Cryptocurrency arbitration

-

- 0

- 2284

- 0

As the cryptocurrency market is an OTC market, the price of each cryptocurrency pair on the trading platforms is fixed according to traders’ offers and bids (the order book). The cryptocurrency market is therefore a market that is supposed to arbitrate itself on each platform for buying or trading cryptocurrencies; But there are plenty of opportunities for individual traders to arbitrate certain cryptocurrencies.

You can profit from the "arbitrage" of a cryptocurrency when it can be bought or traded on a platform for buying or trading cryptocurrencies at a price lower than the selling or trading price on another platform.

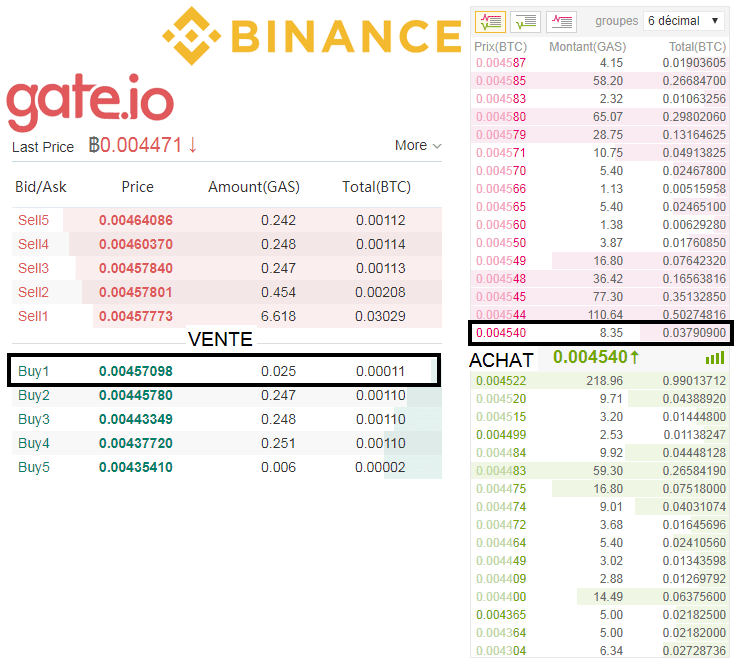

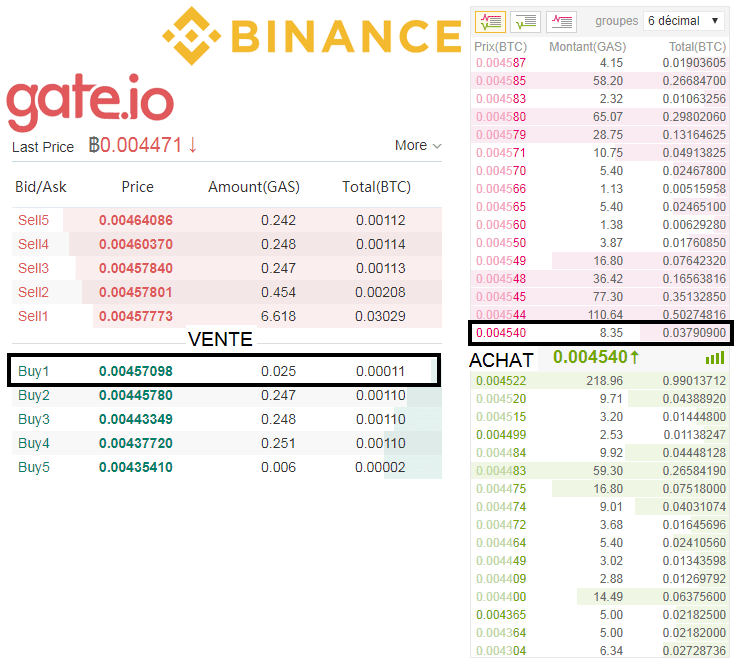

Let's take a concrete case. It didn't take me long to find one. I looked at the GAS/BTC price (GAS / Bitcoin) on the "Gate.io" and "Binance” platforms. Here is the order book (screenshot taken at the same time) :

Gate.io allows you:

- to buy GAS at 0.00457773 BTC

- to sell GAS at 0.00457098 BTC

Binance allows you:

- to buy GAS at 0.004540 BTC

- to sell GAS at 0.004522 BTC

It should be easily understood that arbitration is possible here. You can buy GAS on Binance at 0.004540 BTC and resell them immediately on Gate.io at 0.00457098 BTC, a capital gain of 0.00003098 BTC per GAS.

