Chart pattern: Double bottom

-

- 0

- 6082

- 0

What is a double bottom?

A double Bottom is a bullish chart pattern in the shape of a "W". The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support.

This chart pattern shows the determination of investors not to let the price reach new lower levels, and their willingness to reverse the current trend.

NB: this chart pattern can also be created in the form of "WV" or a "Triple Bottom".

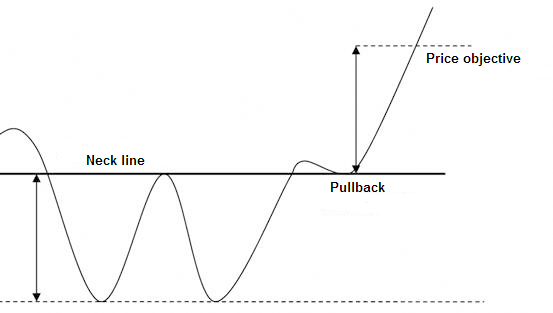

On a double Bottom pattern, the first correction determines the neck line, embodied in the highest point between the two troughs. The price then drops back to the level of the last lowest point (same support level as the first bottom). The magnitude of the two troughs is normally the same, but it is common for the first trough to be lower than the second (or vice versa).

A double Bottom pattern is only definitively validated at a bullish break in the neck line.

The price objective in a double Bottom pattern is calculated by taking the pattern’s highest point above the neck line.

NB: the highest point corresponds to the difference between the neck line and the support line where the two troughs were formed.

When validating a double Bottom pattern (bullish break in the neck line), it is common for the price to make a pullback in support on the neck line before reaching the pattern’s price objective.

Graphical representation of a double Bottom

Double Bottom statistics

- In 70% of cases, the movement is bullish after a double Bottom.

- In 67% of cases, the price objective of a double Bottom pattern is attained when the neck line is broken.

- In 97% of cases, the upward movement continues at the break in the double Bottom pattern’s neck line.

- In 59% of cases, the price makes a pullback in support on the neck line of the double Bottom pattern after exiting.

The various double Bottom representations

There are various double Bottom representations, which are differentiated according to two criteria:

1 - The shape of the trough; it can be in the shape of a peak (called an Adam trough) or a rounded shape (called an Eve trough).

2 - The level of the second trough; this can be higher, at the same level or lower, than the first trough.

Notes on double Bottoms

- Once the price objective is reached, the upward movement is generally less steep if the price has made a pullback at the pattern’s exit.

- The closer the two troughs of the double Bottom pattern are, the higher pattern’s percentage of success.

- The greater the downward movement preceding the formation of a double Bottom pattern, the more powerful the upward movement at the break of the cutting line will be.

For your information: A Double Bottom is a reversal chart pattern. Its opposite is a Double Top.

About author

- 20

- 42

- 60

- 6