USD/CHF - China Acts with Surprising Rate Cut - 11/24/2014 (GMT)

- Who voted?

- 817

- 0

- Chart + Trading signal

- Signal : Buy signal

- |

- Entry price recommended : 0,9688

- |

- Stop loss : 0,9653

- |

- Take profit : 0,9723

- Timeframe : Weekly

USD/CHF Chart

Late last week, the People’s Bank of China (PBOC) announced a cut in interest rates.

It cut 40 basis points to the one-year lending rate to 5.6 percent and 25 basis points to the one-year savings rate to 2.75 percent. In a policy statement, the PBOC said that the reductions to the deposit and lending rates aren’t a shift in policy direction, but were done to protect households and consumers. The rate cuts came after months of targeted measures failed to lower financing costs for smaller companies.

This is China’s first rate cut since July 2012.

Along with the rate cut, banks were given the option of offering depositors as much as 120 percent of the benchmark rate, up from a previous ceiling of 110 percent. In a mixed response by lenders to the latest step in interest-rate liberalisation, five of 16 listed banks have already raised their rates to the ceiling.

The main beneficiaries to the rate cut are business borrowers because the bigger companies, like state-owned enterprises, real estate developers and local government investment platforms will be able to tap new loans at lower rates. Unlike the big boys, private small businesses typically have limited access to raise money through bond or stock markets.

According to data from the PBOC, outstanding bank loans to small businesses were 14.6 trillion yuan at the end of September, or 29.6 percent of total outstanding corporate bank loans.

Only time will tell if the move by the PBOC will help to spur growth. The move is timely because there are signs that a slowdown in the world’s second-largest economy is deepening. Factory production rose 7.7 percent in October from a year earlier, the second-weakest pace since 2009, while retail sales missed economists’ forecasts.

China’s retail inflation held at the slowest pace since January 2010 last month.

Consumer prices increased 1.6 percent, matching September’s rate, while producer prices fell for a record 32nd month, slumping 2.2 percent. GDP expanded 7.3 percent in the third quarter of 2014 and is projected to grow this year at the slowest pace since 1990 amid weakness in the property market and manufacturing.

Another area which the PBOC wants to target is non-performing loans (NPLs). Non-performing loans surged 10 percent last quarter, the most since 2005, and soured loans may rise further as real-estate prices slump and the economy slows. New-home prices declined in October in 67 of 70 major cities, while housing sales slumped 10 percent in the first 10 months from a year earlier.

Top News This Week

Canada: Core Retail Sales m/m. Tuesday, 25th November, 9.30pm.

I expect figures to come in at 0.4% (previous figure was -0.3%).

Australia: Private Capital Expenditure q/q. Thursday, 27th November, 8.30am.

I expect figures to come in at -1.7% (previous figure was 1.1%).

Canada: GDP m/m. Friday, 28th November, 9.30pm.

I expect figures to come in at 0.3% (previous figure was -0.1%).

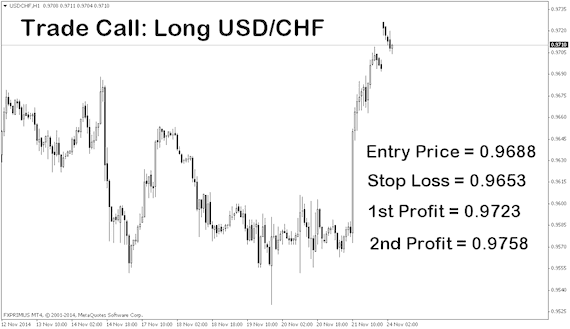

Trade Call

Long USD/CHF at 0.9688

On the H1 chart, USD/CHF is moving in an uptrend after shooting up about 150 in the last few days. The US dollar is continuing its pace of tighter monetary policy, while there is an outside chance that the Swiss National Bank (SNB) could intervene in the markets as EUR/CHF hovers dangerously close to the 1.20 level. This would weaken the Swiss franc.

I expect prices to retrace a little as traders start to take profits. An entry is taken at 0.9688 and a stop loss of 35 pips is placed below the previous low. We will have two targets on this trade, exiting the first position at 0.9723 and the second one at 0.9758.

Entry Price = 0.9688

Stop Loss = 0.9653

1st Profit = 0.9723

2nd Profit = 0.9758

It cut 40 basis points to the one-year lending rate to 5.6 percent and 25 basis points to the one-year savings rate to 2.75 percent. In a policy statement, the PBOC said that the reductions to the deposit and lending rates aren’t a shift in policy direction, but were done to protect households and consumers. The rate cuts came after months of targeted measures failed to lower financing costs for smaller companies.

This is China’s first rate cut since July 2012.

Along with the rate cut, banks were given the option of offering depositors as much as 120 percent of the benchmark rate, up from a previous ceiling of 110 percent. In a mixed response by lenders to the latest step in interest-rate liberalisation, five of 16 listed banks have already raised their rates to the ceiling.

The main beneficiaries to the rate cut are business borrowers because the bigger companies, like state-owned enterprises, real estate developers and local government investment platforms will be able to tap new loans at lower rates. Unlike the big boys, private small businesses typically have limited access to raise money through bond or stock markets.

According to data from the PBOC, outstanding bank loans to small businesses were 14.6 trillion yuan at the end of September, or 29.6 percent of total outstanding corporate bank loans.

Only time will tell if the move by the PBOC will help to spur growth. The move is timely because there are signs that a slowdown in the world’s second-largest economy is deepening. Factory production rose 7.7 percent in October from a year earlier, the second-weakest pace since 2009, while retail sales missed economists’ forecasts.

China’s retail inflation held at the slowest pace since January 2010 last month.

Consumer prices increased 1.6 percent, matching September’s rate, while producer prices fell for a record 32nd month, slumping 2.2 percent. GDP expanded 7.3 percent in the third quarter of 2014 and is projected to grow this year at the slowest pace since 1990 amid weakness in the property market and manufacturing.

Another area which the PBOC wants to target is non-performing loans (NPLs). Non-performing loans surged 10 percent last quarter, the most since 2005, and soured loans may rise further as real-estate prices slump and the economy slows. New-home prices declined in October in 67 of 70 major cities, while housing sales slumped 10 percent in the first 10 months from a year earlier.

Top News This Week

Canada: Core Retail Sales m/m. Tuesday, 25th November, 9.30pm.

I expect figures to come in at 0.4% (previous figure was -0.3%).

Australia: Private Capital Expenditure q/q. Thursday, 27th November, 8.30am.

I expect figures to come in at -1.7% (previous figure was 1.1%).

Canada: GDP m/m. Friday, 28th November, 9.30pm.

I expect figures to come in at 0.3% (previous figure was -0.1%).

Trade Call

Long USD/CHF at 0.9688

On the H1 chart, USD/CHF is moving in an uptrend after shooting up about 150 in the last few days. The US dollar is continuing its pace of tighter monetary policy, while there is an outside chance that the Swiss National Bank (SNB) could intervene in the markets as EUR/CHF hovers dangerously close to the 1.20 level. This would weaken the Swiss franc.

I expect prices to retrace a little as traders start to take profits. An entry is taken at 0.9688 and a stop loss of 35 pips is placed below the previous low. We will have two targets on this trade, exiting the first position at 0.9723 and the second one at 0.9758.

Entry Price = 0.9688

Stop Loss = 0.9653

1st Profit = 0.9723

2nd Profit = 0.9758

This member did not declare if he had a position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis USD/CHF - Weekly