To carry out the arbitration given as an example, you would need:

1/ an account opened on both trading platforms.

2/ to have BTC on Binance.

3/ to purchase GAS on Binance at 0.004540 BTC.

4/ to transfer the GAS to Gate.io

5/ to sell the GAS to Gate.io at 0,00457098 BTC.

Another possible solution would be if you already have GASs on Gate.io and BTCs on Binance; then it would possible, at the same time, to:

1/ sell the GAS already in your possession on Gate.io and buy some on Binance (against BTC).

2/ (only once the price balances on both platforms), buy back the GAS initially sold on Gate.io and resell the GAS purchased on Binance.

NB: this second solution meets the standard for "real" arbitration, which would consist of buying and selling at the same time. The first solution mentioned responds more to particular traders’ abilities, but is not a "real", instant arbitrage.

The major cryptocurrencies are difficult to arbitrate because they are more liquid than altcoins. It creates less price spread on the various platforms, and if there is spread, major cryptocurrencies catch up very quickly. You could easily imagine that automatic arbitration solutions have been implemented on major cryptocurrencies. A little robot that automatically checks if arbitration can be done on exchange platforms. You could even imagine the trading platforms themselves arbitrate their prices according to the price quoted on other platforms.

Coming back to the question:

- major cryptocurrencies are only arbitrable in periods of high volatility.

- mid range (top 100 cryptocurrencies offer the best arbitrage possibilities. They display the widest price spreads between platforms, but are sufficiently liquid to be traded quickly and so unwind arbitrage transactions.

- cryptocurrencies at the bottom of the table are not be sufficiently liquid and display huge spreads on unknown trading platforms. Forget it…! There is already plenty to do with the TOP 100.

To secure your cryptocurrency arbitration, I advise you only to use the trading and purchasing platforms of major cryptocurrencies, known and widely used by crypto-traders. In this way you will have all the liquidity you need and good spread to unwind your arbitrage.

NB: only the cryptocurrencies commonly quoted on your chosen trading platforms can be arbitrated. By this I mean that to arbitrate a cryptocurrency X against Bitcoin, this cryptocurrency X against Bitcoin must be quoted on all your trading platforms.

Arbitrage is possible when you can buy on one side and sell more expensively on the other, or buy and sell simultaneously (if you can manage this with the current funds, or cryptocurrencies in your possession on the platforms). But how do you watch out for arbitration opportunities?

To date, I know only two solutions to watch out for cryptocurrency arbitration opportunities:

1/ The fastest, most accurate, but also the most complicated solution: by keeping your eyes open on cryptocurrency quotations on the various exchange platforms.

2/ Solution including a delay, and not including a comprehensive view of the order book (and thus of the best offer/bid at time T): by consulting the trading price of the cryptocurrency directly on coinmarketcap.com.

