Liberty Gold Reports Weighted Average 80.8% Gold Extraction in Phase 3 Metallurgical Column Testing - Black Pine Oxide Gold Deposit, Idaho

- 42

VANCOUVER, British Columbia, Oct. 27, 2021 (GLOBE NEWSWIRE) -- Liberty Gold Corp. (LGD-TSX; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to report results from Phase 3 variability composite metallurgical column testing from large-diameter (“PQ”) drill core at its Black Pine Oxide Gold Project in southeastern Idaho (“Black Pine”). The objective of the Phase 3 metallurgical program was to expand the geographical and ore type distribution of Phase 1 and Phase 2 column testing which included six surface bulk samples and 29 variability composites.

Highlights

- Phase 3 testing included 45 new variability composites testing the full range of rock types, gold (“Au”) grades and ore types encountered across Black Pine.

- Aggregate results support a simple, low capital, low operating cost, Run-of-Mine (“ROM”) heap leach processing route for Black Pine ores.

- Gold extractions are consistent with previous metallurgical programs, with >80% of the leachable gold extracted within 10 days and final column leach gold extractions ranging up to 94.8%:

- Phase 1 bulk sample column test results: 78.9% weighted average gold extraction, ranging up to 92.8%1

- Phase 2 variability composite column tests: 82.1% weighted average gold extraction, ranging up to 94.5%1

- Historical column tests from bulk samples and drill core composites: 80.8% weighted average gold extraction.

1 See press releases dated August 18, 2020 and June 16, 2020

Gary Simmons, independent consulting metallurgist to Liberty Gold commented: “Data from metallurgical testing to date at Black Pine continues to indicate rapid leaching and relatively high gold extractions from these gold oxide ores, with a consistent insensitivity to particle size and a predictable grade-recovery relationship. In Phase 3 a wider range of material types were tested and 38 of 39 tested composites passed load permeability testing at 100-metre heap height. Internal development of clay and rock models indicate that a smaller portion of the resource may require in-pit or top-of heap blending, eliminating the need for a Crush/Agglomeration flowsheet component, and supporting simple Run-of-Mine leaching at Black Pine.”

All metallurgical work at Black Pine has been supervised by Gary Simmons, formerly the Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed or supervised a significant number of metallurgical testing programs on similar Carlin-style sedimentary-hosted oxide gold deposits.

Jon Gilligan, Chief Operating Officer for Liberty Gold said: “The consistent nature of the metallurgical results to date at Black Pine is very encouraging and points to a simple ROM operation. We are progressing the next phases of test work to confirm gold recoveries at lower operating cut-off grades and to expand our sampling coverage into the new Rangefront D-4 discovery area. These will provide us with an extensive metallurgical database across the deposit, which could support a feasibility-level evaluation at Black Pine.”

Key Points:

- Forty-five column leach tests produced a weighted average* 80.8% gold extraction, with a range from 44.5% to 94.8% gold extraction. See Table 1, below, or click here: https://libertygold.ca/images/news/2021/October/Gold_Extraction_Data.pdf

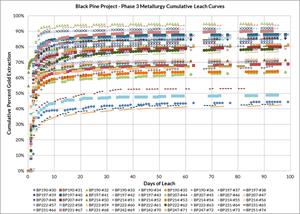

- Gold extraction was rapid, with >80% of the leachable gold extracted within the first 10 days of column leaching. See Figure 1, below or click here: https://libertygold.ca/images/news/2021/October/Cumulative_Leach_Curves.pdf

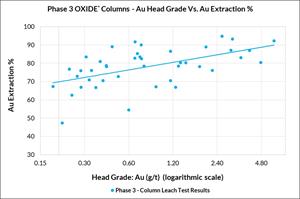

- Percent gold extraction is well-correlated with head grade, with the highest-grade composites returning the higher extraction numbers. Of the 45 column tests:

- 18 column tests were conducted on material below 0.5 grams per tonne (“g/t”) Au, and returned weighted average 71.8% gold extraction

- 10 column tests were conducted on material between 0.5 g/t Au and 1.0 g/t Au and returned weighted average 79.0% gold extraction

- 17 column tests were conducted on material above 1.0 g/t Au, and returned weighted average 82.3% gold extraction

- For further details see the grade recovery curve in Figure 2 or click here: https://libertygold.ca/images/news/2021/October/Grade_Recovery_Curve.pdf

- Phase 4 metallurgical test work has commenced on 15 PQ drill core composite samples of lower-grade Black Pine mineralization, in the range 0.10 g/t Au to 0.20 g/t Au. Further PQ core drilling has commenced in support of a Phase 5 metallurgical program, considered at this time to be sufficient to support a future feasibility study at Black Pine, targeting the recent Rangefront D-4 discovery, Discovery Zone, F Zone, CD Extension and E Zone.

