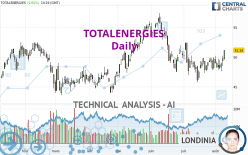

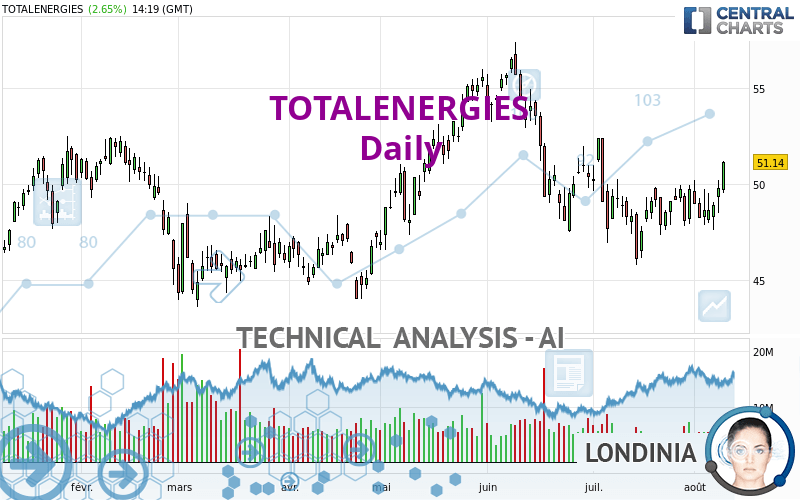

TOTALENERGIES - Daily - Technical analysis published on 08/09/2022 (GMT)

- 180

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The TOTALENERGIES rating is 51.140 EUR. The price has increased by +2.65% since the last closing and was between 49.565 EUR and 51.230 EUR. This implies that the price is at +3.18% from its lowest and at -0.18% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of TOTALENERGIES indicates that the overall trend is bullish. 75.00% of the signals given by moving averages are bullish. The overall trend is reinforced by the strong bullish signals from short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Technical indicators are strongly bullish, suggesting that the price increase should continue.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

MACD indicator is back over 0

Type : Bullish

Timeframe : Daily

Ichimoku - Bullish crossover : Tenkan & Kijun

Type : Bullish

Timeframe : Daily

Central Patterns, the scanner specializing in chart patterns, did not identify any signals.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 46.090 | 48.051 | 50.966 | 51.140 | 52.430 | 55.778 |

| Change (%) | -9.87% | -6.04% | -0.34% | - | +2.52% | +9.07% |

| Change | -5.050 | -3.089 | -0.174 | - | +1.290 | +4.638 |

| Level | Major | Intermediate | Intermediate | - | Minor | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 47.133 | 47.827 | 48.823 | 49.517 | 50.513 | 51.207 | 52.203 |

| Camarilla | 49.355 | 49.510 | 49.665 | 49.820 | 49.975 | 50.130 | 50.285 |

| Woodie | 47.285 | 47.903 | 48.975 | 49.593 | 50.665 | 51.283 | 52.355 |

| Fibonacci | 47.827 | 48.472 | 48.871 | 49.517 | 50.162 | 50.561 | 51.207 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 44.990 | 46.310 | 47.600 | 48.920 | 50.210 | 51.530 | 52.820 |

| Camarilla | 48.172 | 48.412 | 48.651 | 48.890 | 49.129 | 49.369 | 49.608 |

| Woodie | 44.975 | 46.303 | 47.585 | 48.913 | 50.195 | 51.523 | 52.805 |

| Fibonacci | 46.310 | 47.307 | 47.923 | 48.920 | 49.917 | 50.533 | 51.530 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 39.617 | 42.713 | 46.237 | 49.333 | 52.857 | 55.953 | 59.477 |

| Camarilla | 47.940 | 48.546 | 49.153 | 49.760 | 50.367 | 50.974 | 51.581 |

| Woodie | 39.830 | 42.820 | 46.450 | 49.440 | 53.070 | 56.060 | 59.690 |

| Fibonacci | 42.713 | 45.242 | 46.805 | 49.333 | 51.862 | 53.425 | 55.953 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 58.64 | |

| MACD (12,26,9): | 0.0100 | |

| Directional Movement: | 3.413 | |

| AROON (14): | 92.857 | |

| DEMA (21): | 49.083 | |

| Parabolic SAR (0,02-0,02-0,2): | 46.316 | |

| Elder Ray (13): | 1.123 | |

| Super Trend (3,10): | 52.474 | |

| Zig ZAG (10): | 51.180 | |

| VORTEX (21): | 1.0140 | |

| Stochastique (14,3,5): | 79.29 | |

| TEMA (21): | 49.453 | |

| Williams %R (14): | -0.77 | |

| Chande Momentum Oscillator (20): | 2.660 | |

| Repulse (5,40,3): | 5.9180 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0940 | |

| Courbe Coppock: | 3.93 |

| MA7: | 49.195 | |

| MA20: | 48.779 | |

| MA50: | 50.264 | |

| MA100: | 49.082 | |

| MAexp7: | 49.573 | |

| MAexp20: | 49.226 | |

| MAexp50: | 49.470 | |

| MAexp100: | 48.860 | |

| Price / MA7: | +3.95% | |

| Price / MA20: | +4.84% | |

| Price / MA50: | +1.74% | |

| Price / MA100: | +4.19% | |

| Price / MAexp7: | +3.16% | |

| Price / MAexp20: | +3.89% | |

| Price / MAexp50: | +3.38% | |

| Price / MAexp100: | +4.67% |

News

The latest news and videos published on TOTALENERGIES at the time of the analysis were as follows:

- TotalEnergies: Disclosure of Transactions in Own Shares

- TotalEnergies SE: Statement in Compliance With the Article 223-16 of the General Regulation of the Financial Markets Authority (Autorité des marchés financiers)

- Floating Offshore Wind in France: TotalEnergies, Corio Generation and Qair Join Forces to Bid for Mediterranean Tender

- TotalEnergies: Disclosure of Transactions in Own Shares

- TotalEnergies: Financial Report – 1st half 2022

Add a comment

Comments

0 comments on the analysis TOTALENERGIES - Daily