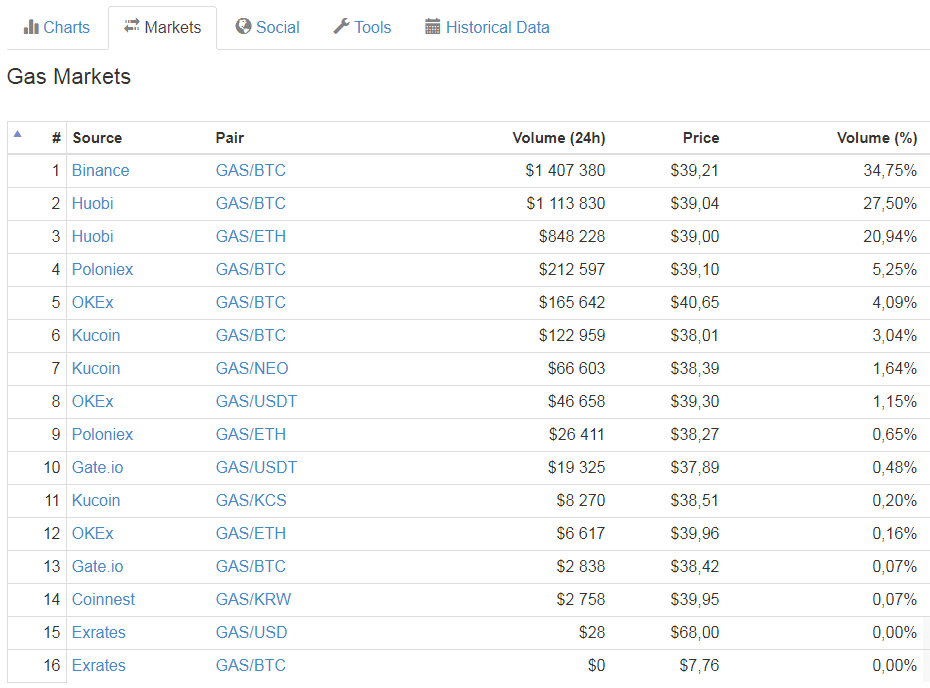

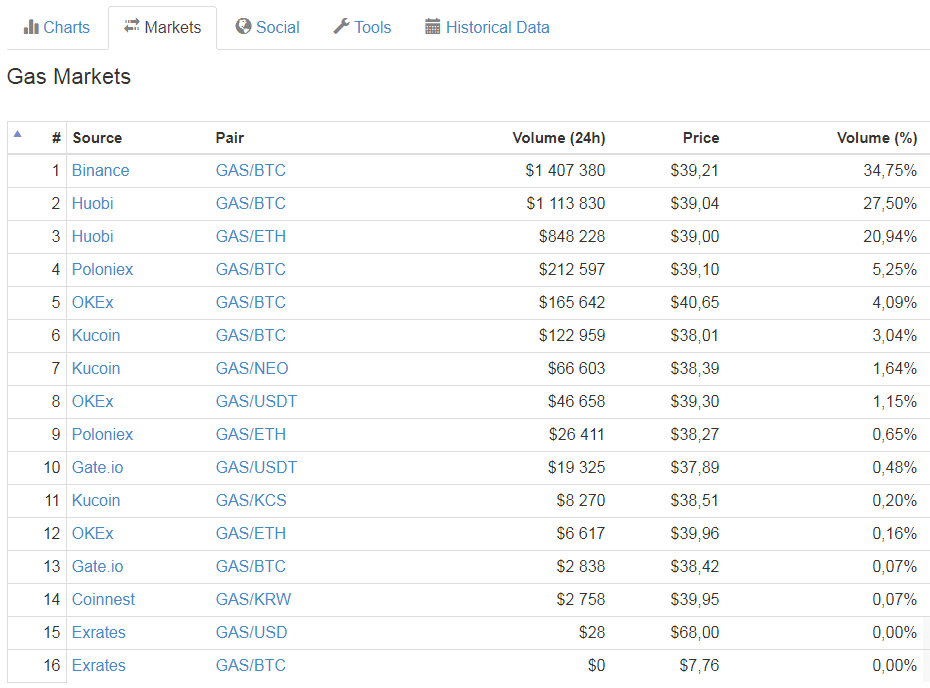

In the “Markets” tab for each listed cryptocurrency, it is possible for you to consult the current price on various trading platforms. Example :

Then you just have to monitor the deviations between your cryptocurrency trading platforms in the table’s "Price" column.

While it may seem easy at first glance to arbitrate cryptocurrencies, the risks should not be underestimated. The major risk comes from the volatility of cryptocurrencies and the exchange rate risk. Indeed, if the purchase and the sale of your arbitration is not carried out instantaneously (see solution 1 of "How to arbitrate cryptocurrencies") there is a risk of seeing the arbitrated cryptocurrency plummet. You buy the cryptocurrency on platform 1 then transfer it to platform 2. During the transfer time, the arbitration can be annulled, or worse, the cryptocurrency can depreciate.

1/ Make sure that you can transfer cryptocurrencies easily and quickly between your two trading platforms.

