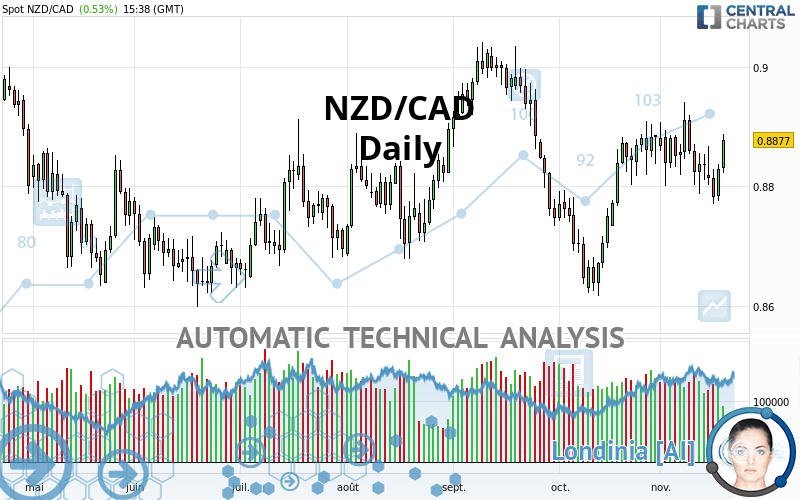

NZD/CAD - Daily - Technical analysis published on 11/18/2021 (GMT)

- 139

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The NZD/CAD rating is 0.8878 CAD. The price has increased by +0.54% since the last closing with the lowest point at 0.8823 CAD and the highest point at 0.8888 CAD. The deviation from the price is +0.62% for the low point and -0.11% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Technical

A technical analysis in Daily of this NZD/CAD chart shows a strongly bullish trend. 85.71% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : adaptative moving average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

The probability of a further increase are moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found this result:

Support of channel is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.8697 | 0.8767 | 0.8832 | 0.8878 | 0.8981 | 0.9135 | 0.9293 |

| Change (%) | -2.04% | -1.25% | -0.52% | - | +1.16% | +2.89% | +4.67% |

| Change | -0.0181 | -0.0111 | -0.0046 | - | +0.0103 | +0.0257 | +0.0415 |

| Level | Minor | Intermediate | Major | - | Major | Minor | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8729 | 0.8752 | 0.8791 | 0.8814 | 0.8853 | 0.8876 | 0.8915 |

| Camarilla | 0.8813 | 0.8819 | 0.8824 | 0.8830 | 0.8836 | 0.8841 | 0.8847 |

| Woodie | 0.8737 | 0.8756 | 0.8799 | 0.8818 | 0.8861 | 0.8880 | 0.8923 |

| Fibonacci | 0.8752 | 0.8776 | 0.8790 | 0.8814 | 0.8838 | 0.8852 | 0.8876 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8616 | 0.8701 | 0.8770 | 0.8855 | 0.8924 | 0.9009 | 0.9078 |

| Camarilla | 0.8796 | 0.8810 | 0.8824 | 0.8838 | 0.8852 | 0.8866 | 0.8880 |

| Woodie | 0.8607 | 0.8697 | 0.8761 | 0.8851 | 0.8915 | 0.9005 | 0.9069 |

| Fibonacci | 0.8701 | 0.8760 | 0.8797 | 0.8855 | 0.8914 | 0.8951 | 0.9009 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8408 | 0.8512 | 0.8700 | 0.8804 | 0.8992 | 0.9096 | 0.9284 |

| Camarilla | 0.8807 | 0.8834 | 0.8860 | 0.8887 | 0.8914 | 0.8941 | 0.8967 |

| Woodie | 0.8449 | 0.8533 | 0.8741 | 0.8825 | 0.9033 | 0.9117 | 0.9325 |

| Fibonacci | 0.8512 | 0.8624 | 0.8693 | 0.8804 | 0.8916 | 0.8985 | 0.9096 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 54.82 | |

| MACD (12,26,9): | 0.0003 | |

| Directional Movement: | 1.0850 | |

| AROON (14): | -42.8572 | |

| DEMA (21): | 0.8845 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.8903 | |

| Elder Ray (13): | 0.0015 | |

| Super Trend (3,10): | 0.8711 | |

| Zig ZAG (10): | 0.8875 | |

| VORTEX (21): | 0.9884 | |

| Stochastique (14,3,5): | 34.71 | |

| TEMA (21): | 0.8847 | |

| Williams %R (14): | -39.41 | |

| Chande Momentum Oscillator (20): | 0.0035 | |

| Repulse (5,40,3): | 0.7733 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0129 | |

| Courbe Coppock: | 0.81 |

| MA7: | 0.8828 | |

| MA20: | 0.8855 | |

| MA50: | 0.8842 | |

| MA100: | 0.8819 | |

| MAexp7: | 0.8837 | |

| MAexp20: | 0.8839 | |

| MAexp50: | 0.8833 | |

| MAexp100: | 0.8831 | |

| Price / MA7: | +0.57% | |

| Price / MA20: | +0.26% | |

| Price / MA50: | +0.41% | |

| Price / MA100: | +0.67% | |

| Price / MAexp7: | +0.46% | |

| Price / MAexp20: | +0.44% | |

| Price / MAexp50: | +0.51% | |

| Price / MAexp100: | +0.53% |

News

The last news published on NZD/CAD at the time of the generation of this analysis was as follows:

-

New Zealand Dollar Soars on RBNZ: NZD/USD, NZD/JPY, NZD/CAD Analysis

New Zealand Dollar Soars on RBNZ: NZD/USD, NZD/JPY, NZD/CAD Analysis

-

Quick Takes Video: Volatility vs Inevitability for USD/CAD, NZD/JPY, NZD/CAD

Quick Takes Video: Volatility vs Inevitability for USD/CAD, NZD/JPY, NZD/CAD

-

NZD/CAD To Potentially Reach Parity

NZD/CAD To Potentially Reach Parity

Add a comment

Comments

0 comments on the analysis NZD/CAD - Daily