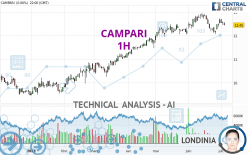

CAMPARI - 1H - Technical analysis published on 07/06/2023 (GMT)

- 147

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The CAMPARI price is 12.410 EUR. The price registered a decrease of -0.32% on the session and was traded between 12.320 EUR and 12.570 EUR over the period. The price is currently at +0.73% from its lowest and -1.27% from its highest.The Central Gaps scanner detects a bearish gap which is a sign that the sellers have taken the lead in the very short term.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of CAMPARI in 1H shows an overall bearish trend. 67.86% of the signals given by moving averages are bearish. This bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Bearish price crossover with Moving Average 100

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 1 hour

In fact, of the 18 technical indicators analysed by Central Analyzer, 4 are bullish, 5 are neutral and 9 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 1 hour

Pivot points : price is under support 1

Type : Neutral

Timeframe : 1 hour

Aroon indicator bullish trend

Type : Bullish

Timeframe : 1 hour

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : 1 hour

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : 1 hour

The analysis of the price chart with Central Patterns scanners does not return any result.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 12.070 | 12.215 | 12.360 | 12.410 | 12.445 | 12.614 | 12.724 |

| Change (%) | -2.74% | -1.57% | -0.40% | - | +0.28% | +1.64% | +2.53% |

| Change | -0.340 | -0.195 | -0.050 | - | +0.035 | +0.204 | +0.314 |

| Level | Major | Major | Minor | - | Minor | Minor | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 12.252 | 12.343 | 12.397 | 12.488 | 12.542 | 12.633 | 12.687 |

| Camarilla | 12.410 | 12.423 | 12.437 | 12.450 | 12.463 | 12.477 | 12.490 |

| Woodie | 12.233 | 12.334 | 12.378 | 12.479 | 12.523 | 12.624 | 12.668 |

| Fibonacci | 12.343 | 12.399 | 12.433 | 12.488 | 12.544 | 12.578 | 12.633 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 11.610 | 11.840 | 12.265 | 12.495 | 12.920 | 13.150 | 13.575 |

| Camarilla | 12.510 | 12.570 | 12.630 | 12.690 | 12.750 | 12.810 | 12.870 |

| Woodie | 11.708 | 11.889 | 12.363 | 12.544 | 13.018 | 13.199 | 13.673 |

| Fibonacci | 11.840 | 12.090 | 12.245 | 12.495 | 12.745 | 12.900 | 13.150 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 11.297 | 11.683 | 12.187 | 12.573 | 13.077 | 13.463 | 13.967 |

| Camarilla | 12.445 | 12.527 | 12.608 | 12.690 | 12.772 | 12.853 | 12.935 |

| Woodie | 11.355 | 11.713 | 12.245 | 12.603 | 13.135 | 13.493 | 14.025 |

| Fibonacci | 11.683 | 12.023 | 12.233 | 12.573 | 12.913 | 13.123 | 13.463 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 35.59 | |

| MACD (12,26,9): | -0.0280 | |

| Directional Movement: | -9.747 | |

| AROON (14): | 28.571 | |

| DEMA (21): | 12.447 | |

| Parabolic SAR (0,02-0,02-0,2): | 12.347 | |

| Elder Ray (13): | -0.054 | |

| Super Trend (3,10): | 12.543 | |

| Zig ZAG (10): | 12.365 | |

| VORTEX (21): | 0.8700 | |

| Stochastique (14,3,5): | 47.10 | |

| TEMA (21): | 12.417 | |

| Williams %R (14): | -84.00 | |

| Chande Momentum Oscillator (20): | -0.130 | |

| Repulse (5,40,3): | -1.2440 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0280 | |

| Courbe Coppock: | 1.13 |

| MA7: | 12.513 | |

| MA20: | 12.549 | |

| MA50: | 12.380 | |

| MA100: | 11.693 | |

| MAexp7: | 12.445 | |

| MAexp20: | 12.479 | |

| MAexp50: | 12.493 | |

| MAexp100: | 12.488 | |

| Price / MA7: | -0.82% | |

| Price / MA20: | -1.11% | |

| Price / MA50: | +0.24% | |

| Price / MA100: | +6.13% | |

| Price / MAexp7: | -0.28% | |

| Price / MAexp20: | -0.55% | |

| Price / MAexp50: | -0.66% | |

| Price / MAexp100: | -0.62% |

News

Don't forget to follow the news on CAMPARI. At the time of publication of this analysis, the latest news was as follows:

- Campari hosts a night of unforgettable moments at 76th Festival de Cannes

- Campari® Poised to Bring Great Stories to Life Through 75th Festival de Cannes

- Acclaimed Master Distiller Jesus Susunaga Acosta Named New Maestro Tequilero at Casa San Nicolás

- Moët Hennessy and Campari Group to partner in a 50/50 joint venture to create a premium pan-European Wines & Spirits e-commerce player through Tannico

- Moët Hennessy and Campari Group to partner in a 50/50 joint venture to create a premium pan-European Wines & Spirits e-commerce player through Tannico

Add a comment

Comments

0 comments on the analysis CAMPARI - 1H