*Weighted average gold extraction is obtained using the following equation: (composite head grade (grams/tonnes) multiplied by extraction (%) for all head grades)/sum of all head grades. Using arithmetic averages tends to over-represent low grade composites and under-represent high grade composites. The arithmetic extraction average of the 45 column tests is 76%.

Table 1: Results, Liberty Gold Phase 3 Variability Composite Testing

| Phase 3 Metallurgical Testing | Fine Bottle Roll | Coarse Bottle Roll | Column Tests | ||||||||||

| Feed Target P80 (75µm) | Feed Target P80 (1,700µm) | ||||||||||||

| Drill Hole ID | Deposit Area | Actual Feed P80 (µm) | Calc Hd Au (g/t) | Direct Leach Gold Extracted (%) | Actual Feed P80(µm) | Calc Hd Au (g/t) | Carbon in Leach Gold Extracted (%) | Actual Feed P80 (µm) | Calc Hd Au (g/t) | Gold Extracted (%) | Actual Feed P80(mm) | Calc Hd Au (g/t) | Gold Extracted (%) |

| BP190-#30 | D1 | 56 | 0.29 | 65.1 | 58 | 0.33 | 68.5 | 1,470 | 0.22 | 49.7 | 11.3 | 0.21 | 47.4 |

| BP190-#31 | D1 | 56 | 0.46 | 69.9 | 38 | 0.46 | 77.3 | 1,590 | 0.40 | 69.3 | 24.0 | 0.40 | 70.5 |

| BP190-#32 | D1 | 65 | 0.62 | 84.4 | 38 | 0.66 | 87.2 | 1,650 | 0.62 | 82.3 | 12.6 | 0.66 | 82.7 |

| BP190-#33 | D1 | 51 | 0.49 | 84.7 | 54 | 0.51 | 89.5 | 1,340 | 0.46 | 86.5 | 12.5 | 0.46 | 89.0 |

| BP190-#34 | D1 | 38 | 0.76 | 73.1 | 46 | 0.77 | 83.4 | 1,410 | 0.80 | 76.3 | 23.8 | 0.76 | 78.5 |

| BP190-#35 | D1 | 48 | 0.35 | 79.3 | 62 | 0.41 | 86.5 | 1,340 | 0.41 | 82.7 | 23.9 | 0.38 | 80.9 |

| BP190-#36 | D1 | 71 | 3.68 | 84.0 | 62 | 3.80 | 89.6 | 1,410 | 3.69 | 83.3 | 10.9 | 3.99 | 87.0 |

| BP197-#37 | D3 | 46 | 1.44 | 71.3 | 60 | 1.73 | 77.2 | 1,490 | 1.46 | 78.6 | 27.9 | 1.31 | 78.4 |

| BP197-#38 | D3 | 64 | 0.25 | 77.6 | 51 | 0.24 | 83.6 | 1,240 | 0.23 | 80.5 | 24.5 | 0.24 | 76.7 |

| BP197-#39 | D3 | 59 | 0.68 | 87.9 | 63 | 0.71 | 90.5 | 1,510 | 0.66 | 87.4 | 22.5 | 0.69 | 85.3 |

| BP197-#40 | D3 | 53 | 2.08 | 89.9 | 52 | 2.22 | 92.5 | 1,810 | 2.11 | 88.4 | 13.7 | 2.01 | 88.9 |

| BP197-#41 | D3 | 65 | 0.53 | 77.3 | 65 | 0.57 | 84.2 | 1,800 | 0.53 | 78.0 | 24.2 | 0.51 | 72.7 |

| BP197-#42 | D3 | 57 | 1.25 | 85.9 | 56 | 1.31 | 91.2 | 1,770 | 1.24 | 88.0 | 11.8 | 1.16 | 86.5 |

| BP197-#43 | D3 | 59 | 0.38 | 68.7 | 66 | 0.41 | 86.2 | 1,490 | 0.42 | 72.3 | 22.6 | 0.34 | 76.1 |

| BP207-#44 | D2 | 60 | 0.22 | 67.8 | 63 | 0.25 | 76.2 | 1,780 | 0.25 | 70.6 | 12.6 | 0.25 | 62.6 |

| BP207-#45 | D2 | 59 | 1.29 | 74.4 | 61 | 1.41 | 79.9 | 1,710 | 1.29 | 71.4 | 22.1 | 1.35 | 80.2 |

