A Martingale in trading? Is that possible?

-

- 0

- 2147

- 0

A lot of traders who start trading on the stock exchange or Forex are looking for THE martingale in trading. That is to say the mostly automated trading strategy using an expert advisor or a trading robot which will let them grow their capital in complete safety.

Is it possible to find a martingale in trading? An infallible strategy that will make you rich?

Like all self-taught traders, I have long sought THE martingale. Here are my leads, my conclusions and my experience on the subject...

A long time ago... I first started with the Expert Advisor SuperTrend(EA);that opened, either:

- a long position at the bullish breach of a bearish SuperTrend technical indicator, with a Stop Loss under the SuperTrend (turned bullish).

- a short position at the bearish break of a bullish SuperTrend, with a Stop Loss above the SuperTrend (turned bearish).

The EA SuperTrend soon proved not to be a "martingale EA ". It is perfectly suited to be a support for manual trading and offers good entry and Stop Loss. But to leave it running alone, we too often suffer with the volatility of the market, the shadow that come to stop our positions. Long trend movements without a hint of breaching the SuperTrend are rare.

So I immediately concluded that I didn't need a Stop Loss, and that I needed another tool to build my martingale.

After a few hours of thinking about my charts, I then thought about the following strategy:

Open a long position at each bullish candle, or a short one at each bearish candle. All without a Stop Loss or Take Profit order.

The basic idea: accumulate longs and shorts, bearing in mind that on a bullish swing movement there are more bullish candles than bearish candles, or conversely, that on a bearish movement there are more bearish candles than bullish candles.

I quickly moved on to something else. Why was that? Because the basic idea is completely wrong! It is possible that a bullish rally completes with only 2-3 candles, but includes several dozen bearish correction candles.

On to the next idea...

(The last one I worked on before stopping my research.)

The basic idea was that prices always return (one day or another) to the entry price. With this basic idea, which martingale should I build? An expert advisor, which would automatically open a counter trend position after validating a certain configuration of Japanese candlesticks. From there was born the Multi-Candle Expert Advisor. What exactly does this EA do? It allows you to determine a precise number of consecutive candles from which your position will open (trending or counter-trending, with or without TP, with or without SL).

After days of back testing certain EA settings, there was only one conclusion: you must not set a Stop Loss, just a Take Profit, and trade against the trend.

An example of parameter setting: the EA is set to wait for 5 consecutive bullish candles and closures to enter a counter trend without a Stop Loss and with a Take Profit at 30 pips.

In any case, the more candles you set, the fewer open trades there are and the higher the chances that the position reaches the TP. Similarly, the lower the Take Profit, the greater the chance that it will be executed quickly.

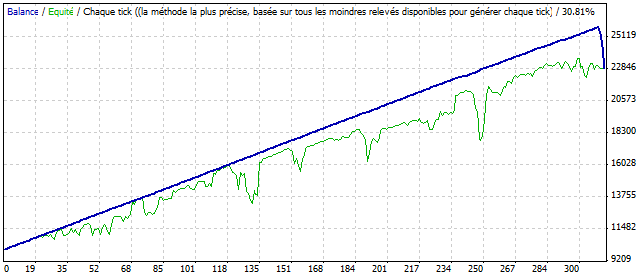

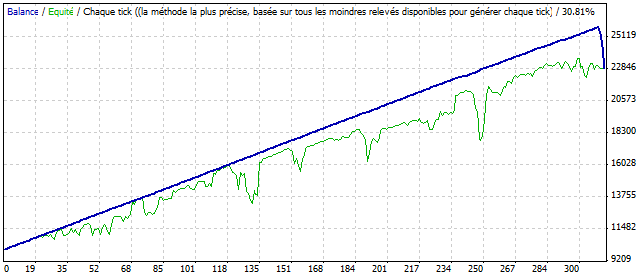

Backtests were used to highlight performance charts such as the following:

As we can see on this performance chart, the martingale strategy seems, at first sight, to be winning! And yet, it blocks... It’s impossible to apply... I’ll explain why later...

This martingale strategy means that our active positions are constantly negative. Indeed, the winning positions are quickly cut and there are only the loss positions which have not yet managed to reach their Take Profit. In summary, the strategy accumulates small profits but permanently displays drawdown. By dint of accumulating small profits, the account balance quickly rises, quite high, making it possible to support the potential future drawdown better.

