BreakOut 30min Trading Strategy on CAC 40

-

- 0

- 1131

- 0

Basic principle of the BreakOut 30min strategy on CAC 40

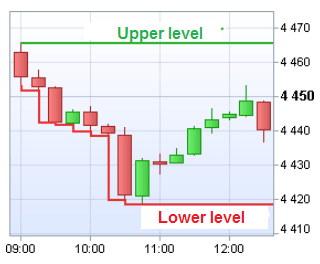

The traditional 30minute Breakout identifies the highest and lowest mini-contract value points that the CFD France 40 reached over the first thirty minutes of the day's significant quotations, i.e. between 9:00 and 9:30 for this value (this period is represented by two 15 minute candlesticks, both in the below diagrams), and defines these levels as the upper and lower level.

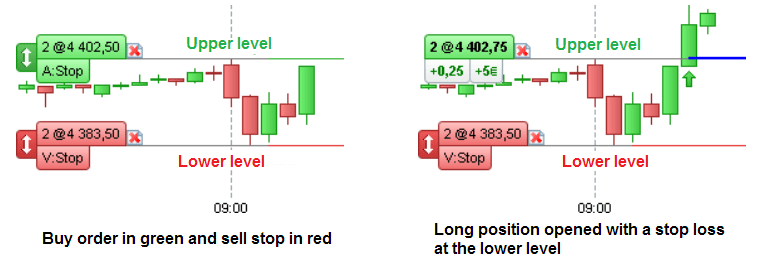

Then, a stop buy order is placed on the upper level and a stop sell order is placed on the lower level as shown in the below left diagram:

If the upper level is affected first by this value, a long position will be opened as shown in the below right diagram.

If the lower level is hit first by this value, a short position will be opened.

The trading system does not use a profit target to close a position. However, any position still open at 7.45 p.m. is closed to avoid the risk of exposure overnight.

Rule 1: A maximum of two positions are opened per day

In our example, we open a maximum of two positions per day (one buy and one sell).

When one of the two levels is hit first, a position is opened and the opposite level then becomes a protection stop that reverses the position if it is hit afterwards.

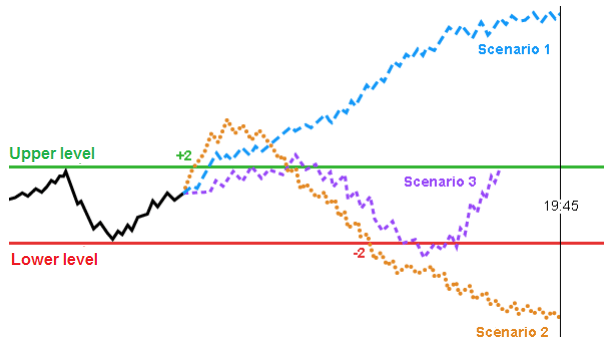

Let's examine three of the scenarios that might have occurred if a long position had been opened first:

Scenario 1:

1. A +2 long position is opened

2. Throughout the day the value moves above the upper level

3. The position is closed at 7:45 p.m. with a gain

Scenario 2:

1. A +2 long position is opened

2. The value drops to the lower level.

3. A protective stop cuts the position with a loss and a new -2 short position is opened this time. The starting position is thus reversed.

4. The value continues its decline and this second short position is closed at 7:45 p.m. with a gain.

Scenario 3:

1. A +2 long position is opened

2. The value drops to the lower level.

3. A protection stop cuts the position with a loss and a new -2 short position is opened (reversed position).

4. The value goes up again to the next level. The second short position is then closed by a protection stop with a loss (without reversing the position this time).

All the above scenarios are also possible in the opposite direction, when a short position is taken first from the outset.

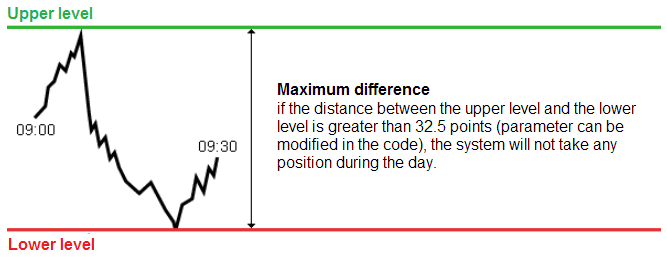

Rule 2: Limit risk by defining a maximum gap between the two levels

In our example code, if more than 32.5 points separate the upper level from the lower level, the trading system will not open a position on the day.

This condition was introduced in an attempt to directly limit risk, because, as seen in the previous scenarios, the trading system can theoretically at most lose twice the distance between the lower and upper level.

The maximum spread is a parameter in the system code that can be adjusted according to the risk level desired by each investor.

