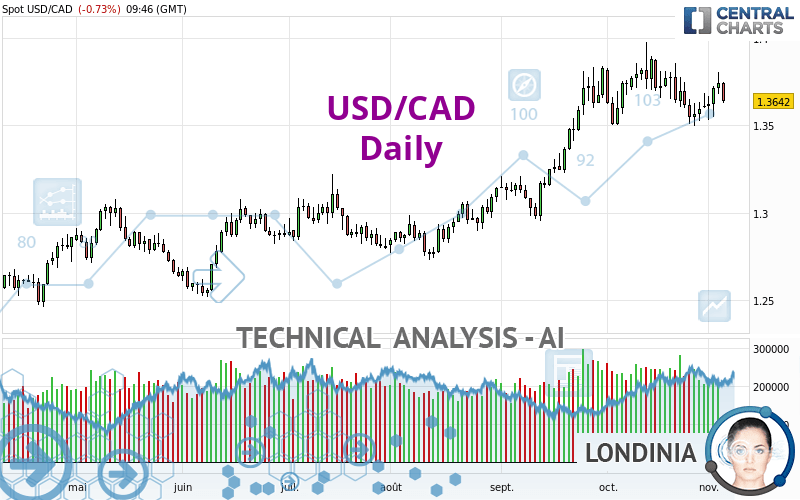

USD/CAD - Daily - Technical analysis published on 11/04/2022 (GMT)

- 133

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

USD/CAD rating 1.3642 CAD. On the day, this instrument lost -0.74% with the lowest point at 1.3629 CAD and the highest point at 1.3746 CAD. The deviation from the price is +0.10% for the low point and -0.76% for the high point.Here is a more detailed summary of the historical variations registered by USD/CAD:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of USD/CAD indicates that the overall trend is bullish. 71.43% of the signals given by moving averages are bullish. Caution: the neutral signals currently given by the short-term moving averages indicate that this bullish trend is showing signs of running out of steam. An assessment of moving averages reveals several bearish signals that could impact this trend:

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : Daily

On the 18 technical indicators analysed, 4 are bullish, 7 are neutral and 7 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.2986 | 1.3348 | 1.3550 | 1.3642 | 1.3752 | 1.3881 | 1.4567 |

| Change (%) | -4.81% | -2.16% | -0.67% | - | +0.81% | +1.75% | +6.78% |

| Change | -0.0656 | -0.0294 | -0.0092 | - | +0.0110 | +0.0239 | +0.0925 |

| Level | Major | Minor | Intermediate | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.3555 | 1.3618 | 1.3681 | 1.3744 | 1.3807 | 1.3870 | 1.3933 |

| Camarilla | 1.3708 | 1.3720 | 1.3732 | 1.3743 | 1.3755 | 1.3766 | 1.3778 |

| Woodie | 1.3554 | 1.3618 | 1.3680 | 1.3744 | 1.3806 | 1.3870 | 1.3932 |

| Fibonacci | 1.3618 | 1.3667 | 1.3696 | 1.3744 | 1.3793 | 1.3822 | 1.3870 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.3191 | 1.3343 | 1.3470 | 1.3622 | 1.3749 | 1.3901 | 1.4028 |

| Camarilla | 1.3519 | 1.3545 | 1.3570 | 1.3596 | 1.3622 | 1.3647 | 1.3673 |

| Woodie | 1.3178 | 1.3337 | 1.3457 | 1.3616 | 1.3736 | 1.3895 | 1.4015 |

| Fibonacci | 1.3343 | 1.3450 | 1.3516 | 1.3622 | 1.3729 | 1.3795 | 1.3901 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.2931 | 1.3213 | 1.3413 | 1.3695 | 1.3895 | 1.4177 | 1.4377 |

| Camarilla | 1.3480 | 1.3524 | 1.3568 | 1.3612 | 1.3656 | 1.3700 | 1.3745 |

| Woodie | 1.2889 | 1.3193 | 1.3371 | 1.3675 | 1.3853 | 1.4157 | 1.4335 |

| Fibonacci | 1.3213 | 1.3398 | 1.3511 | 1.3695 | 1.3880 | 1.3993 | 1.4177 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 50.88 | |

| MACD (12,26,9): | 0.0033 | |

| Directional Movement: | 5.2718 | |

| AROON (14): | -57.1429 | |

| DEMA (21): | 1.3713 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.3502 | |

| Elder Ray (13): | 0.0025 | |

| Super Trend (3,10): | 1.3395 | |

| Zig ZAG (10): | 1.3638 | |

| VORTEX (21): | 1.0204 | |

| Stochastique (14,3,5): | 52.91 | |

| TEMA (21): | 1.3650 | |

| Williams %R (14): | -60.45 | |

| Chande Momentum Oscillator (20): | -0.0135 | |

| Repulse (5,40,3): | -0.3739 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.0555 | |

| Courbe Coppock: | 1.81 |

| MA7: | 1.3641 | |

| MA20: | 1.3701 | |

| MA50: | 1.3496 | |

| MA100: | 1.3207 | |

| MAexp7: | 1.3662 | |

| MAexp20: | 1.3652 | |

| MAexp50: | 1.3503 | |

| MAexp100: | 1.3295 | |

| Price / MA7: | +0.01% | |

| Price / MA20: | -0.43% | |

| Price / MA50: | +1.08% | |

| Price / MA100: | +3.29% | |

| Price / MAexp7: | -0.15% | |

| Price / MAexp20: | -0.07% | |

| Price / MAexp50: | +1.03% | |

| Price / MAexp100: | +2.61% |

News

Don't forget to follow the news on USD/CAD. At the time of publication of this analysis, the latest news was as follows:

-

USD/CAD Forecast November 1, 2022

USD/CAD Forecast November 1, 2022

-

Technical Analysis: 21/10/2022 - USDCAD trapped below 1.3800; uptrend intact

Technical Analysis: 21/10/2022 - USDCAD trapped below 1.3800; uptrend intact

-

USD/CAD Breakout | Tuesday Market Outlook with Michael Boutros

USD/CAD Breakout | Tuesday Market Outlook with Michael Boutros

-

USD/CAD Technical Outlook: Big Reversal Sets Up the Downside

USD/CAD Technical Outlook: Big Reversal Sets Up the Downside

-

Technical Analysis: 14/10/2022 - USDCAD retraces after hitting fresh 29-month high

Technical Analysis: 14/10/2022 - USDCAD retraces after hitting fresh 29-month high

Add a comment

Comments

0 comments on the analysis USD/CAD - Daily