Money management for novice traders

-

- 0

- 2621

- 0

Definition of money management

Money management is risk management in trading. Novice traders often don't pay attention to this, yet it is the key to success in the financial markets. You can't win in the long run without following the rules of money management. Technical analysis saves you money and money management prevents you from losing too much. You should bear in mind that your capital is your working tool in trading. So you need to protect it, just like you take out insurance for your car or house. Without money management, you risk razing your trading account. At the risk of surprising you, it is not a bad trading strategy that causes most traders to lose, but poor risk management and their psychology. But then, what is money management?

Money management: a safeguard against emotions

The psychological factor plays a major role in trading. Trading can be compared to gambling (like in a casino for example) by the emotions it activates in the trader, namely greed (insatiable lure of gains), stress, euphoria, depression, fear of losing, frustration and panic. All these emotions mean that traders (especially novices) can make irrational decisions and endanger their working tool, i.e. their capital. This is where money management comes in. It allows you to protect yourself against your emotions by following certain rules.

In trading, novice traders often only think about the gains they can make, but never about the losses. Losses are part of trading and you have to accept it. If you don't accept losing, you can't win in the financial markets. Losing trades are the daily routine of all traders. You can't always be right. Your analysis can be the best there is, it's the market that decides. As is said, so correctly, better to be wrong with others than right alone. Money management is used to manage loss phases and prevents you from razing your account when you are wrong.

Money management against leverage

Leverage, which determines your risk, is calculated as follows: Total amount of your positions / account balance. In other words, the larger your position sizes, the greater your risk. This does not mean that leverage is to be avoided to comply with money management rules. You simply need to take positions commensurate with the size of your capital. This is valid for all types of markets, Forex, equities, indices and commodities (with CFDs), derivatives.

Remember that leverage is accumulated on all your positions. The more positions you open, the greater your risk. However, this risk can be mitigated with diversification into different markets/products. But be warned, to be effective, diversification must be efficient. If you gamble, for example, on the increase of different shares in the CAC40, or the increase of the Euro on several currency pairs, the diversification effect is almost nil. Effectively, if the CAC40 plunges, all the shares will fall, the same goes for the Euro. This is why novice traders would be wise to ignore the effect of diversification in their risk management, because to use it well, you need to understand the correlations between different markets/products.

The leverage you can use depends on how far away your stop loss is. The further away your stop loss is, the more important it is to reduce the size of your position. It is better for your leverage, on all your positions, to be under 10. Several studies have shown that the traders who use the least leverage are those who last on the financial markets and also those who have the best performance. These traders generally use a leverage not exceeding 5, especially on Forex.

I still hear some traders bragging that they are the best because they have doubled their capital in a week. As if by chance, there is no sign of them a week later. I’ll let you guess why. It is important to understand that you can't last in the financial markets if you use too much leverage (which induces significant risk). The goal of money management is precisely to make sure that you last. Then, it is your trading strategy that will be the sole judge of your trading results (and not your emotions or bad money management!).

If your goal is still to double your capital, go to a casino and gamble on red or black, this will lower the statistic of the number of losing traders in the financial markets.

The rules of money management

-

Using a stop loss

: A stop loss is a protection stop that represents a level at which you feel your scenario will not occur. Stop losses are mandatory on every position! If you don't place a stop loss, your emotions take control of you when there are unfavourable price movements and this is the beginning of the end. A single trade can be enough to ruin you (even with low leverage). Don't believe that the price will always come back to your entry price. Some trends last several days, weeks, months or even years. In addition, a losing trade appearing permanently in your open position lines will crush your psychology. It is hard to continue to respect money management rules when they have not been respected from the beginning.A stop loss must NEVER be moved if the price moves in the wrong direction. The stop loss level is decided before the position is taken (this is when you are most objective). Only a favourable price change should involve moving a stop loss to follow the movement and protect your gains.

