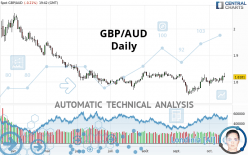

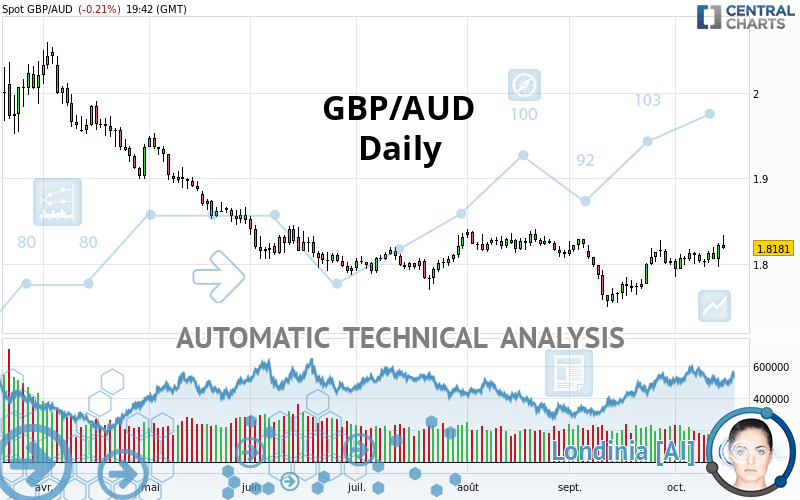

GBP/AUD - Daily - Technical analysis published on 10/15/2020 (GMT)

- Who voted?

- 144

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The GBP/AUD price is 1.8181 AUD. On the day, this instrument lost -0.21% and was between 1.8177 AUD and 1.8333 AUD. This implies that the price is at +0.02% from its lowest and at -0.83% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this GBP/AUD chart shows a neutral trend. The trend could quickly turn bullish due to the strong bullish signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

Technical indicators are slightly bullish. There is therefore considerable uncertainty about the continuation of the increase.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bearish reversal

Type : Bearish

Timeframe : Daily

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.7694 | 1.7933 | 1.8153 | 1.8181 | 1.8762 | 1.9454 | 1.9734 |

| Change (%) | -2.68% | -1.36% | -0.15% | - | +3.20% | +7.00% | +8.54% |

| Change | -0.0487 | -0.0248 | -0.0028 | - | +0.0581 | +0.1273 | +0.1553 |

| Level | Major | Major | Major | - | Intermediate | Intermediate | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.7758 | 1.7862 | 1.8041 | 1.8145 | 1.8324 | 1.8428 | 1.8607 |

| Camarilla | 1.8142 | 1.8168 | 1.8194 | 1.8220 | 1.8246 | 1.8272 | 1.8298 |

| Woodie | 1.7796 | 1.7881 | 1.8079 | 1.8164 | 1.8362 | 1.8447 | 1.8645 |

| Fibonacci | 1.7862 | 1.7970 | 1.8037 | 1.8145 | 1.8253 | 1.8320 | 1.8428 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.0257 | 2.0613 | 2.0801 | 2.1157 | 2.1345 | 2.1701 | 2.1889 |

| Camarilla | 2.0838 | 2.0888 | 2.0938 | 2.0988 | 2.1038 | 2.1088 | 2.1138 |

| Woodie | 2.0172 | 2.0571 | 2.0716 | 2.1115 | 2.1260 | 2.1659 | 2.1804 |

| Fibonacci | 2.0613 | 2.0821 | 2.0950 | 2.1157 | 2.1365 | 2.1494 | 2.1701 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6791 | 1.7142 | 1.7585 | 1.7936 | 1.8379 | 1.8730 | 1.9173 |

| Camarilla | 1.7809 | 1.7881 | 1.7954 | 1.8027 | 1.8100 | 1.8173 | 1.8245 |

| Woodie | 1.6836 | 1.7165 | 1.7630 | 1.7959 | 1.8424 | 1.8753 | 1.9218 |

| Fibonacci | 1.7142 | 1.7446 | 1.7633 | 1.7936 | 1.8240 | 1.8427 | 1.8730 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 52.14 | |

| MACD (12,26,9): | 0.0062 | |

| Directional Movement: | 5.9661 | |

| AROON (14): | 50.0000 | |

| DEMA (21): | 1.8182 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.8919 | |

| Elder Ray (13): | 0.0104 | |

| Super Trend (3,10): | 1.8925 | |

| Zig ZAG (10): | 1.8177 | |

| VORTEX (21): | 1.0565 | |

| Stochastique (14,3,5): | 27.86 | |

| TEMA (21): | 1.8253 | |

| Williams %R (14): | -69.27 | |

| Chande Momentum Oscillator (20): | 0.0156 | |

| Repulse (5,40,3): | 0.1149 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0351 | |

| Courbe Coppock: | 2.52 |

| MA7: | 1.8223 | |

| MA20: | 1.8087 | |

| MA50: | 1.8081 | |

| MA100: | 1.8093 | |

| MAexp7: | 1.8192 | |

| MAexp20: | 1.8114 | |

| MAexp50: | 1.8096 | |

| MAexp100: | 1.8240 | |

| Price / MA7: | -0.23% | |

| Price / MA20: | +0.52% | |

| Price / MA50: | +0.55% | |

| Price / MA100: | +0.49% | |

| Price / MAexp7: | -0.06% | |

| Price / MAexp20: | +0.37% | |

| Price / MAexp50: | +0.47% | |

| Price / MAexp100: | -0.32% |

News

The last news published on GBP/AUD at the time of the generation of this analysis was as follows:

-

GBPAUD Clears 1.8500 Level

GBPAUD Clears 1.8500 Level

-

Pound Pairs Breaking Critical Levels From GBP/USD to GBP/AUD (Quick Take Video)

Pound Pairs Breaking Critical Levels From GBP/USD to GBP/AUD (Quick Take Video)

-

Volatility In Commodities GBP/AUD

Volatility In Commodities GBP/AUD

-

Risk on pressures GBPAUD

Risk on pressures GBPAUD

-

Potential short-term upside for GBP/USD, GBP/AUD a longer-term play on sterling weakness

Potential short-term upside for GBP/USD, GBP/AUD a longer-term play on sterling weakness

Add a comment

Comments

0 comments on the analysis GBP/AUD - Daily