| BP207-#46 | D2 | 60 | 0.85 | 76.6 | 66 | 0.88 | 86.5 | 1,280 | 0.85 | 76.6 | 8.9 | 0.73 | 82.5 |

| BP207-#47 | D2 | 54 | 2.68 | 32.6 | 54 | 2.80 | 59.3 | 1,320 | 2.70 | 28.2 | 12.5 | 2.77 | 44.5 |

| BP207-#48 | D2 | 54 | 4.07 | 83.2 | 53 | 4.12 | 86.1 | 1,400 | 3.98 | 79.4 | 24.7 | 4.75 | 80.4 |

| BP207-#49 | D2 | 63 | 1.31 | 79.2 | 42 | 1.38 | 84.3 | 1,610 | 1.33 | 77.5 | 24.3 | 1.47 | 80.2 |

| BP214-#50 | D2 | 60 | 0.30 | 79.0 | 53 | 0.29 | 82.1 | 1,740 | 0.30 | 74.7 | 11.6 | 0.28 | 76.0 |

| BP214-#51 | D2 | 60 | 0.31 | 73.9 | 52 | 0.33 | 80.5 | 170 | 0.32 | 73.0 | 0.2 | 0.32 | 70.9 |

| BP214-#52 | D2 | 65 | 1.00 | 62.1 | 71 | 1.02 | 69.4 | 1,650 | 0.97 | 58.9 | 23.5 | 0.92 | 67.1 |

| BP214-#53 | D2 | 44 | 1.18 | 56.3 | 57 | 1.21 | 72.2 | 1,870 | 1.27 | 57.5 | 12.0 | 1.25 | 66.8 |

| BP214-#54 | D2 | 52 | 4.95 | 88.2 | 67 | 5.77 | 91.0 | 1,340 | 5.51 | 90.8 | 11.1 | 5.86 | 92.2 |

| BP214-#55 | D2 | 53 | 3.93 | 92.5 | 84 | 4.00 | 94.0 | 1,190 | 3.92 | 92.2 | 11.3 | 3.05 | 93.2 |

| BP214-#56 | D2 | 34 | 2.28 | 73.8 | 51 | 2.34 | 77.8 | 1,270 | 2.42 | 73.7 | 12.5 | 2.22 | 76.1 |

| BP222-#57 | D3 | 39 | 0.47 | 83.0 | 55 | 0.50 | 85.5 | 1,560 | 0.50 | 80.4 | 12.1 | 0.42 | 78.1 |

| BP222-#58 | D3 | 53 | 0.25 | 37.4 | 54 | 0.30 | 68.7 | 1,690 | 0.28 | 49.7 | 25.3 | 0.28 | 51.3 |

| BP222-#59 | D3 | 57 | 0.26 | 62.7 | 49 | 0.28 | 80.1 | 2,200 | 0.25 | 62.8 | 25.1 | 0.27 | 72.8 |

| BP222-#60 | D3 | 54 | 0.63 | 82.4 | 53 | 0.74 | 84.9 | 1,650 | 0.62 | 85.1 | 11.2 | 0.66 | 91.7 |

| BP222-#61 | D3 | 56 | 3.83 | 88.3 | 55 | 4.01 | 88.9 | 1,550 | 3.86 | 84.6 | 12.0 | 3.48 | 83.1 |

| BP222-#62 | D3 | 53 | 1.96 | 83.3 | 52 | 2.08 | 90.1 | 1,760 | 1.92 | 78.8 | 23.4 | 1.82 | 78.2 |

| BP222-#63 | D3 | 54 | 0.41 | 79.8 | 53 | 0.48 | 82.7 | 1,480 | 0.45 | 78.5 | 22.9 | 0.42 | 78.7 |

| BP231-#64 | D3 | 53 | 0.26 | 47.1 | 49 | 0.28 | 70.9 | 1,610 | 0.27 | 49.1 | 23.2 | 0.29 | 49.1 |

| BP231-#65 | D3 | 53 | 0.30 | 56.8 | 55 | 0.34 | 87.3 | 1,820 | 0.31 | 72.4 | 28.1 | 0.31 | 83.4 |

| BP231-#66 | D3 | 71 | 0.73 | 83.6 | 72 | 0.75 | 88.4 | 1,490 | 0.71 | 82.2 | 21.4 | 0.71 | 83.5 |

| BP231-#67 | D3 | 55 | 0.72 | 88.5 | 54 | 0.81 | 92.4 | 1,420 | 0.71 | 87.8 | 23.7 | 0.73 | 90.0 |

| BP231-#68 | D3 | 60 | 2.64 | 93.9 | 62 | 2.69 | 95.7 | 1,430 | 2.55 | 94.3 | 10.6 | 2.59 | 94.8 |

| BP242-#69 | F Zone | 59 | 1.18 | 82.2 | 58 | 1.20 | 83.8 | 1,370 | 0.98 | 68.2 | 12.2 | 1.16 | 70.5 |

| BP242-#70 | F Zone | 56 | 3.18 | 92.0 | 58 | 3.25 | 92.7 | 1,560 | 2.88 | 87.4 | 14.7 | 2.97 | 87.1 |

| BP242-#71 | E Pit | 57 | 0.28 | 74.1 | 58 | 0.30 | 75.6 | 1,590 | 0.25 | 61.7 | 13.7 | 0.28 | 66.8 |

