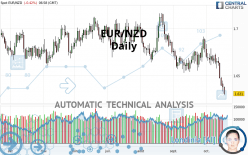

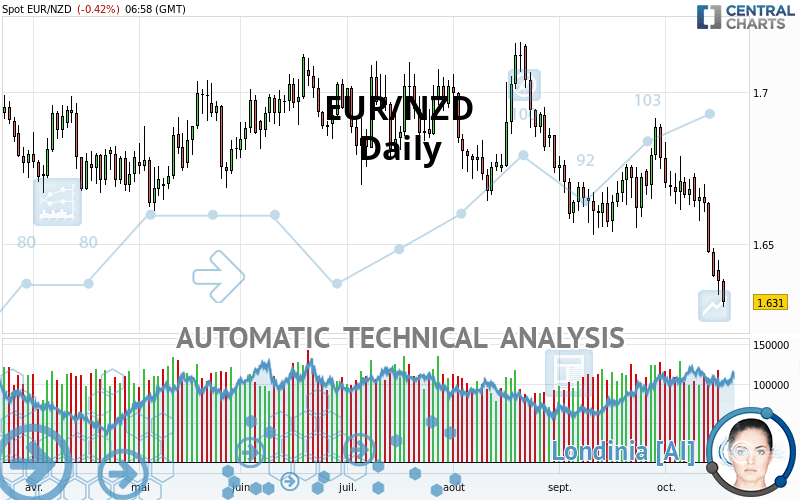

EUR/NZD - Daily - Technical analysis published on 10/19/2021 (GMT)

- 537

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The EUR/NZD rating is 1.6309 NZD. On the day, this instrument lost -0.43% and was traded between 1.6294 NZD and 1.6387 NZD over the period. The price is currently at +0.09% from its lowest and -0.48% from its highest.A study of price movements over other periods shows the following variations:

New LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this EUR/NZD chart shows a sharp bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

An assessment of technical indicators shows a strong bearish signal.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal support

Type : Bullish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 1.4001 | 1.5050 | 1.6309 | 1.6345 | 1.6626 | 1.6816 |

| Change (%) | -14.15% | -7.72% | - | +0.22% | +1.94% | +3.11% |

| Change | -0.2308 | -0.1259 | - | +0.0036 | +0.0317 | +0.0507 |

| Level | Minor | Minor | - | Major | Major | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6209 | 1.6270 | 1.6325 | 1.6386 | 1.6441 | 1.6502 | 1.6557 |

| Camarilla | 1.6347 | 1.6358 | 1.6368 | 1.6379 | 1.6390 | 1.6400 | 1.6411 |

| Woodie | 1.6205 | 1.6269 | 1.6321 | 1.6385 | 1.6437 | 1.6501 | 1.6553 |

| Fibonacci | 1.6270 | 1.6315 | 1.6342 | 1.6386 | 1.6431 | 1.6458 | 1.6502 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.5936 | 1.6164 | 1.6279 | 1.6507 | 1.6622 | 1.6850 | 1.6965 |

| Camarilla | 1.6301 | 1.6332 | 1.6364 | 1.6395 | 1.6426 | 1.6458 | 1.6489 |

| Woodie | 1.5881 | 1.6136 | 1.6224 | 1.6479 | 1.6567 | 1.6822 | 1.6910 |

| Fibonacci | 1.6164 | 1.6295 | 1.6376 | 1.6507 | 1.6638 | 1.6719 | 1.6850 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6191 | 1.6361 | 1.6573 | 1.6743 | 1.6955 | 1.7125 | 1.7337 |

| Camarilla | 1.6679 | 1.6714 | 1.6749 | 1.6784 | 1.6819 | 1.6854 | 1.6889 |

| Woodie | 1.6211 | 1.6372 | 1.6593 | 1.6754 | 1.6975 | 1.7136 | 1.7357 |

| Fibonacci | 1.6361 | 1.6507 | 1.6597 | 1.6743 | 1.6889 | 1.6979 | 1.7125 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 27.80 | |

| MACD (12,26,9): | -0.0087 | |

| Directional Movement: | -17.6249 | |

| AROON (14): | -100.0000 | |

| DEMA (21): | 1.6492 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.6759 | |

| Elder Ray (13): | -0.0200 | |

| Super Trend (3,10): | 1.6685 | |

| Zig ZAG (10): | 1.6298 | |

| VORTEX (21): | 0.8672 | |

| Stochastique (14,3,5): | 3.00 | |

| TEMA (21): | 1.6439 | |

| Williams %R (14): | -100.00 | |

| Chande Momentum Oscillator (20): | -0.0405 | |

| Repulse (5,40,3): | -1.6212 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0379 | |

| Courbe Coppock: | 3.10 |

| MA7: | 1.6497 | |

| MA20: | 1.6641 | |

| MA50: | 1.6721 | |

| MA100: | 1.6824 | |

| MAexp7: | 1.6461 | |

| MAexp20: | 1.6591 | |

| MAexp50: | 1.6692 | |

| MAexp100: | 1.6765 | |

| Price / MA7: | -1.14% | |

| Price / MA20: | -2.00% | |

| Price / MA50: | -2.46% | |

| Price / MA100: | -3.06% | |

| Price / MAexp7: | -0.92% | |

| Price / MAexp20: | -1.69% | |

| Price / MAexp50: | -2.29% | |

| Price / MAexp100: | -2.71% |

News

The last news published on EUR/NZD at the time of the generation of this analysis was as follows:

Add a comment

Comments

0 comments on the analysis EUR/NZD - Daily