To diversify and thus secure the account, it is also possible to apply this strategy on different currency pairs. By accumulating all the small profits, we make the balance of the account go up even faster and we smooth the drawdown.

But then why isn't it applicable? Everything looks good you'll tell me...

This martingale is limited by several things:

1/ Without a Stop Loss, the account is not covered against possible ultra-powerful rallies (as was the case recently on CHF pairs). The account can very well end up razed in a few seconds as there is no Stop Loss.

2/ The more the strategy is left active over time, the more counter-trend positions are accumulated. Small profits keep the account stable but drawdowns are more and more marked over time; if there is a powerful movement in the opposite direction to all remaining active positions, the account can quickly be razed.

3/ To diversify this strategy well, it would be good to be able to apply it to different pairs. It is important to choose uncorrelated currency pairs, otherwise the risk would only increase. But adding new pairs to the strategy increases the total number of positions that can remain active on the account. If I am not mistaken, the MetaTrader platform limits the total number of positions that can be opened at the same time to 900.

4/ Time plays against this martingale strategy. Indeed, trend waves can be very long. Just look at any daily chart to see. And to accumulate counter-trend positions, you end up having far too many in the portfolio with this strategy. No more possibility to open new positions... In the long run, this strategy ensures that leverage reaches its maximum. I don’t need to tell you the enormous risk of seeing the account razed in under 5 minutes. Drawdown becomes a real game of yo-yo for your account.

NB: without forgetting that, if there is a reversal in the long-term trend, the account’s drawdown position components will eventually reach their Take Profit, but will be incrementally replaced by reverse positions (oh yes! that is the correction counter trend.)

How could this strategy work (at a push)?

1/ By having an account with a broker that allows you to hedge. That is to say to open both long and short positions on the same product

2/ By having an account on which it would be possible to trade micro-lots, with a leverage of less than 1:1, or even less than 1:01

3/ By manually cutting all positions at once (martingale strategy reset) as soon as the drawdown is close to zero.

4/ no... Forget this strategy. That's the easiest thing to do.

My conclusion

I don't know if "martingale" strategies exist. I've given up my research and now I have to stick to my position that they don't exist.

And who really knows if martingales exist? Those (like me) who have not found any will say that they don’t exist; that they are a dream for the masses. Those who have found one, say nothing; they are not to be found. Only one thing is certain: those who say they have found THE martingale and sell it on the net are crooks. Don't be fooled by the so-called Expert Advisors that will make you rich... They only do one thing: make those who sell them rich.

TO SOW DOUBT

Bruno and I know a trader who created a martingale (I don't know how...) that generates micro profits below 1 pip on each position. Its EA is installed on a 1min time unit chart and multiplies operations at all times. Apparently it's very profitable.

So in the end, I don’t know what to think about martingales.

What have you tried?

Do you think martingales exist in trading?

Is it possible to find a martingale in trading? An infallible strategy that will make you rich?

Like all self-taught traders, I have long sought THE martingale. Here are my leads, my conclusions and my experience on the subject...

A long time ago... I first started with the Expert Advisor SuperTrend(EA);that opened, either:

- a long position at the bullish breach of a bearish SuperTrend technical indicator, with a Stop Loss under the SuperTrend (turned bullish).

- a short position at the bearish break of a bullish SuperTrend, with a Stop Loss above the SuperTrend (turned bearish).

The EA SuperTrend soon proved not to be a "martingale EA ". It is perfectly suited to be a support for manual trading and offers good entry and Stop Loss. But to leave it running alone, we too often suffer with the volatility of the market, the shadow that come to stop our positions. Long trend movements without a hint of breaching the SuperTrend are rare.

So I immediately concluded that I didn't need a Stop Loss, and that I needed another tool to build my martingale.

After a few hours of thinking about my charts, I then thought about the following strategy:

Open a long position at each bullish candle, or a short one at each bearish candle. All without a Stop Loss or Take Profit order.

The basic idea: accumulate longs and shorts, bearing in mind that on a bullish swing movement there are more bullish candles than bearish candles, or conversely, that on a bearish movement there are more bearish candles than bullish candles.

I quickly moved on to something else. Why was that? Because the basic idea is completely wrong! It is possible that a bullish rally completes with only 2-3 candles, but includes several dozen bearish correction candles.

