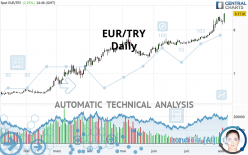

EUR/TRY - Daily - Technical analysis published on 08/05/2020 (GMT)

- Who voted?

- 213

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

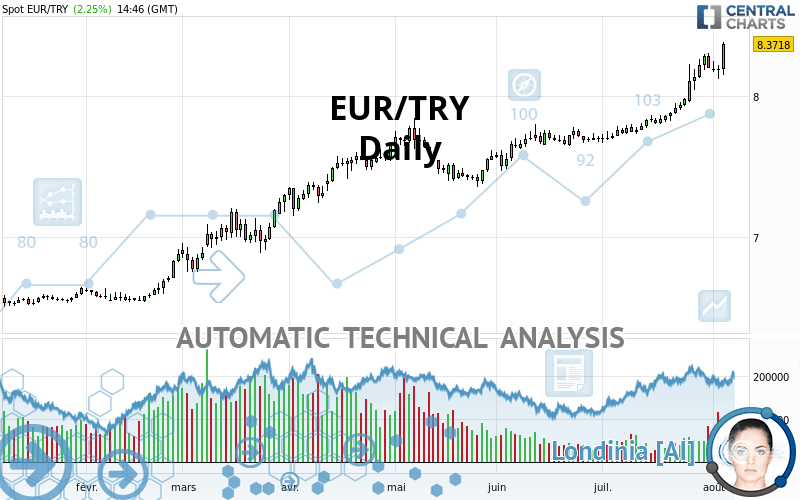

EUR/TRY rating 8.3717 TRY. On the day, this instrument gained +2.25% and was traded between 8.1512 TRY and 8.3827 TRY over the period. The price is currently at +2.71% from its lowest and -0.13% from its highest.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of EUR/TRY in Daily shows a strongly overall bullish trend. The signals given by the moving averages are 92.86% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Moving Average bearish crossovers : AMA20 & AMA50

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 100

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

An assessment of technical indicators shows a moderate bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is oversold : under 20

Type : Neutral

Timeframe : Daily

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back under 50

Type : Bearish

Timeframe : Daily

MACD crosses DOWN its Moving Average

Type : Bearish

Timeframe : Daily

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : Daily

SuperTrend indicator bearish reversal

Type : Bearish

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Downside gap

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 7.3959 | 7.7729 | 7.9252 | 8.3717 |

| Change (%) | -11.66% | -7.15% | -5.33% | - |

| Change | -0.9758 | -0.5988 | -0.4465 | - |

| Level | Intermediate | Intermediate | Major | - |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 6.0450 | 6.1211 | 6.1730 | 6.2491 | 6.3010 | 6.3771 | 6.4290 |

| Camarilla | 6.1898 | 6.2015 | 6.2133 | 6.2250 | 6.2367 | 6.2485 | 6.2602 |

| Woodie | 6.0330 | 6.1151 | 6.1610 | 6.2431 | 6.2890 | 6.3711 | 6.4170 |

| Fibonacci | 6.1211 | 6.1700 | 6.2002 | 6.2491 | 6.2980 | 6.3282 | 6.3771 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.2344 | 3.3000 | 3.3474 | 3.4130 | 3.4604 | 3.5260 | 3.5734 |

| Camarilla | 3.3637 | 3.3741 | 3.3844 | 3.3948 | 3.4052 | 3.4155 | 3.4259 |

| Woodie | 3.2253 | 3.2955 | 3.3383 | 3.4085 | 3.4513 | 3.5215 | 3.5643 |

| Fibonacci | 3.3000 | 3.3432 | 3.3698 | 3.4130 | 3.4562 | 3.4828 | 3.5260 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 7.1663 | 7.4168 | 7.8063 | 8.0568 | 8.4463 | 8.6968 | 9.0863 |

| Camarilla | 8.0198 | 8.0785 | 8.1371 | 8.1958 | 8.2545 | 8.3131 | 8.3718 |

| Woodie | 7.2358 | 7.4516 | 7.8758 | 8.0916 | 8.5158 | 8.7316 | 9.1558 |

| Fibonacci | 7.4168 | 7.6613 | 7.8123 | 8.0568 | 8.3013 | 8.4523 | 8.6968 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 56.13 | |

| MACD (12,26,9): | 0.0208 | |

| Directional Movement: | 10.2431 | |

| AROON (14): | 7.1429 | |

| DEMA (21): | 7.9379 | |

| Parabolic SAR (0,02-0,02-0,2): | 6.1971 | |

| Elder Ray (13): | 0.4055 | |

| Super Trend (3,10): | 6.8842 | |

| Zig ZAG (10): | 8.3713 | |

| VORTEX (21): | 1.0384 | |

| Stochastique (14,3,5): | 59.12 | |

| TEMA (21): | 7.8914 | |

| Williams %R (14): | -0.91 | |

| Chande Momentum Oscillator (20): | 0.4826 | |

| Repulse (5,40,3): | 1.5506 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.1374 | |

| Courbe Coppock: | 1.95 |

| MA7: | 7.9520 | |

| MA20: | 7.9164 | |

| MA50: | 7.7773 | |

| MA100: | 7.6062 | |

| MAexp7: | 7.8469 | |

| MAexp20: | 7.8880 | |

| MAexp50: | 7.7795 | |

| MAexp100: | 7.5709 | |

| Price / MA7: | +5.28% | |

| Price / MA20: | +5.75% | |

| Price / MA50: | +7.64% | |

| Price / MA100: | +10.06% | |

| Price / MAexp7: | +6.69% | |

| Price / MAexp20: | +6.13% | |

| Price / MAexp50: | +7.61% | |

| Price / MAexp100: | +10.58% |

Add a comment

Comments

0 comments on the analysis EUR/TRY - Daily