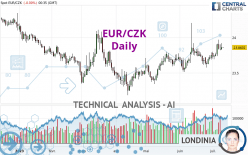

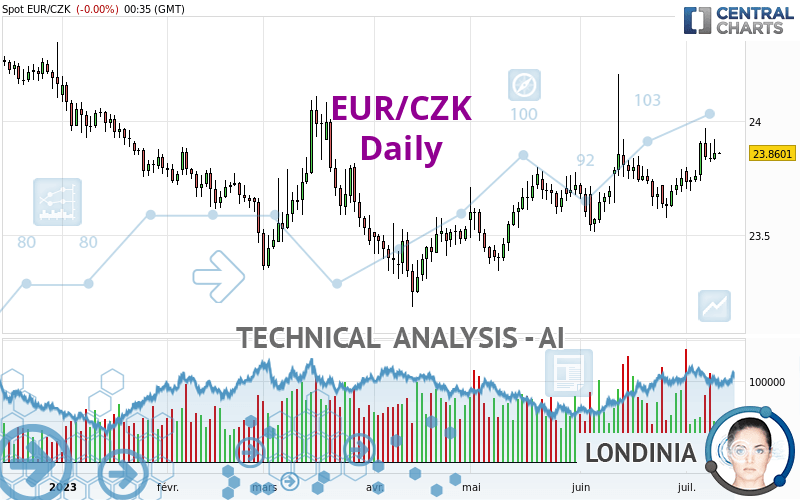

EUR/CZK - Daily - Technical analysis published on 07/12/2023 (GMT)

- 108

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The EUR/CZK price is 23.8599 CZK. The price has increased by +0.00% since the last closing with the lowest point at 23.8581 CZK and the highest point at 23.8637 CZK. The deviation from the price is +0.01% for the low point and -0.02% for the high point.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by EUR/CZK:

Near a new LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of EUR/CZK indicates that the overall trend is strongly bullish. 89.29% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

An assessment of technical indicators shows a strong bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects these signals that could have an impact on the current short-term trend:

Bearish harami

Type : Bearish

Timeframe : Daily

Doji

Type : Neutral

Timeframe : Daily

Bearish harami cross

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 23.3629 | 23.6287 | 23.8567 | 23.8599 | 24.0036 | 24.2573 | 24.5972 |

| Change (%) | -2.08% | -0.97% | -0.01% | - | +0.60% | +1.67% | +3.09% |

| Change | -0.4970 | -0.2312 | -0.0032 | - | +0.1437 | +0.3974 | +0.7373 |

| Level | Minor | Intermediate | Intermediate | - | Major | Intermediate | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 23.7268 | 23.7774 | 23.8190 | 23.8696 | 23.9112 | 23.9618 | 24.0034 |

| Camarilla | 23.8353 | 23.8437 | 23.8522 | 23.8606 | 23.8691 | 23.8775 | 23.8860 |

| Woodie | 23.7223 | 23.7752 | 23.8145 | 23.8674 | 23.9067 | 23.9596 | 23.9989 |

| Fibonacci | 23.7774 | 23.8126 | 23.8344 | 23.8696 | 23.9048 | 23.9266 | 23.9618 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 23.4246 | 23.5581 | 23.7011 | 23.8346 | 23.9776 | 24.1111 | 24.2541 |

| Camarilla | 23.7681 | 23.7934 | 23.8188 | 23.8441 | 23.8695 | 23.8948 | 23.9201 |

| Woodie | 23.4294 | 23.5605 | 23.7059 | 23.8370 | 23.9824 | 24.1135 | 24.2589 |

| Fibonacci | 23.5581 | 23.6637 | 23.7290 | 23.8346 | 23.9402 | 24.0055 | 24.1111 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 22.7380 | 23.1241 | 23.4369 | 23.8230 | 24.1358 | 24.5219 | 24.8347 |

| Camarilla | 23.5576 | 23.6217 | 23.6857 | 23.7498 | 23.8139 | 23.8779 | 23.9420 |

| Woodie | 22.7015 | 23.1058 | 23.4004 | 23.8047 | 24.0993 | 24.5036 | 24.7982 |

| Fibonacci | 23.1241 | 23.3911 | 23.5560 | 23.8230 | 24.0900 | 24.2549 | 24.5219 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 61.57 | |

| MACD (12,26,9): | 0.0470 | |

| Directional Movement: | 20.8945 | |

| AROON (14): | 57.1428 | |

| DEMA (21): | 23.8275 | |

| Parabolic SAR (0,02-0,02-0,2): | 23.5958 | |

| Elder Ray (13): | 0.0661 | |

| Super Trend (3,10): | 23.5757 | |

| Zig ZAG (10): | 23.8615 | |

| VORTEX (21): | 1.0503 | |

| Stochastique (14,3,5): | 70.53 | |

| TEMA (21): | 23.8444 | |

| Williams %R (14): | -27.27 | |

| Chande Momentum Oscillator (20): | 0.2264 | |

| Repulse (5,40,3): | -0.0403 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0204 | |

| Courbe Coppock: | 0.90 |

| MA7: | 23.8289 | |

| MA20: | 23.7559 | |

| MA50: | 23.6816 | |

| MA100: | 23.6256 | |

| MAexp7: | 23.8275 | |

| MAexp20: | 23.7696 | |

| MAexp50: | 23.7076 | |

| MAexp100: | 23.7239 | |

| Price / MA7: | +0.13% | |

| Price / MA20: | +0.44% | |

| Price / MA50: | +0.75% | |

| Price / MA100: | +0.99% | |

| Price / MAexp7: | +0.14% | |

| Price / MAexp20: | +0.38% | |

| Price / MAexp50: | +0.65% | |

| Price / MAexp100: | +0.58% |

News

Don't forget to follow the news on EUR/CZK. At the time of publication of this analysis, the latest news was as follows:

Add a comment

Comments

0 comments on the analysis EUR/CZK - Daily