Definition - Quantitative Easing (QE)

-

- 0

- 867

- 0

What is QE?

Quantitative Easing (QE) is monetary easing, organized by a central bank, to stimulate economic activity within a country. It is an unconventional measure causing an increase in the money supply.

Why does a central bank decide to launch quantitative easing?

A central bank can use the policy rate to increase the money supply. By lowering its policy rate, it encourages investment. Effectively, low rates allow an increase in the number of loans granted by banks to companies and individuals. Financing from a bank is less expensive, so companies are able to invest more. Individuals are able to consume more, which in the long run is expected to boost growth within the country. Lowering policy rates is therefore often sufficient, but if the economic crisis is too intense, economic recovery must be achieved by other means.

If the central bank has policy rates close to zero, its manoeuvring ability is thereby extremely limited. It may then decide to use non-conventional measures, including Quantitative Easing (QE). This has happened with all central banks, the FED the BoE, the ECB and the EQ champion, the BoJ. Quantitative Easing is therefore used as a last resort by central banks. It's a kind of faint hope manoeuvre.

How does a Quantitative Easing operation work?

Quantitative Easing (QE) is an operation to create money supply for subsequent injection into the real economy. The central bank creates money by creating a simple line of credit on its account, as if you were writing a cheque. The difference between a central bank and you, is that the central bank does not need to have the money in its account. It can create as much money as it wants. The money that is created is not physical, it is just an accounting entry. The increase in the money supply is perpetual at a central bank (this is how our economy works) but Quantitative Easing considerably speeds up the money creation process.

Quantitative Easing then enables the central bank to buy massively:

-

Long-term treasury bills

: This manoeuvre makes it possible to lower long-term borrowing rates due to a massive increase in demand. Lowering rates favours investment (lower rates) and encourages households to consume more (lower-income savings).The central bank repurchases treasury bills from financial institutions (banks, insurance companies, pension funds). As a result, these institutions are left with significant liquidity. In theory, banks can then grant loans to individuals and companies more easily.

-

Toxic assets

: If necessary, the central bank agrees to repurchase toxic assets from the banks. In the event of an actor’s default, the commercial bank then suffers no loss. Its counterparty risk following a loan is then zero, since it is entirely borne by the central bank. Again, this manoeuvre is intended to encourage commercial banks to grant more loans.What are the risks of Quantitative Easing?

-

Inflationary pressures

: The increase in the money stock in circulation encourages inflation. The currency of the country concerned by the Quantitative Easing operation therefore depreciates against other currencies. A decline in the currency on the Forex market has a strong impact on the economy. It favours exports but imports become more expensive. The impact is very different depending on the economic profile of the country.At the end of a Quantitative Easing operation, the central bank is expected to sell the treasury bills purchased during its operation or wait until they mature to destroy them. But in practice, this operation is far from being applied, and inflationary pressures are therefore persistent.

However, the facts show that inflationary pressures rarely appear in practice after a Quantitative Easing operation. Why? Well, for inflation to occur, there must be an increase in the number of credits granted, which then encourages demand for goods. The problem is that commercial banks do not play the game. Despite the massive influx of liquidity due to QEs, they do not pass on any benefits for loans to individuals and companies.

-

Increase in the size of central banks' balance sheets

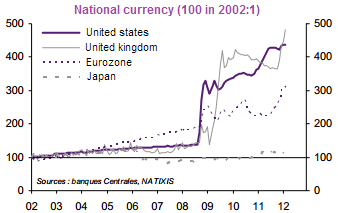

: Quantitative Easing is a line of credit on the central bank's account. But credit is debt and the larger the EQ transaction, the larger the amount of debt. To be able to repay its debts, the central bank must therefore constantly create money and increase the money supply. All the money that is created is covered by debt. Money creation is done through the redemption of assets (treasury bills). Quantitative easing accelerates the phenomenon considerably, as shown in the graph below, with the size of central banks' balance sheets:

It can be seen that the size of central banks' balance sheets has exploded since the 2008 crisis (implementation of quantitative easing by central banks), while growth was stable in the pre-crisis years. In this balance sheet, there are a lot of toxic assets. There is a significant risk of default on these assets. If this happens, the state pays for the loss, and when I say the state, I mean its taxpayers.

-

Promotes public debt

: With a Quantitative Easing operation, the central bank buys treasury securities issued by governments on a large scale. States may then be tempted to issue treasury bills on a large scale (and thus to take on significant debt and increase their deficits), as they know that the central bank always ends up buying them. The central bank pushes long-term rates down, which allows governments to finance themselves at a lower cost. We can see today that some states are not making much effort to reduce their deficits. They tell themselves that they will always be able to finance themselves and that they will always find a buyer for their securities with the central bank and QE. But there is no guarantee, if the Quantitative Easing operation stops, then the purchase of treasury securities depends entirely on investor confidence in the country. Then, anything is possible.-

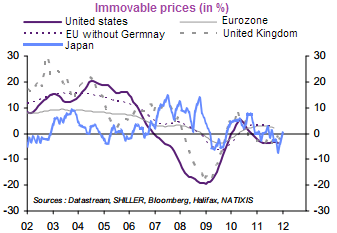

Creation of speculative bubbles

: Quantitative Easing is supposed to encourage commercial banks to lend more. But in reality, these banks prefer to speculate in the financial markets. This massive influx of liquidity into the markets creates speculative bubbles. This was the case for real estate, for example. The following graph clearly shows that, starting from the use of QE by central banks, real estate prices have risen sharply:

With all the Quantitative Easing underway and to come, one wonders what the next speculative bubble will be?

About author

- 20

- 42

- 61

- 6