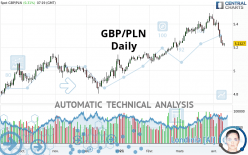

GBP/PLN - Daily - Technical analysis published on 04/12/2021 (GMT)

- 238

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The GBP/PLN rating is 5.2327 PLN. The price has increased by +0.31% since the last closing with the lowest point at 5.2073 PLN and the highest point at 5.2331 PLN. The deviation from the price is +0.49% for the low point and -0.01% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by GBP/PLN:

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of GBP/PLN in Daily shows an overall slightly bullish trend. 57.14% of the signals given by moving averages are bullish. Caution: a reversal of the trend could be possible given the strong bearish signals of short-term moving averages. The Central Indicators market scanner is currently detecting a bearish signal that could impact this trend:

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

In fact, 11 technical indicators on 18 studied are currently positioned bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

MACD indicator: bearish divergence

Type : Bearish

Timeframe : Daily

RSI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

Ichimoku - Bearish crossover : Tenkan & Kijun

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal support

Type : Bullish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 4.9793 | 5.1209 | 5.2231 | 5.2327 | 5.3376 | 5.3982 | 5.4950 |

| Change (%) | -4.84% | -2.14% | -0.18% | - | +2.00% | +3.16% | +5.01% |

| Change | -0.2534 | -0.1118 | -0.0096 | - | +0.1049 | +0.1655 | +0.2623 |

| Level | Major | Intermediate | Major | - | Minor | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5.1504 | 5.1821 | 5.1993 | 5.2310 | 5.2482 | 5.2799 | 5.2971 |

| Camarilla | 5.2032 | 5.2076 | 5.2121 | 5.2166 | 5.2211 | 5.2256 | 5.2301 |

| Woodie | 5.1433 | 5.1785 | 5.1922 | 5.2274 | 5.2411 | 5.2763 | 5.2900 |

| Fibonacci | 5.1821 | 5.2008 | 5.2123 | 5.2310 | 5.2497 | 5.2612 | 5.2799 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.9226 | 5.0681 | 5.1424 | 5.2879 | 5.3622 | 5.5077 | 5.5820 |

| Camarilla | 5.1562 | 5.1763 | 5.1965 | 5.2166 | 5.2368 | 5.2569 | 5.2771 |

| Woodie | 4.8869 | 5.0503 | 5.1067 | 5.2701 | 5.3265 | 5.4899 | 5.5463 |

| Fibonacci | 5.0681 | 5.1521 | 5.2040 | 5.2879 | 5.3719 | 5.4238 | 5.5077 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.9957 | 5.1046 | 5.2740 | 5.3829 | 5.5523 | 5.6612 | 5.8306 |

| Camarilla | 5.3669 | 5.3924 | 5.4179 | 5.4434 | 5.4689 | 5.4944 | 5.5199 |

| Woodie | 5.0260 | 5.1197 | 5.3043 | 5.3980 | 5.5826 | 5.6763 | 5.8609 |

| Fibonacci | 5.1046 | 5.2109 | 5.2766 | 5.3829 | 5.4892 | 5.5549 | 5.6612 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 35.36 | |

| MACD (12,26,9): | -0.0069 | |

| Directional Movement: | -14.3748 | |

| AROON (14): | -71.4286 | |

| DEMA (21): | 5.3371 | |

| Parabolic SAR (0,02-0,02-0,2): | 5.4454 | |

| Elder Ray (13): | -0.1032 | |

| Super Trend (3,10): | 5.3669 | |

| Zig ZAG (10): | 5.2226 | |

| VORTEX (21): | 0.8856 | |

| Stochastique (14,3,5): | 2.38 | |

| TEMA (21): | 5.2870 | |

| Williams %R (14): | -96.66 | |

| Chande Momentum Oscillator (20): | -0.1927 | |

| Repulse (5,40,3): | -2.0382 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0725 | |

| Courbe Coppock: | 2.77 |

| MA7: | 5.3040 | |

| MA20: | 5.3640 | |

| MA50: | 5.2738 | |

| MA100: | 5.1434 | |

| MAexp7: | 5.2852 | |

| MAexp20: | 5.3291 | |

| MAexp50: | 5.2774 | |

| MAexp100: | 5.1930 | |

| Price / MA7: | -1.34% | |

| Price / MA20: | -2.45% | |

| Price / MA50: | -0.78% | |

| Price / MA100: | +1.74% | |

| Price / MAexp7: | -0.99% | |

| Price / MAexp20: | -1.81% | |

| Price / MAexp50: | -0.85% | |

| Price / MAexp100: | +0.76% |

Add a comment

Comments

0 comments on the analysis GBP/PLN - Daily