2/ Thoroughly check the quantities available in the order book on both trading platforms. If buying 100 units is possible on platform 1, it might not be possible to sell them at an interesting price on platform 2..

To give you an example, let's come back to the GAS/BTC screenshot on Gate.io and Binance: we see that the arbitrage purchases would not have been much of a problem on Binance; liquidity and prices were there. On the other hand it would only have been possible on Gate.io to resell 0.025 GAS at 0.00457098 BTC. The next best bid was 0.2470 GAS at 0.00445780 BTC (below the purchase price of the GAS on the Binance platform.).

The arbitration example was therefore only possible for 0.025 GAS.

3/ Beware of wallet to wallet transfers. Wallet to wallet transfer arbitration is on the increase, and therefore so is the risk of transferring a cryptocurrency to a wallet that is unable to receive it, or the risk of an error when entering the wallet’s public address.

Reminder: transferring a cryptocurrency to an erroneous public address, results in permanent loss of the cryptocurrency. Transfering a cryptocurrency to a wallet that is not able to receive it (e.g.: sending BTC to a NEO wallet.) also results in permanent loss of the cryptocurrency

4/ Think about transaction or transfer fees. Even if they are generally very low on different trading platforms, these fees should be taken into account in your arbitration transaction. As arbitrage is an operation consisting in taking advantage of small quotation spreads, it is therefore important that this spread is much higher than the transaction and transfer costs (not free of charge) of the cryptocurrency concerned.

If arbitrating cryptocurrency quotations between several trading platforms seems too complicated for you, there is simpler way: arbitrating a cryptocurrency against that cryptocurrency pair against another cryptocurrency pair including one of the same cryptocurrencies.

