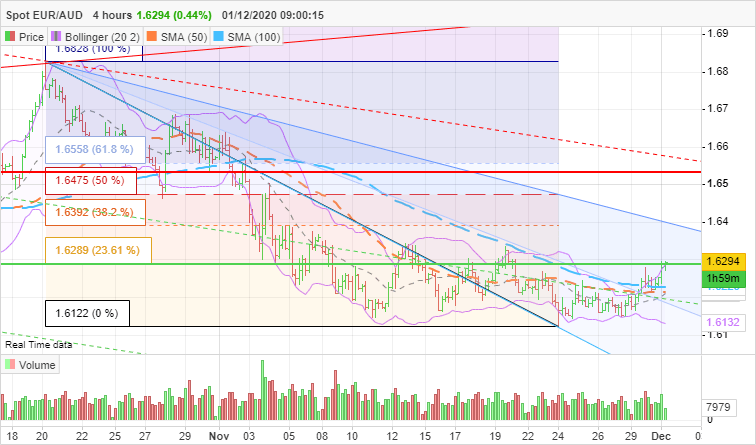

- Chart + Price target(s)

- Target : Upper

- |

- Target 1 : 1,63

- |

- Target 2 : 1,635

- |

- Target 3 : 1,64

- |

- Invalidation threshold : 1,618

- Timeframe : 4H

EUR/AUD Chart

STATE OF THE MARKETS

Profit taking continues as buyers left stocks. Global stocks took another dip on Monday as investors continue to take profit to prepare for their book closing of the year. The middle east tension between Israel and Iran was muted as investors saw it more as a show of strength than an actual threat. Optimism retreated, yet remains in the driver seat as big pharmas started to apply for mass vaccine production. Crude remains above $45/barrel as OPEC+ continue to debate about output cut in the wake of reviving Covid cases globally though vaccine hopes continue to suppress the price of gold. Gold continue to dive and closed below $1,800/oz for the first time in 20 weeks.

In the FX space, Dollar continue to be the favorite in the short term, along side Sterling, Euro and Loonie; while remain in the back burner in the medium and long term accounts. Though China data was surprisingly positive, medium term investors decided to take profit and liquidate Aussie longs. On another note, more than $1.2b Euro futures were traded as price reached 1.20 handle.

OUR PICK – EUR/AUD

Euro/Aussie shows a convergence of sentiments in the short and medium term accounts. If you had heard the old trading adage, “buy the rumors, sell the facts”; then this is the trade for it. Despite surprisingly bullish China data, Aussie was sold and failed to continue the rally on the news. Indeed, short and medium term accounts just point to this trade idea as three blocks of currencies set the pair apart. Weekly VPOC is around 1.62 and 21 days VPOC is around 1.6250. We believe, once the pair break 1.6280, the next leg up could go as high as 50% retracement of October high and November low, around 1.6480 and 1.6520 in extension.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Profit taking continues as buyers left stocks. Global stocks took another dip on Monday as investors continue to take profit to prepare for their book closing of the year. The middle east tension between Israel and Iran was muted as investors saw it more as a show of strength than an actual threat. Optimism retreated, yet remains in the driver seat as big pharmas started to apply for mass vaccine production. Crude remains above $45/barrel as OPEC+ continue to debate about output cut in the wake of reviving Covid cases globally though vaccine hopes continue to suppress the price of gold. Gold continue to dive and closed below $1,800/oz for the first time in 20 weeks.

In the FX space, Dollar continue to be the favorite in the short term, along side Sterling, Euro and Loonie; while remain in the back burner in the medium and long term accounts. Though China data was surprisingly positive, medium term investors decided to take profit and liquidate Aussie longs. On another note, more than $1.2b Euro futures were traded as price reached 1.20 handle.

OUR PICK – EUR/AUD

Euro/Aussie shows a convergence of sentiments in the short and medium term accounts. If you had heard the old trading adage, “buy the rumors, sell the facts”; then this is the trade for it. Despite surprisingly bullish China data, Aussie was sold and failed to continue the rally on the news. Indeed, short and medium term accounts just point to this trade idea as three blocks of currencies set the pair apart. Weekly VPOC is around 1.62 and 21 days VPOC is around 1.6250. We believe, once the pair break 1.6280, the next leg up could go as high as 50% retracement of October high and November low, around 1.6480 and 1.6520 in extension.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

This member declared having a buying position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis EUR/AUD - 4H