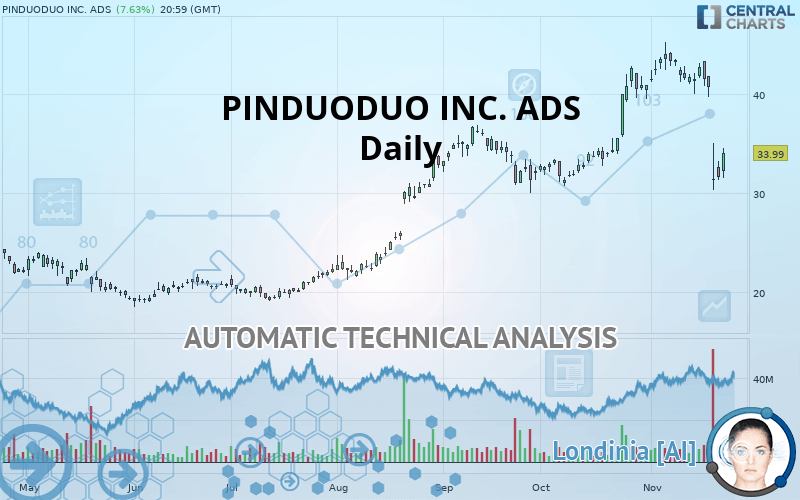

PDD HOLDINGS INC. ADS - Daily - Technical analysis published on 11/25/2019 (GMT)

- Who voted?

- 356

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

PINDUODUO INC. ADS rating 33.99 USD. The price has increased by +7.63% since the last closing and was traded between 31.52 USD and 34.57 USD over the period. The price is currently at +7.84% from its lowest and -1.68% from its highest.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by PINDUODUO INC. ADS:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Technical

Technical analysis of this Daily chart of PINDUODUO INC. ADS indicates that the overall trend is not clearly defined. The trend could quickly turn bearish due to the strong bearish signals currently being given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

Technical indicators are bearish. There is still some doubt about the decline in the price.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : Daily

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 21.61 | 24.42 | 31.16 | 33.99 | 36.67 | 43.53 |

| Change (%) | -36.42% | -28.16% | -8.33% | - | +7.88% | +28.07% |

| Change | -12.38 | -9.57 | -2.83 | - | +2.68 | +9.54 |

| Level | Minor | Minor | Major | - | Minor | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.83 | 30.05 | 30.81 | 32.03 | 32.79 | 34.01 | 34.77 |

| Camarilla | 31.04 | 31.22 | 31.40 | 31.58 | 31.76 | 31.94 | 32.12 |

| Woodie | 28.61 | 29.94 | 30.59 | 31.92 | 32.57 | 33.90 | 34.55 |

| Fibonacci | 30.05 | 30.80 | 31.27 | 32.03 | 32.78 | 33.25 | 34.01 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 37.74 | 38.87 | 40.82 | 41.95 | 43.90 | 45.03 | 46.98 |

| Camarilla | 41.91 | 42.20 | 42.48 | 42.76 | 43.04 | 43.33 | 43.61 |

| Woodie | 38.14 | 39.08 | 41.22 | 42.16 | 44.30 | 45.24 | 47.38 |

| Fibonacci | 38.87 | 40.05 | 40.78 | 41.95 | 43.13 | 43.86 | 45.03 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 21.20 | 25.93 | 33.40 | 38.13 | 45.60 | 50.33 | 57.80 |

| Camarilla | 37.53 | 38.64 | 39.76 | 40.88 | 42.00 | 43.12 | 44.24 |

| Woodie | 22.58 | 26.62 | 34.78 | 38.82 | 46.98 | 51.02 | 59.18 |

| Fibonacci | 25.93 | 30.59 | 33.47 | 38.13 | 42.79 | 45.67 | 50.33 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 38.23 | |

| MACD (12,26,9): | -0.3700 | |

| Directional Movement: | -19.04 | |

| AROON (14): | -71.42 | |

| DEMA (21): | 38.75 | |

| Parabolic SAR (0,02-0,02-0,2): | 41.18 | |

| Elder Ray (13): | -5.05 | |

| Super Trend (3,10): | 40.00 | |

| Zig ZAG (10): | 33.99 | |

| VORTEX (21): | 0.9600 | |

| Stochastique (14,3,5): | 13.76 | |

| TEMA (21): | 36.79 | |

| Williams %R (14): | -75.12 | |

| Chande Momentum Oscillator (20): | -9.50 | |

| Repulse (5,40,3): | 0.2700 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.4800 | |

| Courbe Coppock: | 21.69 |

| MA7: | 37.61 | |

| MA20: | 40.54 | |

| MA50: | 36.42 | |

| MA100: | 31.03 | |

| MAexp7: | 36.40 | |

| MAexp20: | 38.48 | |

| MAexp50: | 36.48 | |

| MAexp100: | 32.86 | |

| Price / MA7: | -9.63% | |

| Price / MA20: | -16.16% | |

| Price / MA50: | -6.67% | |

| Price / MA100: | +9.54% | |

| Price / MAexp7: | -6.62% | |

| Price / MAexp20: | -11.67% | |

| Price / MAexp50: | -6.83% | |

| Price / MAexp100: | +3.44% |

News

The last news published on PINDUODUO INC. ADS at the time of the generation of this analysis was as follows:

- Pinduoduo Announces Third Quarter 2019 Unaudited Financial Results

- Pinduoduo to Report Third Quarter 2019 Unaudited Financial Results on Nov 20, 2019

- Pinduoduo Announces Proposed Offering of US$875 Million Convertible Senior Notes

- Pinduoduo Announces Second Quarter 2019 Unaudited Financial Results and Appoints New Independent Director

- Pinduoduo to Report Second Quarter 2019 Unaudited Financial Results on Aug 21, 2019

Add a comment

Comments

0 comments on the analysis PDD HOLDINGS INC. ADS - Daily