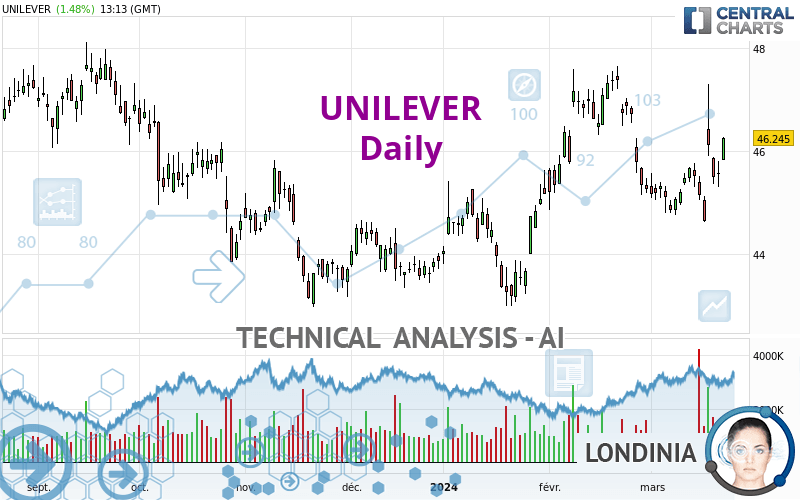

UNILEVER - Daily - Technical analysis published on 03/22/2024 (GMT)

- 89

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The UNILEVER price is 46.245 EUR. The price has increased by +1.48% since the last closing with the lowest point at 45.820 EUR and the highest point at 46.270 EUR. The deviation from the price is +0.93% for the low point and -0.05% for the high point.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of UNILEVER in Daily shows a strongly overall bullish trend. The signals given by moving averages are 89.29% bullish. This strongly bullish trend seems to be running out of steam given the signals being given by short-term moving averages. The Central Indicators scanner detects a bullish signal on moving averages that could impact this trend:

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

The probability of a further increase are moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

MACD crosses UP its Moving Average

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

MACD indicator is back over 0

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Upside gap

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 44.096 | 45.077 | 45.592 | 46.245 | 46.571 | 47.709 | 48.662 |

| Change (%) | -4.65% | -2.53% | -1.41% | - | +0.70% | +3.17% | +5.23% |

| Change | -2.149 | -1.168 | -0.653 | - | +0.326 | +1.464 | +2.417 |

| Level | Minor | Major | Major | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 44.808 | 45.057 | 45.313 | 45.562 | 45.818 | 46.067 | 46.323 |

| Camarilla | 45.431 | 45.477 | 45.524 | 45.570 | 45.616 | 45.663 | 45.709 |

| Woodie | 44.813 | 45.059 | 45.318 | 45.564 | 45.823 | 46.069 | 46.328 |

| Fibonacci | 45.057 | 45.250 | 45.369 | 45.562 | 45.755 | 45.874 | 46.067 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 43.998 | 44.477 | 44.808 | 45.287 | 45.618 | 46.097 | 46.428 |

| Camarilla | 44.917 | 44.992 | 45.066 | 45.140 | 45.214 | 45.289 | 45.363 |

| Woodie | 43.925 | 44.440 | 44.735 | 45.250 | 45.545 | 46.060 | 46.355 |

| Fibonacci | 44.477 | 44.786 | 44.977 | 45.287 | 45.596 | 45.787 | 46.097 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 41.319 | 42.889 | 44.074 | 45.644 | 46.829 | 48.399 | 49.584 |

| Camarilla | 44.502 | 44.755 | 45.008 | 45.260 | 45.513 | 45.765 | 46.018 |

| Woodie | 41.128 | 42.793 | 43.883 | 45.548 | 46.638 | 48.303 | 49.393 |

| Fibonacci | 42.889 | 43.941 | 44.591 | 45.644 | 46.696 | 47.346 | 48.399 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 57.37 | |

| MACD (12,26,9): | 0.0480 | |

| Directional Movement: | 14.175 | |

| AROON (14): | 7.142 | |

| DEMA (21): | 45.626 | |

| Parabolic SAR (0,02-0,02-0,2): | 44.726 | |

| Elder Ray (13): | 0.474 | |

| Super Trend (3,10): | 44.056 | |

| Zig ZAG (10): | 46.245 | |

| VORTEX (21): | 0.7900 | |

| Stochastique (14,3,5): | 42.85 | |

| TEMA (21): | 45.494 | |

| Williams %R (14): | -39.18 | |

| Chande Momentum Oscillator (20): | 1.155 | |

| Repulse (5,40,3): | -0.0450 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0050 | |

| Courbe Coppock: | 0.52 |

| MA7: | 45.528 | |

| MA20: | 45.441 | |

| MA50: | 45.260 | |

| MA100: | 44.495 | |

| MAexp7: | 45.655 | |

| MAexp20: | 45.555 | |

| MAexp50: | 45.295 | |

| MAexp100: | 45.078 | |

| Price / MA7: | +1.57% | |

| Price / MA20: | +1.77% | |

| Price / MA50: | +2.18% | |

| Price / MA100: | +3.93% | |

| Price / MAexp7: | +1.29% | |

| Price / MAexp20: | +1.51% | |

| Price / MAexp50: | +2.10% | |

| Price / MAexp100: | +2.59% |

Add a comment

Comments

0 comments on the analysis UNILEVER - Daily