With a maximum amplitude of 32.5 points, the theoretical maximum trading system loss is €130 per day (twice the amplitude x €32.5 x 2 positions).

It should be noted that:

1) The theoretical maximum loss indicated above is based on order executions at stop prices calculated by the system. In some cases, the actual execution price may differ from the stop price requested.

2) If the high and low breakpoints between 9:00 and 9:30 are crossed several times a day between 9:30 and 7:45 p.m. (the worst case for scenario 3), and this happens every day from today onwards, then the system results are negative day after day over this period and the initial capital would eventually be lost.

3) The trading system may open a 3rd position on the same day if both the buy order and the sell order are crossed within the same 15 minute period after defining these two levels.

4) Our ProOrder trading module easily simulates the system with several different maximum spread values. This variable optimization shows us that the performance of the system could have been better over the period with a greater value of the maximum spread but we would then have run a greater risk of loss per transaction because the protection orders would have been further away from the position entry orders.

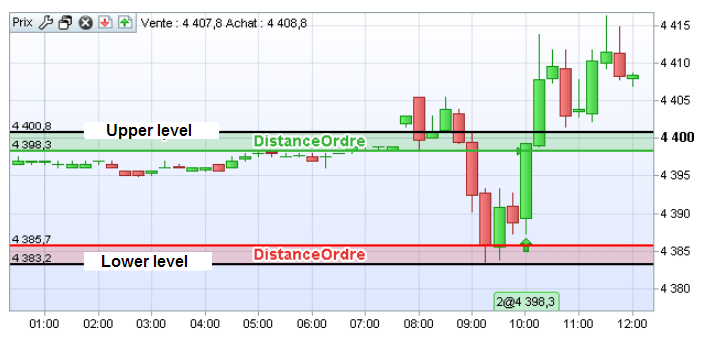

Rule 3: Increase the chances of favourable execution

In our example, we have assumed that the upper and lower levels are important support and resistance areas on which a lot of investors may have placed orders. This often results, when the price breaks a highest or lowest point, in a more or less strong price acceleration in the direction of the breakout over a few seconds.

To take advantage of this possible trend amplification just after the breakout, and thus increase the chances that our orders will be executed favourably, we have set up the system so that it only uses stop loss orders placed 2.5 points below the upper level and 2.5 points above the lower level, as shown below. This 2.5 parameter, called "DistanceOrder" in the system code, can be modified according to each investor’s choice.

It should be noted that:

1) This condition reduces the distance between the buy order and the sell order by 2 x 2.5 points, and therefore the maximum system risk because, in our example, the 2 orders are separated by 27.5 points in the end. The new theoretical maximum loss in the system is €110 per day (twice the amplitude x €27.5 x 2 positions). This happened on a single day, the 11th May 2010, out of the 2,221 days of the ProBacktest simulation sample.

2) In the event that a lot of other investors position themselves at the buy and sell thresholds in the same direction as the trading system, it is possible to modify the "DistanceOrder" parameter (to 3 or 3.5 or 4 or more) to take advantage of the acceleration that could follow after executing your own order.

Rule 4: Intervene only on clear breakouts to avoid false signals

Case 1: value too close to the upper or lower level at 9.30 a.m.

In our example we made sure that the system did not place an order when our reference value price was too close to the upper or lower level at the end of the second 15 minute period.

In such cases, the system waits an additional 15 minutes.

If at the end of the new 15 minute period (9:45 a.m.) the value price is still too close to the levels, the system waits another 15 minutes, and so on until the levels can be set. In all cases, for a given day, if the maximum deviation of 32.5 points is exceeded, the system does not open a position on that day.

This parameter for the distance between the upper and lower levels, called "MinPercent", in the system code example, is set here to 35% but it can be modified according to each investor’s choice.

In the diagram below, the closing price for each period is too close to the lower level up to the 10:45 a.m. candlestick.

The lower level was, therefore, lowered until the candlestick closed at 10:45 - 11:00 a.m.

However, as at this point, the distance between the upper and lower level was more than 32.5 points, our system example would not have taken a position that day.

Case 2: difference between upper and lower levels too small

In our example, the system also avoids situations where the difference between the upper and lower levels is too small (the breakout could then be considered insignificant). The system measures the distance between the buy order and the sell order: if this distance is less than 11.5 points (parameter called "AmplitudeMin" and modifiable in the code), the system does not open a position on the day.

Rule 5: Do not open a position if there is not enough time left

Since in our code example we cannot be in position after 7:45 p.m., we have set the system example so that it does not open a new position after 5 p.m.

Similarly, when a trading day is shortened due to a holiday (Christmas or New Year's Eve), the system does not open a position.

We can also customize this setting in the strategy’s code to change the time at which the system ignores signals.

About author

- 20

- 42

- 61

- 6