| BP242-#72 | E Pit | 55 | 0.41 | 72.9 | 50 | 0.42 | 84.2 | 1,640 | 0.33 | 66.4 | 14.0 | 0.18 | 67.3 |

| BP242-#73 | C/D Pit | 63 | 0.59 | 70.8 | 65 | 0.61 | 78.0 | 1,630 | 0.51 | 51.7 | 13.9 | 0.60 | 54.5 |

| BP242-#74 | C/D Pit | 55 | 0.37 | 79.1 | 59 | 0.38 | 82.5 | 1,600 | 0.25 | 58.3 | 12.3 | 0.36 | 66.7 |

Figure 1: Cumulative Leach Curves Confirm Rapid Leach Kinetics

https://www.globenewswire.com/NewsRoom/AttachmentNg/0c85b714-93da-4567-9799-f1a493643584

Figure 2: Phase 3 Column Test, Grade Recovery vs. Au Extraction % *

https://www.globenewswire.com/NewsRoom/AttachmentNg/66552eb3-f6a1-4a23-88d6-88174dd28f57

*Transition Columns: BP207-#47, BP222-#58 & BP231-#64 are excluded in the above graph.

Metallurgical Program

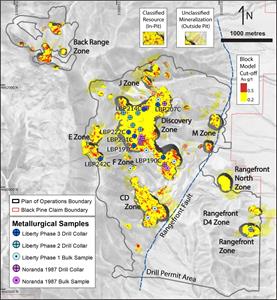

Samples for this study were obtained through drilling of seven PQ core holes. Composites were selected through consideration of rock type, alteration and gold grade to achieve a wide range of ore types. Program details included:

- Forty-five coarse bottle roll tests (target of 80% passing 10 mesh or 1.7 millimeter (“mm”) particle size) produced a weighted average 78.7% gold extraction.

- Forty-five fine bottle roll tests (target of 80% passing 200 mesh or 75 micron particle size) produced a weighted average 80.1% gold extraction for direct leach, and 45 fine bottle roll tests produced a weighted average 85.7% for carbon in leach (“CIL”).

- Samples for bottle roll testing were milled/crushed respectively targeting 80% passing 200 mesh (75 microns) and 80% passing 10 mesh (1.7 mm) particle size. The direct leach samples were rolled/agitated in bottles in a 1.0 grams per liter (“g/l”) dilute sodium cyanide (“NaCN”) solution for 72 hours (for 200 mesh) or 144 hours (for 10 mesh). The 200 mesh (75 microns) CIL samples were rolled/agitated in bottles for 72 hours in a 1.0 g/l dilute NaCN solution, containing 20 g/l of activated carbon.

- Forty-five column tests targeted 80% passing 0.5 inch (12.7 mm) and 1 inch (25.4 mm) crushed material and produced a weighted average 80.8% gold extraction.

- The variability composites were leached continuously between 82 to 99 days, including two on/off cycles for last three weeks at the end. Crushed material was leached in 10.2 mm and 15.2 mm columns irrigated by low strength (0.50 g/l) NaCN solution.

- Gold extraction is relatively insensitive to particle size. Most composites can be projected to coarse particle sizes approximating run of mine conditions without significant loss of gold extraction.

