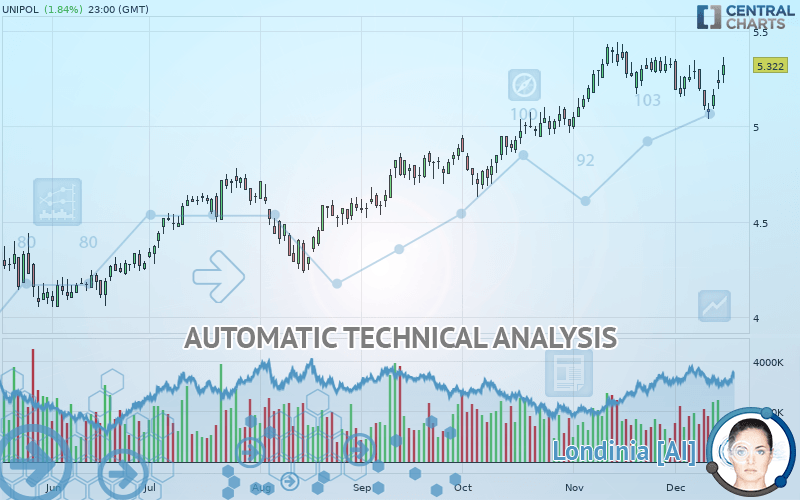

UNIPOL - Daily - Technical analysis published on 12/17/2019 (GMT)

- Who voted?

- 238

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The UNIPOL price is 5.322 EUR. The price registered an increase of +1.84% on the session with the lowest point at 5.226 EUR and the highest point at 5.362 EUR. The deviation from the price is +1.84% for the low point and -0.75% for the high point.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of UNIPOL indicates that the overall trend is strongly bullish. 89.29% of the signals given by moving averages are bullish. The slightly bullish signals given by the short-term moving averages indicate this trend is showing signs of running out of steam. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

In fact, of the 18 technical indicators analysed by Central Analyzer, 6 are bullish, 7 are neutral and 5 are bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near horizontal support

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

White morning star

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 4.513 | 4.727 | 5.284 | 5.322 | 5.416 | 23.620 | 42.100 |

| Change (%) | -15.20% | -11.18% | -0.71% | - | +1.77% | +343.82% | +691.06% |

| Change | -0.809 | -0.595 | -0.038 | - | +0.094 | +18.298 | +36.778 |

| Level | Major | Intermediate | Major | - | Major | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.995 | 5.041 | 5.103 | 5.149 | 5.211 | 5.257 | 5.319 |

| Camarilla | 5.134 | 5.144 | 5.154 | 5.164 | 5.174 | 5.184 | 5.194 |

| Woodie | 5.002 | 5.045 | 5.110 | 5.153 | 5.218 | 5.261 | 5.326 |

| Fibonacci | 5.041 | 5.083 | 5.108 | 5.149 | 5.191 | 5.216 | 5.257 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.977 | 5.065 | 5.175 | 5.263 | 5.373 | 5.461 | 5.571 |

| Camarilla | 5.230 | 5.248 | 5.266 | 5.284 | 5.302 | 5.320 | 5.338 |

| Woodie | 4.987 | 5.071 | 5.185 | 5.269 | 5.383 | 5.467 | 5.581 |

| Fibonacci | 5.065 | 5.141 | 5.188 | 5.263 | 5.339 | 5.386 | 5.461 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.603 | 4.795 | 5.057 | 5.249 | 5.511 | 5.703 | 5.965 |

| Camarilla | 5.195 | 5.237 | 5.278 | 5.320 | 5.362 | 5.403 | 5.445 |

| Woodie | 4.639 | 4.813 | 5.093 | 5.267 | 5.547 | 5.721 | 6.001 |

| Fibonacci | 4.795 | 4.968 | 5.075 | 5.249 | 5.422 | 5.529 | 5.703 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 51.89 | |

| MACD (12,26,9): | 0.0010 | |

| Directional Movement: | 1.737 | |

| AROON (14): | -64.285 | |

| DEMA (21): | 5.231 | |

| Parabolic SAR (0,02-0,02-0,2): | 5.315 | |

| Elder Ray (13): | 0.038 | |

| Super Trend (3,10): | 5.374 | |

| Zig ZAG (10): | 5.226 | |

| VORTEX (21): | 0.9140 | |

| Stochastique (14,3,5): | 35.94 | |

| TEMA (21): | 5.168 | |

| Williams %R (14): | -42.77 | |

| Chande Momentum Oscillator (20): | -0.064 | |

| Repulse (5,40,3): | -1.0740 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0700 | |

| Courbe Coppock: | 4.61 |

| MA7: | 5.187 | |

| MA20: | 5.246 | |

| MA50: | 5.134 | |

| MA100: | 4.880 | |

| MAexp7: | 5.187 | |

| MAexp20: | 5.213 | |

| MAexp50: | 5.121 | |

| MAexp100: | 4.935 | |

| Price / MA7: | +2.60% | |

| Price / MA20: | +1.45% | |

| Price / MA50: | +3.66% | |

| Price / MA100: | +9.06% | |

| Price / MAexp7: | +2.60% | |

| Price / MAexp20: | +2.09% | |

| Price / MAexp50: | +3.93% | |

| Price / MAexp100: | +7.84% |

News

The latest news and videos published on UNIPOL at the time of the analysis were as follows:

- Unipol Group Partners with TrueMotion for Italy's First Smartphone-Only Telematics Program

-

Unipol

Unipol

-

Unipol

Unipol

Add a comment

Comments

0 comments on the analysis UNIPOL - Daily