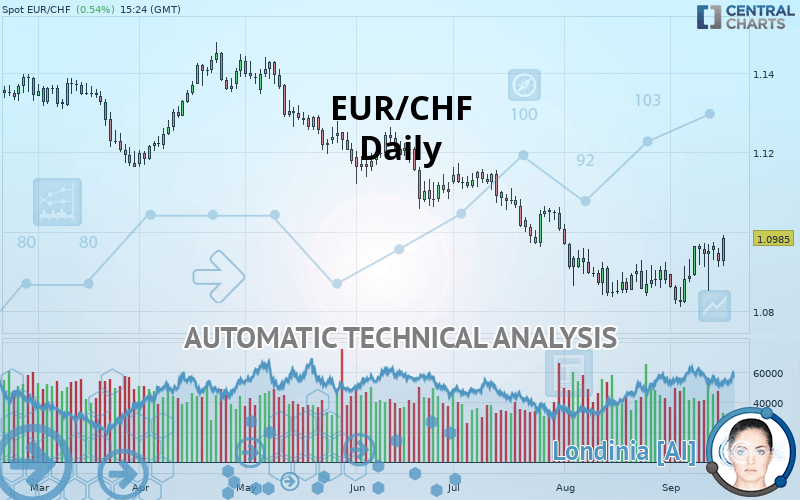

EUR/CHF - Daily - Technical analysis published on 09/17/2019 (GMT)

- Who voted?

- 164

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

EUR/CHF rating 1.0985 CHF. The price has increased by +0.54% since the last closing and was traded between 1.0914 CHF and 1.0993 CHF over the period. The price is currently at +0.65% from its lowest and -0.07% from its highest.A study of price movements over other periods shows the following variations:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of EUR/CHF indicates that the overall trend is slightly bearish. Only 57.14% of the signals given by moving averages are bearish. This slightly bearish trend could quickly be reversed due to the strong bullish signals currently being given by short-term moving averages. An assessment of moving averages reveals several bearish signals that could impact this trend:

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

Technical indicators are strongly bullish, suggesting that the price increase should continue.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

RSI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.0783 | 1.0908 | 1.0971 | 1.0985 | 1.1082 | 1.1167 | 1.1323 |

| Change (%) | -1.84% | -0.70% | -0.13% | - | +0.88% | +1.66% | +3.08% |

| Change | -0.0202 | -0.0077 | -0.0014 | - | +0.0097 | +0.0182 | +0.0338 |

| Level | Major | Intermediate | Intermediate | - | Minor | Major | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0859 | 1.0885 | 1.0906 | 1.0932 | 1.0953 | 1.0979 | 1.1000 |

| Camarilla | 1.0913 | 1.0917 | 1.0922 | 1.0926 | 1.0930 | 1.0935 | 1.0939 |

| Woodie | 1.0856 | 1.0884 | 1.0903 | 1.0931 | 1.0950 | 1.0978 | 1.0997 |

| Fibonacci | 1.0885 | 1.0903 | 1.0914 | 1.0932 | 1.0950 | 1.0961 | 1.0979 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0763 | 1.0807 | 1.0886 | 1.0930 | 1.1009 | 1.1053 | 1.1132 |

| Camarilla | 1.0930 | 1.0942 | 1.0953 | 1.0964 | 1.0975 | 1.0987 | 1.0998 |

| Woodie | 1.0780 | 1.0816 | 1.0903 | 1.0939 | 1.1026 | 1.1062 | 1.1149 |

| Fibonacci | 1.0807 | 1.0854 | 1.0883 | 1.0930 | 1.0977 | 1.1006 | 1.1053 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0618 | 1.0726 | 1.0803 | 1.0911 | 1.0988 | 1.1096 | 1.1173 |

| Camarilla | 1.0828 | 1.0845 | 1.0862 | 1.0879 | 1.0896 | 1.0913 | 1.0930 |

| Woodie | 1.0602 | 1.0718 | 1.0787 | 1.0903 | 1.0972 | 1.1088 | 1.1157 |

| Fibonacci | 1.0726 | 1.0797 | 1.0841 | 1.0911 | 1.0982 | 1.1026 | 1.1096 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 59.03 | |

| MACD (12,26,9): | 0.0007 | |

| Directional Movement: | -0.1195 | |

| AROON (14): | 64.2857 | |

| DEMA (21): | 1.0921 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.0864 | |

| Elder Ray (13): | 0.0026 | |

| Super Trend (3,10): | 1.0987 | |

| Zig ZAG (10): | 1.0983 | |

| VORTEX (21): | 1.0509 | |

| Stochastique (14,3,5): | 86.16 | |

| TEMA (21): | 1.0957 | |

| Williams %R (14): | -5.49 | |

| Chande Momentum Oscillator (20): | 0.0104 | |

| Repulse (5,40,3): | 0.9232 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0115 | |

| Courbe Coppock: | 1.30 |

| MA7: | 1.0956 | |

| MA20: | 1.0902 | |

| MA50: | 1.0948 | |

| MA100: | 1.1085 | |

| MAexp7: | 1.0945 | |

| MAexp20: | 1.0921 | |

| MAexp50: | 1.0961 | |

| MAexp100: | 1.1049 | |

| Price / MA7: | +0.26% | |

| Price / MA20: | +0.76% | |

| Price / MA50: | +0.34% | |

| Price / MA100: | -0.90% | |

| Price / MAexp7: | +0.37% | |

| Price / MAexp20: | +0.59% | |

| Price / MAexp50: | +0.22% | |

| Price / MAexp100: | -0.58% |

News

The latest news and videos published on EUR/CHF at the time of the analysis were as follows:

-

Weekly Technical Analysis: 26/08/2019 - USDJPY, EURCHF, NZDUSD

Weekly Technical Analysis: 26/08/2019 - USDJPY, EURCHF, NZDUSD

-

Quick EURUSD EURCHF 07 25 2019

Quick EURUSD EURCHF 07 25 2019

-

As France, Italy, ECB and Other Euro Risks Rise, Watch EURCHF

As France, Italy, ECB and Other Euro Risks Rise, Watch EURCHF

-

Could a Desperate SNB Trigger a EURCHF, Swiss Franc Reversal?

Could a Desperate SNB Trigger a EURCHF, Swiss Franc Reversal?

-

Weekly Technical Analysis: 29/05/2018 - USDJPY, EURUSD, GBPUSD, EURCHF

Weekly Technical Analysis: 29/05/2018 - USDJPY, EURUSD, GBPUSD, EURCHF

Add a comment

Comments

0 comments on the analysis EUR/CHF - Daily