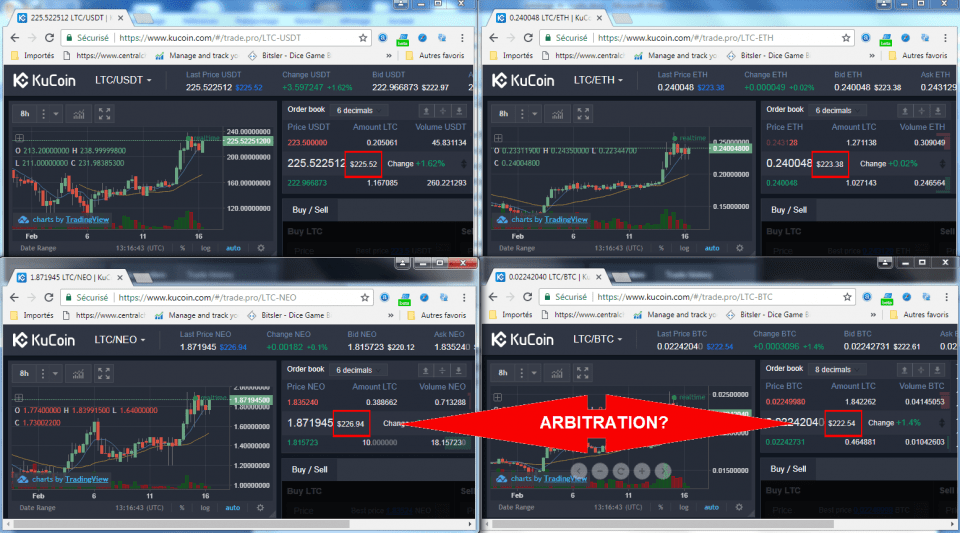

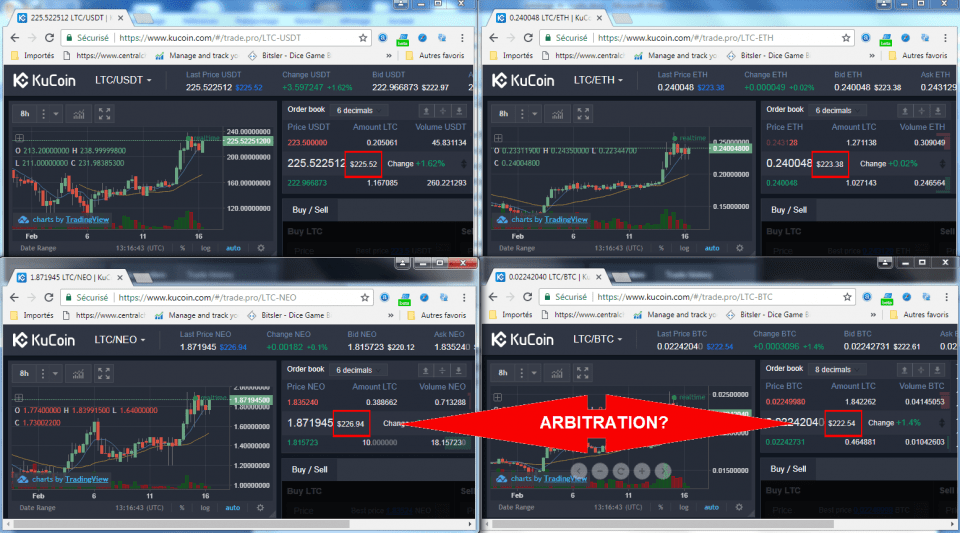

Let me explain: cryptocurrency trading platforms generally allow you to trade a cryptocurrency against BTC, ETH, USDT, BTG, and even against NEO (on the Kucoin trading platform). Price differences, and therefore possible arbitrations, are clearly displayed; Example :

In this example, I opened 4 windows quoting Litecoin:

- Top left: LTC against USDT

- Top right: LTC against ETH

- Bottom left: LTC against NEO

- Bottom right: LTC against BTC

There is a clear difference in Litecoin between LTC/NEO ($226.94) and LTC/BTC ($222.54). Arbitration is possible.

Attention: I specify that abtriation is "possible", because the price indicated in dollars is a function of the price of the last trade (and not the order book). In this example, buying at the lowest price we would choose LTC/BTC (shown at $222.,54 or 0.,002242040 BTC), but looking at the order book we see that the best offer is actually 0.,02249980 BTC (much more expensive.).

To arbitrate correctly in this way, you have to have software (or an excel file.) which can directly compare the price (after conversion) between the best offer and the best bid. In this case, arbitrage is only possible if the US dollar value of 0.02249980 BTC is lower than the US dollar value of 1.815723 NEO. The maximum amount of the transaction is 1.842262 LTC, available for purchase on LTC/BTC and widely available for resale (10 LTC on order book) on LTC/NEO.

NB: What conditions must be met to be able to arbitrate cryptocurrency quotations against differently valued cryptocurrencies?

Answer: Always have all the cryptocurrency equivalents at your disposal, so that you can buy Litecoin at any time at the lowest price (whether in USDT, NEO, BTC, or ETH.). No problem to resell it…

Problem 1: Having all the differently valued cryptocurrencies at any time is investing in the increase of all these cryptocurrencies.

There is only one solution: only arbitrate with LTC in USDT purchases so as not to constantly have cryptocurrencies that do not replicate a fiatcurrency .

Problem 2: By buying Litecoins against BTC, to resell them instantly against NEO, you can finally convert BTC into NEO at a good price. Certainly ... But the order book of the pair NEO/BTC still has to have a good price to match NEO in BTCs, otherwise the arbitration operation of the LTC will be useless. With arbitrage using only purchases in USDT (see problem 1), the result is the same. Still, the order book of the pair NEO/USDT - BTC/USDT - or ETH/USDT has to have a good price to match the cryptocurrencies in USDT which enables the resale of the LTC, otherwise the arbitrage operation of the LTC will be useless.

When can I arbitrate the price of a cryptocurrency?

You can profit from the "arbitrage" of a cryptocurrency when it can be bought or traded on a platform for buying or trading cryptocurrencies at a price lower than the selling or trading price on another platform.

Let's take a concrete case. It didn't take me long to find one. I looked at the GAS/BTC price (GAS / Bitcoin) on the "Gate.io" and "Binance” platforms. Here is the order book (screenshot taken at the same time) :

Gate.io allows you:

- to buy GAS at 0.00457773 BTC

- to sell GAS at 0.00457098 BTC

Binance allows you:

- to buy GAS at 0.004540 BTC

- to sell GAS at 0.004522 BTC

It should be easily understood that arbitration is possible here. You can buy GAS on Binance at 0.004540 BTC and resell them immediately on Gate.io at 0.00457098 BTC, a capital gain of 0.00003098 BTC per GAS.

