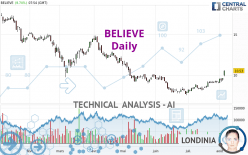

BELIEVE - Daily - Technical analysis published on 08/04/2022 (GMT)

- 199

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The BELIEVE rating is 10.530 EUR. The price has increased by +9.75% since the last closing with the lowest point at 9.830 EUR and the highest point at 10.570 EUR. The deviation from the price is +7.12% for the low point and -0.38% for the high point.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BELIEVE:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Daily of this BELIEVE chart shows a bullish trend. 64.29% of the signals given by moving averages are bullish. The overall trend is reinforced by the strong bullish signals from short-term moving averages. An assessment of moving averages reveals a bullish signal that could impact this trend:

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : Daily

In fact, 17 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The presence of a bullish Japanese candlestick pattern detected by Central Candlesticks that could cause a very short term rebound was also detected:

Upside gap

Type : Bullish

Timeframe : Daily

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 7.680 | 9.116 | 10.530 | 10.568 | 14.641 | 17.370 |

| Change (%) | -27.07% | -13.43% | - | +0.36% | +39.04% | +64.96% |

| Change | -2.850 | -1.414 | - | +0.038 | +4.111 | +6.840 |

| Level | Minor | Major | - | Minor | Intermediate | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 9.033 | 9.152 | 9.373 | 9.492 | 9.713 | 9.832 | 10.053 |

| Camarilla | 9.502 | 9.533 | 9.564 | 9.595 | 9.626 | 9.657 | 9.689 |

| Woodie | 9.085 | 9.178 | 9.425 | 9.518 | 9.765 | 9.858 | 10.105 |

| Fibonacci | 9.152 | 9.282 | 9.362 | 9.492 | 9.622 | 9.702 | 9.832 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 8.613 | 8.797 | 8.908 | 9.092 | 9.203 | 9.387 | 9.498 |

| Camarilla | 8.939 | 8.966 | 8.993 | 9.020 | 9.047 | 9.074 | 9.101 |

| Woodie | 8.578 | 8.779 | 8.873 | 9.074 | 9.168 | 9.369 | 9.463 |

| Fibonacci | 8.797 | 8.909 | 8.979 | 9.092 | 9.204 | 9.274 | 9.387 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 6.647 | 7.223 | 8.122 | 8.698 | 9.597 | 10.173 | 11.072 |

| Camarilla | 8.614 | 8.750 | 8.885 | 9.020 | 9.155 | 9.290 | 9.426 |

| Woodie | 6.808 | 7.304 | 8.283 | 8.779 | 9.758 | 10.254 | 11.233 |

| Fibonacci | 7.223 | 7.787 | 8.135 | 8.698 | 9.262 | 9.610 | 10.173 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 71.91 | |

| MACD (12,26,9): | 0.3100 | |

| Directional Movement: | 31.077 | |

| AROON (14): | 100.000 | |

| DEMA (21): | 9.422 | |

| Parabolic SAR (0,02-0,02-0,2): | 9.120 | |

| Elder Ray (13): | 0.863 | |

| Super Trend (3,10): | 9.003 | |

| Zig ZAG (10): | 10.440 | |

| VORTEX (21): | 1.1520 | |

| Stochastique (14,3,5): | 93.84 | |

| TEMA (21): | 9.841 | |

| Williams %R (14): | -1.91 | |

| Chande Momentum Oscillator (20): | 1.845 | |

| Repulse (5,40,3): | 9.8770 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.2940 | |

| Courbe Coppock: | 25.56 |

| MA7: | 9.469 | |

| MA20: | 8.947 | |

| MA50: | 8.755 | |

| MA100: | 10.259 | |

| MAexp7: | 9.581 | |

| MAexp20: | 9.099 | |

| MAexp50: | 9.173 | |

| MAexp100: | 10.247 | |

| Price / MA7: | +11.20% | |

| Price / MA20: | +17.69% | |

| Price / MA50: | +20.27% | |

| Price / MA100: | +2.64% | |

| Price / MAexp7: | +9.91% | |

| Price / MAexp20: | +15.73% | |

| Price / MAexp50: | +14.79% | |

| Price / MAexp100: | +2.76% |

News

The latest news and videos published on BELIEVE at the time of the analysis were as follows:

- JULY HARVARD-CAPS HARRIS POLL: BIDEN APPROVAL REMAINS AT HISTORIC LOWS AS VOTERS OVERWHELMINGLY BELIEVE WE ARE IN OR HEADED FOR A RECESSION

-

Jesse Watters: You are not going to believe who is the new judge in Paul Pelosi's DUI case

Jesse Watters: You are not going to believe who is the new judge in Paul Pelosi's DUI case

- Information mensuelle relative au nombre total de droits de vote et d’actions composant le capital social / Monthly information relating to the total number of voting rights and shares making up the share capital

-

Benson: I don’t believe Biden will be the nominee of the Democratic Party

Benson: I don’t believe Biden will be the nominee of the Democratic Party

- American Migraine Foundation Survey Shows Nearly All People with Migraine and Healthcare Professionals Believe Migraine and Mental Health Significantly Impact Each Other

Add a comment

Comments

0 comments on the analysis BELIEVE - Daily