-

Have a positive risk/return ratio

: This means that your stop loss must be less distant from your entry price, in terms of points, than your price objective. All trades with a ratio below 1 should be excluded! For example, you should not take a position on the EUR/USD when buying with an objective of 1.3550 and a stop at 1.34 while the pair costs 1.35. The risk/return ratio on this trade is (1.3550-1.35) / (1.35-1.34) = 0.50 / 1 = 0.5.A good risk/return ratio is around 2. Your expectation of gain is then twice your risk. Between 1 and 2 is tolerable but is more reserved for experienced traders. The less experience you have, the more important it is to select trades with a ratio of at least 2. This will reduce your trading opportunities but a novice usually has a lower positive trading percentage than an experienced trader (better analysis), so you need to compensate with a good ratio.

Effectively, if you open trades with a minimum ratio of 2, it means that one winning trade is enough to cover 2 losing trades.

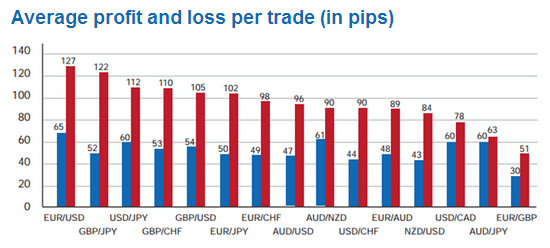

- A study of the forex broker FXCM (conducted on its client base - FXCM is the market leader) shows that the majority of forex traders lose, not because of their analysis (50% of their clients' trades win), but because of non-compliance with money management rules as shown in the chart below :

In red: Average losses per trade / In blue: Average profits per trade

This illustrates perfectly that the majority of traders do not use stop losses (and do not accept taking their loss) or they open positions with a risk/return ratio below 1. As a reminder, 90% of traders lose on Forex, while 50% of their trades win.

-

Adapt the size of your positions

: For each trade, the price objective and the stop loss will be more or less distant in terms of points, according to the characteristics of the trade and the product traded. For each trade, it is therefore important to calculate the appropriate position size so as not to risk more on one trade than on another. It is important that risk is constant, this is a very important element. This risk should not exceed 2% on one trade and it is important not to risk more than 1%. If you open a lot of positions at the same time, then you could reduce your risk to 0.5% per trade maximum.-

Set yourself a maximum loss threshold

: There are dark days in trading when no matter how many trades you do, they all lose. This should be integrated and accepted. This does not happen often but every trader has gone through it several times. The important thing is to limit losses during these days and to be able to return without taking additional risk during the following days. This way, you will only have wasted time and not money.It is therefore important to set yourself a maximum daily percentage loss threshold. Once this threshold is reached, you simply stop your trading day and come back the next day. To determine this, you can calculate your average performance over a winning day. Multiply this number by 2, and you get your maximum loss threshold. So, even after a dark day, you could make up your loss within 2 days. It is up to you to set this threshold but keep in mind that you should not have too large a threshold, this would give you the impression of never being able to make up for your loss. This could affect your psychology and emotions will then take over your trading.

The limits of money management

Money management is the key to successful trading but it is sometimes difficult to apply it to the letter. On Forex, for example, there is a minimum contract size of 1,000 units, or 0.01 lot (this is called a micro lot). Some brokers do not even offer this type of contract and the minimum trade amount is 10,000 units, or 0.1 lot. If your upfront investment (deposit) is too low, you are forced to leverage all your positions. This is the case on Forex, if your deposit is less than €1,000. Effectively, your leverage on one trade is calculated as follows: your position amount / your account balance.

In this case, strict money management will force you not to open a lot of positions simultaneously as that would result in the cumulative leverage (on all your positions) being too high. Another part of the FXCM broker study shows, and I quote: "It is estimated that 8/10 of losing traders with accounts under $1,000 use leverage in excess of 26:1”.

Worse, if your upfront investment is very small, the application of money management rules will penalize you in your trading results. Effectively, not being able to reduce position size, you will have to bring your stop losses closer (so as not to risk too large an amount on one trade) and you will therefore have a greater number of losing trades.

It’s not fair, but it is only from a particular upfront investment that money management rules can be correctly applied. If your upfront investment is really too low, compared to the minimum position size offered by the broker, it might be better not to make that deposit. Before opening an account with a broker, check this information.

About author

- 20

- 42

- 61

- 6