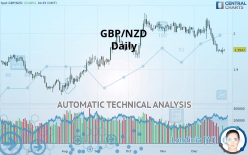

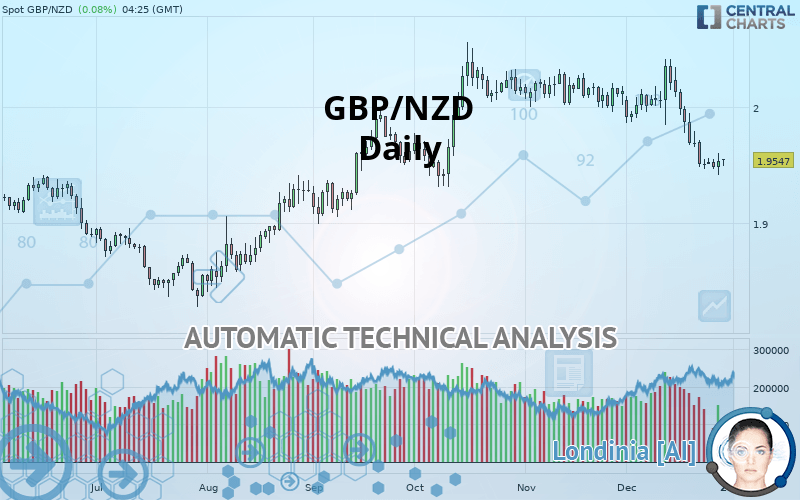

GBP/NZD - Daily - Technical analysis published on 12/30/2019 (GMT)

- Who voted?

- 253

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

GBP/NZD rating 1.9547 NZD. The price has increased by +0.08% since the last closing and was between 1.9489 NZD and 1.9554 NZD. This implies that the price is at +0.30% from its lowest and at -0.04% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by GBP/NZD:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Technical

A technical analysis in Daily of this GBP/NZD chart shows a bearish trend. 71.43% of the signals given by moving averages are bearish. This bearish trend is supported by the strong bearish signals given by short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

In fact, of the 18 technical indicators analysed by Central Analyzer, 5 are bullish, 6 are neutral and 7 are bearish. Caution: the Central Indicators scanner currently detects an excess:

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Daily

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found this result:

Near support of channel

Type : Bullish

Timeframe : Daily

There is also a Japanese candlestick pattern detected by Central Candlesticks that could mark the end of the current short-term trend:

Doji

Type : Neutral

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.8938 | 1.9112 | 1.9397 | 1.9547 | 1.9813 | 2.0113 | 2.0419 |

| Change (%) | -3.12% | -2.23% | -0.77% | - | +1.36% | +2.90% | +4.46% |

| Change | -0.0609 | -0.0435 | -0.0150 | - | +0.0266 | +0.0566 | +0.0872 |

| Level | Major | Minor | Major | - | Major | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.8574 | 1.8995 | 1.9574 | 1.9995 | 2.0574 | 2.0995 | 2.1574 |

| Camarilla | 1.9877 | 1.9969 | 2.0060 | 2.0152 | 2.0244 | 2.0335 | 2.0427 |

| Woodie | 1.8652 | 1.9035 | 1.9652 | 2.0035 | 2.0652 | 2.1035 | 2.1652 |

| Fibonacci | 1.8995 | 1.9377 | 1.9613 | 1.9995 | 2.0377 | 2.0613 | 2.0995 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.7612 | 1.8226 | 1.9189 | 1.9803 | 2.0766 | 2.1380 | 2.2343 |

| Camarilla | 1.9718 | 1.9863 | 2.0007 | 2.0152 | 2.0297 | 2.0441 | 2.0586 |

| Woodie | 1.7787 | 1.8313 | 1.9364 | 1.9890 | 2.0941 | 2.1467 | 2.2518 |

| Fibonacci | 1.8226 | 1.8828 | 1.9201 | 1.9803 | 2.0405 | 2.0778 | 2.1380 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.8160 | 1.8789 | 1.9160 | 1.9789 | 2.0160 | 2.0789 | 2.1160 |

| Camarilla | 1.9257 | 1.9349 | 1.9440 | 1.9532 | 1.9624 | 1.9715 | 1.9807 |

| Woodie | 1.8032 | 1.8725 | 1.9032 | 1.9725 | 2.0032 | 2.0725 | 2.1032 |

| Fibonacci | 1.8789 | 1.9171 | 1.9407 | 1.9789 | 2.0171 | 2.0407 | 2.0789 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 45.70 | |

| MACD (12,26,9): | -0.0145 | |

| Directional Movement: | 11.9622 | |

| AROON (14): | 7.1428 | |

| DEMA (21): | 1.9567 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.8840 | |

| Elder Ray (13): | -0.0141 | |

| Super Trend (3,10): | 1.8837 | |

| Zig ZAG (10): | 1.9538 | |

| VORTEX (21): | 0.8191 | |

| Stochastique (14,3,5): | 43.58 | |

| TEMA (21): | 1.9459 | |

| Williams %R (14): | -55.74 | |

| Chande Momentum Oscillator (20): | -0.0592 | |

| Repulse (5,40,3): | 0.9506 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0935 | |

| Courbe Coppock: | 5.63 |

| MA7: | 1.9519 | |

| MA20: | 1.9819 | |

| MA50: | 2.0009 | |

| MA100: | 1.9770 | |

| MAexp7: | 1.9590 | |

| MAexp20: | 1.9744 | |

| MAexp50: | 1.9853 | |

| MAexp100: | 1.9745 | |

| Price / MA7: | +0.14% | |

| Price / MA20: | -1.37% | |

| Price / MA50: | -2.31% | |

| Price / MA100: | -1.13% | |

| Price / MAexp7: | -0.22% | |

| Price / MAexp20: | -1.00% | |

| Price / MAexp50: | -1.54% | |

| Price / MAexp100: | -1.00% |

News

Don"t forget to follow the news on GBP/NZD. At the time of publication of this analysis, the latest news was as follows:

-

Why I'm looking to buy GBPNZD: Coleman

Why I'm looking to buy GBPNZD: Coleman

-

Why I'm looking to buy GBPNZD: Coleman

Why I'm looking to buy GBPNZD: Coleman

-

GBP/NZD: Pound Has Upperhand

GBP/NZD: Pound Has Upperhand

-

Forex Trading Video: GBP/NZD The Cross Roads of BoE and RBNZ, Dollar Faces Wave of Data

Forex Trading Video: GBP/NZD The Cross Roads of BoE and RBNZ, Dollar Faces Wave of Data

-

Forex Strategy Video: Time Frame Matters on Entry from Themes Like Risk Trends to GBPNZD

Forex Strategy Video: Time Frame Matters on Entry from Themes Like Risk Trends to GBPNZD

Add a comment

Comments

0 comments on the analysis GBP/NZD - Daily