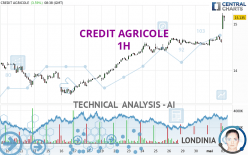

CREDIT AGRICOLE - 1H - Technical analysis published on 05/03/2024 (GMT)

- 75

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

CREDIT AGRICOLE rating 15.105 EUR. The price registered an increase of +3.39% on the session with the lowest point at 14.885 EUR and the highest point at 15.230 EUR. The deviation from the price is +1.48% for the low point and -0.82% for the high point.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in 1H of this CREDIT AGRICOLE chart shows a strongly bullish trend. The signals given by the moving averages are 92.86% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

An assessment of technical indicators shows a strong bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : 1 hour

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : 1 hour

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bearish signal that could support the hypothesis of a small drop in the very short term:

Bearish harami

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 14.240 | 14.555 | 14.700 | 15.105 |

| Change (%) | -5.73% | -3.64% | -2.68% | - |

| Change | -0.865 | -0.550 | -0.405 | - |

| Level | Intermediate | Minor | Intermediate | - |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 14.285 | 14.410 | 14.510 | 14.635 | 14.735 | 14.860 | 14.960 |

| Camarilla | 14.548 | 14.569 | 14.589 | 14.610 | 14.631 | 14.651 | 14.672 |

| Woodie | 14.273 | 14.404 | 14.498 | 14.629 | 14.723 | 14.854 | 14.948 |

| Fibonacci | 14.410 | 14.496 | 14.549 | 14.635 | 14.721 | 14.774 | 14.860 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 13.520 | 13.785 | 14.170 | 14.435 | 14.820 | 15.085 | 15.470 |

| Camarilla | 14.376 | 14.436 | 14.495 | 14.555 | 14.615 | 14.674 | 14.734 |

| Woodie | 13.580 | 13.815 | 14.230 | 14.465 | 14.880 | 15.115 | 15.530 |

| Fibonacci | 13.785 | 14.033 | 14.187 | 14.435 | 14.683 | 14.837 | 15.085 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 12.550 | 13.010 | 13.780 | 14.240 | 15.010 | 15.470 | 16.240 |

| Camarilla | 14.212 | 14.325 | 14.437 | 14.550 | 14.663 | 14.776 | 14.888 |

| Woodie | 12.705 | 13.088 | 13.935 | 14.318 | 15.165 | 15.548 | 16.395 |

| Fibonacci | 13.010 | 13.480 | 13.770 | 14.240 | 14.710 | 15.000 | 15.470 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 72.94 | |

| MACD (12,26,9): | 0.0950 | |

| Directional Movement: | 39.989 | |

| AROON (14): | 64.286 | |

| DEMA (21): | 14.824 | |

| Parabolic SAR (0,02-0,02-0,2): | 14.590 | |

| Elder Ray (13): | 0.347 | |

| Super Trend (3,10): | 14.784 | |

| Zig ZAG (10): | 15.095 | |

| VORTEX (21): | 1.1310 | |

| Stochastique (14,3,5): | 67.47 | |

| TEMA (21): | 14.872 | |

| Williams %R (14): | -21.58 | |

| Chande Momentum Oscillator (20): | 0.500 | |

| Repulse (5,40,3): | 0.8090 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0420 | |

| Courbe Coppock: | 3.49 |

| MA7: | 14.612 | |

| MA20: | 14.188 | |

| MA50: | 13.502 | |

| MA100: | 13.209 | |

| MAexp7: | 14.860 | |

| MAexp20: | 14.719 | |

| MAexp50: | 14.585 | |

| MAexp100: | 14.403 | |

| Price / MA7: | +3.37% | |

| Price / MA20: | +6.46% | |

| Price / MA50: | +11.87% | |

| Price / MA100: | +14.35% | |

| Price / MAexp7: | +1.65% | |

| Price / MAexp20: | +2.62% | |

| Price / MAexp50: | +3.57% | |

| Price / MAexp100: | +4.87% |

News

Don't forget to follow the news on CREDIT AGRICOLE. At the time of publication of this analysis, the latest news was as follows:

- CREDIT AGRICOLE SA: Q1-2024 Results : THE GROUP CONTINUES TO GROW

- Release of the 2023 Credit Agricole Assurances group’s SFCR

- CREDIT AGRICOLE SA: Availability of Crédit Agricole S.A.’s 2023 Universal Registration Document and Annual Financial Report

- Crédit Agricole S.A. announces the reduction of its share capital through the cancellation of treasury shares purchased under a share repurchase program

- CREDIT AGRICOLE SA: Fourth quarter and full-year 2023 - VERY GOOD RESULTS IN 2023

Add a comment

Comments

0 comments on the analysis CREDIT AGRICOLE - 1H