How to arbitrate cryptocurrencies?

To carry out the arbitration given as an example, you would need:

1/ an account opened on both trading platforms.

2/ to have BTC on Binance.

3/ to purchase GAS on Binance at 0.004540 BTC.

4/ to transfer the GAS to Gate.io

5/ to sell the GAS to Gate.io at 0,00457098 BTC.

Another possible solution would be if you already have GASs on Gate.io and BTCs on Binance; then it would possible, at the same time, to:

1/ sell the GAS already in your possession on Gate.io and buy some on Binance (against BTC).

2/ (only once the price balances on both platforms), buy back the GAS initially sold on Gate.io and resell the GAS purchased on Binance.

NB: this second solution meets the standard for "real" arbitration, which would consist of buying and selling at the same time. The first solution mentioned responds more to particular traders’ abilities, but is not a "real", instant arbitrage.

Which cryptocurrencies to arbitrate?

The major cryptocurrencies are difficult to arbitrate because they are more liquid than altcoins. It creates less price spread on the various platforms, and if there is spread, major cryptocurrencies catch up very quickly. You could easily imagine that automatic arbitration solutions have been implemented on major cryptocurrencies. A little robot that automatically checks if arbitration can be done on exchange platforms. You could even imagine the trading platforms themselves arbitrate their prices according to the price quoted on other platforms.

Coming back to the question:

- major cryptocurrencies are only arbitrable in periods of high volatility.

- mid range (top 100 cryptocurrencies offer the best arbitrage possibilities. They display the widest price spreads between platforms, but are sufficiently liquid to be traded quickly and so unwind arbitrage transactions.

- cryptocurrencies at the bottom of the table are not be sufficiently liquid and display huge spreads on unknown trading platforms. Forget it…! There is already plenty to do with the TOP 100.

Which platforms to use for arbitrating cryptocurrencies?

To secure your cryptocurrency arbitration, I advise you only to use the trading and purchasing platforms of major cryptocurrencies, known and widely used by crypto-traders. In this way you will have all the liquidity you need and good spread to unwind your arbitrage.

NB: only the cryptocurrencies commonly quoted on your chosen trading platforms can be arbitrated. By this I mean that to arbitrate a cryptocurrency X against Bitcoin, this cryptocurrency X against Bitcoin must be quoted on all your trading platforms.

Where and how to watch out for possible cryptocurrency arbitrage?

Arbitrage is possible when you can buy on one side and sell more expensively on the other, or buy and sell simultaneously (if you can manage this with the current funds, or cryptocurrencies in your possession on the platforms). But how do you watch out for arbitration opportunities?

To date, I know only two solutions to watch out for cryptocurrency arbitration opportunities:

1/ The fastest, most accurate, but also the most complicated solution: by keeping your eyes open on cryptocurrency quotations on the various exchange platforms.

2/ Solution including a delay, and not including a comprehensive view of the order book (and thus of the best offer/bid at time T): by consulting the trading price of the cryptocurrency directly on coinmarketcap.com.

In the “Markets” tab for each listed cryptocurrency, it is possible for you to consult the current price on various trading platforms. Example :

Then you just have to monitor the deviations between your cryptocurrency trading platforms in the table’s "Price" column.

What is the risk in arbitrating cryptocurrencies?

While it may seem easy at first glance to arbitrate cryptocurrencies, the risks should not be underestimated. The major risk comes from the volatility of cryptocurrencies and the exchange rate risk. Indeed, if the purchase and the sale of your arbitration is not carried out instantaneously (see solution 1 of "How to arbitrate cryptocurrencies") there is a risk of seeing the arbitrated cryptocurrency plummet. You buy the cryptocurrency on platform 1 then transfer it to platform 2. During the transfer time, the arbitration can be annulled, or worse, the cryptocurrency can depreciate.

Here are a few tips before you get into the cryptocurrency arbitration

1/ Make sure that you can transfer cryptocurrencies easily and quickly between your two trading platforms.

