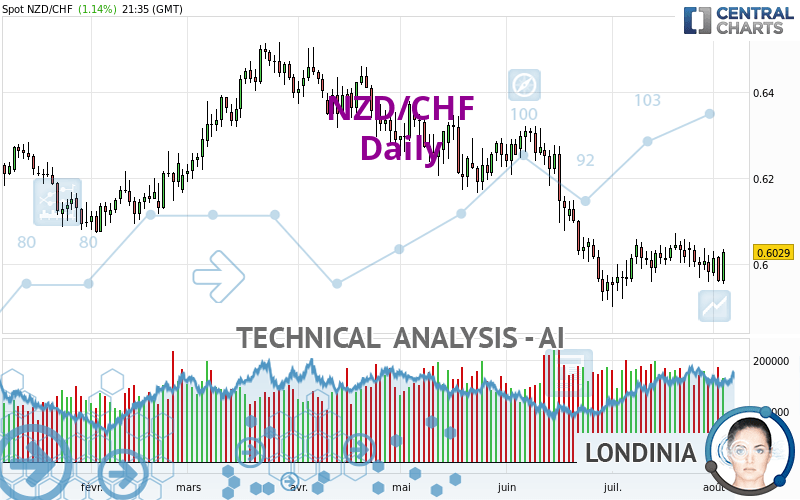

NZD/CHF - Daily - Technical analysis published on 08/03/2022 (GMT)

- 117

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

NZD/CHF rating 0.6029 CHF. The price has increased by +1.14% since the last closing and was between 0.5955 CHF and 0.6035 CHF. This implies that the price is at +1.24% from its lowest and at -0.10% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by NZD/CHF:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of NZD/CHF in Daily shows an overall bearish trend. 71.43% of the signals given by moving averages are bearish. Caution: as the signals currently given by short-term moving averages are rather neutral, the bearish trend could slow down. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

In fact, only 9 technical indicators out of 18 studied are currently positioned bullish. Caution: the Central Indicators scanner currently detects an excess:

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.5531 | 0.5934 | 0.5991 | 0.6029 | 0.6040 | 0.6188 | 0.6267 |

| Change (%) | -8.26% | -1.58% | -0.63% | - | +0.18% | +2.64% | +3.95% |

| Change | -0.0498 | -0.0095 | -0.0038 | - | +0.0011 | +0.0159 | +0.0238 |

| Level | Major | Intermediate | Intermediate | - | Major | Intermediate | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.5879 | 0.5918 | 0.5940 | 0.5979 | 0.6001 | 0.6040 | 0.6062 |

| Camarilla | 0.5944 | 0.5950 | 0.5955 | 0.5961 | 0.5967 | 0.5972 | 0.5978 |

| Woodie | 0.5870 | 0.5914 | 0.5931 | 0.5975 | 0.5992 | 0.6036 | 0.6053 |

| Fibonacci | 0.5918 | 0.5942 | 0.5956 | 0.5979 | 0.6003 | 0.6017 | 0.6040 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.5851 | 0.5905 | 0.5944 | 0.5998 | 0.6037 | 0.6091 | 0.6130 |

| Camarilla | 0.5957 | 0.5966 | 0.5975 | 0.5983 | 0.5992 | 0.6000 | 0.6009 |

| Woodie | 0.5844 | 0.5901 | 0.5937 | 0.5994 | 0.6030 | 0.6087 | 0.6123 |

| Fibonacci | 0.5905 | 0.5941 | 0.5963 | 0.5998 | 0.6034 | 0.6056 | 0.6091 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.5725 | 0.5813 | 0.5898 | 0.5986 | 0.6071 | 0.6159 | 0.6244 |

| Camarilla | 0.5935 | 0.5951 | 0.5967 | 0.5983 | 0.5999 | 0.6015 | 0.6031 |

| Woodie | 0.5724 | 0.5812 | 0.5897 | 0.5985 | 0.6070 | 0.6158 | 0.6243 |

| Fibonacci | 0.5813 | 0.5879 | 0.5920 | 0.5986 | 0.6052 | 0.6093 | 0.6159 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 49.53 | |

| MACD (12,26,9): | -0.0021 | |

| Directional Movement: | -6.6331 | |

| AROON (14): | -71.4286 | |

| DEMA (21): | 0.5985 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.6055 | |

| Elder Ray (13): | -0.0013 | |

| Super Trend (3,10): | 0.6138 | |

| Zig ZAG (10): | 0.6024 | |

| VORTEX (21): | 1.0314 | |

| Stochastique (14,3,5): | 37.55 | |

| TEMA (21): | 0.6003 | |

| Williams %R (14): | -38.66 | |

| Chande Momentum Oscillator (20): | 0.0014 | |

| Repulse (5,40,3): | 0.7607 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.0603 | |

| Courbe Coppock: | 0.33 |

| MA7: | 0.6000 | |

| MA20: | 0.6015 | |

| MA50: | 0.6092 | |

| MA100: | 0.6226 | |

| MAexp7: | 0.6004 | |

| MAexp20: | 0.6017 | |

| MAexp50: | 0.6081 | |

| MAexp100: | 0.6160 | |

| Price / MA7: | +0.48% | |

| Price / MA20: | +0.23% | |

| Price / MA50: | -1.03% | |

| Price / MA100: | -3.16% | |

| Price / MAexp7: | +0.42% | |

| Price / MAexp20: | +0.20% | |

| Price / MAexp50: | -0.86% | |

| Price / MAexp100: | -2.13% |

News

Don't forget to follow the news on NZD/CHF. At the time of publication of this analysis, the latest news was as follows:

Add a comment

Comments

0 comments on the analysis NZD/CHF - Daily