- Results generated by this program are consistent with historical column test results generated by Noranda in 1988 prior to mining, as well as metallurgical testing by Liberty Gold using large diameter columns and 300 kilogram bulk samples, and Phase 2 variability composite testing using drill core.

For a map showing locations of drill holes used for metallurgical testing, see Figure 3, below, or click here: https://libertygold.ca/images/news/2021/October/BlackPineMet3PRmap.pdf.

Composites were assembled in Elko, Nevada by Liberty Gold staff, utilizing one-half or three-quarter sawed core, then shipped to Kappes, Cassiday and Associates in Reno, Nevada for metallurgical testing, comprising bottle rolls, column testing and geo-metallurgical characterization, including gold and silver assays, cyanide solubility, sulphur and carbon speciation, preg-robbing analysis, ICP geochemical assays, whole rock analysis, QXRD, modified SMC comminution testing and Bond Abrasion (Ai) testing.

Figure 3: Locations of Drill Holes Used for Phase 3 Metallurgical Study

https://www.globenewswire.com/NewsRoom/AttachmentNg/71a118f9-186e-4892-ba50-66e0e85f9fd5

QUALIFIED PERSON

Moira Smith, Ph.D., P.Geo., Vice-President Exploration and Geoscience, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios. Our flagship projects are Black Pine in Idaho and Goldstrike in Utah, both past- producing open-pit mines, where previous operators only scratched the surface.

For more information, visit www.libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

[email protected]

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.20 g/t. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between 30% and 100% of the reported lengths due to varying drill hole orientations but are typically in the range of 60% to 80% of true width. Drill samples were assayed by ALS Limited in Reno, Nevada for gold by Fire Assay of a 30 gram (1 assay ton) charge with an AA finish, or if over 5.0 g/t were re-assayed and completed with a gravimetric finish. For these samples, the gravimetric data were utilized in calculating gold intersections. For any samples assaying over 0.200 ppm an additional cyanide leach analysis is done where the sample is treated with a 0.25% NaCN solution and rolled for an hour. An aliquot of the final leach solution is then centrifuged and analyzed by Atomic Absorption Spectroscopy. QA/QC for all drill samples consists of the insertion and continual monitoring of numerous standards and blanks into the sample stream, and the collection of duplicate samples at random intervals within each batch. Selected holes are also analyzed for a 51 multi-element geochemical suite by ICP-MS. ALS Geochemistry-Reno is ISO 17025:2005 Accredited, with the Elko prep lab listed on the scope of accreditation.

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to Liberty Gold within the meaning of applicable securities laws, including statements that address potential quantity and/or grade of minerals. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the impact from the pandemic of the novel coronavirus (COVID-19), availability of equipment, timing of assay results, scalability of metallurgical results, results and accuracy of mineral resources, the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; timing of any preliminary economic assessments or feasibility assessments; scalability of metallurgical results, delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry, including impacts from the pandemic of the novel coronavirus (COVID-19); delays in obtaining governmental approvals, financing or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 26, 2021 in the section entitled "Risk Factors", under Liberty Gold’s SEDAR profile at www.sedar.com.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases, financial disclosures and multimedia content to media, investors, and consumers worldwide.

- AGILON HEALTH SHAREHOLDER ALERT: CLAIMSFILER Reminds Investors with Losses in Excess of $100,000 of Lead Plaintiff Deadline in Class Action Lawsuits Against agilon health, inc. - AGL

- IROBOT SHAREHOLDER ALERT: CLAIMSFILER Reminds Investors with Losses in Excess of $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against iRobot Corporation - IRBT

- PERION NETWORK SHAREHOLDER ALERT: CLAIMSFILER Reminds Investors with Losses in Excess of $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against Perion Network Ltd. - PERI

- THE CHEMOURS COMPANY SHAREHOLDER ALERT: CLAIMSFILER Reminds Investors with Losses in Excess of $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against The Chemours Company - CC

- SSR MINING SHAREHOLDER ALERT: CLAIMSFILER REMINDS INVESTORS WITH LOSSES IN EXCESS OF $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against SSR Mining Inc. - SSRM

- SHOALS TECHNOLOGIES SHAREHOLDER ALERT: CLAIMSFILER REMINDS INVESTORS WITH LOSSES IN EXCESS OF $100,000 of Lead Plaintiff Deadline in Class Action Lawsuit Against Shoals Technologies Group, Inc. - SHLS