2/ Thoroughly check the quantities available in the order book on both trading platforms. If buying 100 units is possible on platform 1, it might not be possible to sell them at an interesting price on platform 2..

To give you an example, let's come back to the GAS/BTC screenshot on Gate.io and Binance: we see that the arbitrage purchases would not have been much of a problem on Binance; liquidity and prices were there. On the other hand it would only have been possible on Gate.io to resell 0.025 GAS at 0.00457098 BTC. The next best bid was 0.2470 GAS at 0.00445780 BTC (below the purchase price of the GAS on the Binance platform.).

The arbitration example was therefore only possible for 0.025 GAS.

3/ Beware of wallet to wallet transfers. Wallet to wallet transfer arbitration is on the increase, and therefore so is the risk of transferring a cryptocurrency to a wallet that is unable to receive it, or the risk of an error when entering the wallet’s public address.

Reminder: transferring a cryptocurrency to an erroneous public address, results in permanent loss of the cryptocurrency. Transfering a cryptocurrency to a wallet that is not able to receive it (e.g.: sending BTC to a NEO wallet.) also results in permanent loss of the cryptocurrency

4/ Think about transaction or transfer fees. Even if they are generally very low on different trading platforms, these fees should be taken into account in your arbitration transaction. As arbitrage is an operation consisting in taking advantage of small quotation spreads, it is therefore important that this spread is much higher than the transaction and transfer costs (not free of charge) of the cryptocurrency concerned.

Even simpler cryptocurrency arbitration (on a single trading platform):

If arbitrating cryptocurrency quotations between several trading platforms seems too complicated for you, there is simpler way: arbitrating a cryptocurrency against that cryptocurrency pair against another cryptocurrency pair including one of the same cryptocurrencies.

Let me explain: cryptocurrency trading platforms generally allow you to trade a cryptocurrency against BTC, ETH, USDT, BTG, and even against NEO (on the Kucoin trading platform). Price differences, and therefore possible arbitrations, are clearly displayed; Example :

In this example, I opened 4 windows quoting Litecoin:

- Top left: LTC against USDT

- Top right: LTC against ETH

- Bottom left: LTC against NEO

- Bottom right: LTC against BTC

There is a clear difference in Litecoin between LTC/NEO ($226.94) and LTC/BTC ($222.54). Arbitration is possible.

Attention: I specify that abtriation is "possible", because the price indicated in dollars is a function of the price of the last trade (and not the order book). In this example, buying at the lowest price we would choose LTC/BTC (shown at $222.,54 or 0.,002242040 BTC), but looking at the order book we see that the best offer is actually 0.,02249980 BTC (much more expensive.).

To arbitrate correctly in this way, you have to have software (or an excel file.) which can directly compare the price (after conversion) between the best offer and the best bid. In this case, arbitrage is only possible if the US dollar value of 0.02249980 BTC is lower than the US dollar value of 1.815723 NEO. The maximum amount of the transaction is 1.842262 LTC, available for purchase on LTC/BTC and widely available for resale (10 LTC on order book) on LTC/NEO.

NB: What conditions must be met to be able to arbitrate cryptocurrency quotations against differently valued cryptocurrencies?

Answer: Always have all the cryptocurrency equivalents at your disposal, so that you can buy Litecoin at any time at the lowest price (whether in USDT, NEO, BTC, or ETH.). No problem to resell it…

Problem 1: Having all the differently valued cryptocurrencies at any time is investing in the increase of all these cryptocurrencies.

There is only one solution: only arbitrate with LTC in USDT purchases so as not to constantly have cryptocurrencies that do not replicate a fiatcurrency .

Problem 2: By buying Litecoins against BTC, to resell them instantly against NEO, you can finally convert BTC into NEO at a good price. Certainly ... But the order book of the pair NEO/BTC still has to have a good price to match NEO in BTCs, otherwise the arbitration operation of the LTC will be useless. With arbitrage using only purchases in USDT (see problem 1), the result is the same. Still, the order book of the pair NEO/USDT - BTC/USDT - or ETH/USDT has to have a good price to match the cryptocurrencies in USDT which enables the resale of the LTC, otherwise the arbitrage operation of the LTC will be useless.

About author

- 20

- 42

- 60

- 6