On to the next idea...

(The last one I worked on before stopping my research.)

The basic idea was that prices always return (one day or another) to the entry price. With this basic idea, which martingale should I build? An expert advisor, which would automatically open a counter trend position after validating a certain configuration of Japanese candlesticks. From there was born the Multi-Candle Expert Advisor. What exactly does this EA do? It allows you to determine a precise number of consecutive candles from which your position will open (trending or counter-trending, with or without TP, with or without SL).

After days of back testing certain EA settings, there was only one conclusion: you must not set a Stop Loss, just a Take Profit, and trade against the trend.

An example of parameter setting: the EA is set to wait for 5 consecutive bullish candles and closures to enter a counter trend without a Stop Loss and with a Take Profit at 30 pips.

In any case, the more candles you set, the fewer open trades there are and the higher the chances that the position reaches the TP. Similarly, the lower the Take Profit, the greater the chance that it will be executed quickly.

Backtests were used to highlight performance charts such as the following:

As we can see on this performance chart, the martingale strategy seems, at first sight, to be winning! And yet, it blocks... It’s impossible to apply... I’ll explain why later...

This martingale strategy means that our active positions are constantly negative. Indeed, the winning positions are quickly cut and there are only the loss positions which have not yet managed to reach their Take Profit. In summary, the strategy accumulates small profits but permanently displays drawdown. By dint of accumulating small profits, the account balance quickly rises, quite high, making it possible to support the potential future drawdown better.

To diversify and thus secure the account, it is also possible to apply this strategy on different currency pairs. By accumulating all the small profits, we make the balance of the account go up even faster and we smooth the drawdown.

But then why isn't it applicable? Everything looks good you'll tell me...

This martingale is limited by several things:

1/ Without a Stop Loss, the account is not covered against possible ultra-powerful rallies (as was the case recently on CHF pairs). The account can very well end up razed in a few seconds as there is no Stop Loss.

2/ The more the strategy is left active over time, the more counter-trend positions are accumulated. Small profits keep the account stable but drawdowns are more and more marked over time; if there is a powerful movement in the opposite direction to all remaining active positions, the account can quickly be razed.

3/ To diversify this strategy well, it would be good to be able to apply it to different pairs. It is important to choose uncorrelated currency pairs, otherwise the risk would only increase. But adding new pairs to the strategy increases the total number of positions that can remain active on the account. If I am not mistaken, the MetaTrader platform limits the total number of positions that can be opened at the same time to 900.

4/ Time plays against this martingale strategy. Indeed, trend waves can be very long. Just look at any daily chart to see. And to accumulate counter-trend positions, you end up having far too many in the portfolio with this strategy. No more possibility to open new positions... In the long run, this strategy ensures that leverage reaches its maximum. I don’t need to tell you the enormous risk of seeing the account razed in under 5 minutes. Drawdown becomes a real game of yo-yo for your account.

NB: without forgetting that, if there is a reversal in the long-term trend, the account’s drawdown position components will eventually reach their Take Profit, but will be incrementally replaced by reverse positions (oh yes! that is the correction counter trend.)

How could this strategy work (at a push)?

1/ By having an account with a broker that allows you to hedge. That is to say to open both long and short positions on the same product

2/ By having an account on which it would be possible to trade micro-lots, with a leverage of less than 1:1, or even less than 1:01

3/ By manually cutting all positions at once (martingale strategy reset) as soon as the drawdown is close to zero.

4/ no... Forget this strategy. That's the easiest thing to do.

My conclusion

I don't know if "martingale" strategies exist. I've given up my research and now I have to stick to my position that they don't exist.

And who really knows if martingales exist? Those (like me) who have not found any will say that they don’t exist; that they are a dream for the masses. Those who have found one, say nothing; they are not to be found. Only one thing is certain: those who say they have found THE martingale and sell it on the net are crooks. Don't be fooled by the so-called Expert Advisors that will make you rich... They only do one thing: make those who sell them rich.

TO SOW DOUBT

Bruno and I know a trader who created a martingale (I don't know how...) that generates micro profits below 1 pip on each position. Its EA is installed on a 1min time unit chart and multiplies operations at all times. Apparently it's very profitable.

So in the end, I don’t know what to think about martingales.

What have you tried?

Do you think martingales exist in trading?

About author

- 20

- 42

- 60

- 6