Japanese candlesticks - Kicking

-

- 0

- 1105

- 0

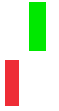

Bullish kicking

Definition: A bullish kicking structure is comprised of two Japanese candlesticks. The first is a bearish marubozu (red) followed by a bullish marubozu (green) with an opening occurring in a large bullish gap. The opening price of the second candlestick must be higher than the opening price of the first candlestick.

Illustration:

Characteristic: A bullish kicking often occurs after a significant drop characterized by several large red Japanese candlesticks.

Significance: A bullish kicking is a reversal pattern indicating a bullish trend reversal. It reflects an effect of total surprise and aggressive opposition.

Note: A bullish kicking is a very powerful pattern. The trend preceding the pattern’s formation is of little importance.

Invalidation: If the next candlestick is not bullish or does not open on a new bullish gap, the bullish kicking is invalidated.

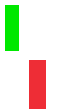

Bearish kicking

Definition: A bearish kicking structure is comprised of two Japanese candlesticks. The first is a bullish marubozu (green) followed by a bearish marubozu (red) with an opening occurring in a large bearish gap. The opening price of the second candlestick must be lower than the opening price of the first candlestick.

Illustration:

Characteristic: A bearish kicking often occurs after a significant increase characterized by several large green Japanese candlesticks.

Significance: A bearish kicking is a reversal pattern indicating a reversal of a bearish trend. It reflects an effect of total surprise and aggressive opposition.

Note: A bearish kicking is a very powerful pattern. The trend preceding the pattern’s formation is of little importance.

Invalidation: If the next candlestick is not bearish or does not open on a new bearish gap, the bearish kicking is invalidated.

About author

- 20

- 42

- 61

- 6