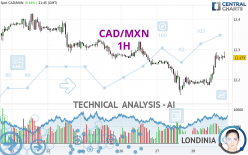

CAD/MXN - 1H - Technical analysis published on 03/28/2024 (GMT)

- 120

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The CAD/MXN rating is 12.273 MXN. The price has increased by +0.66% since the last closing and was traded between 12.181 MXN and 12.294 MXN over the period. The price is currently at +0.76% from its lowest and -0.17% from its highest.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by CAD/MXN:

New LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this 1H chart of CAD/MXN indicates that the overall trend is bullish. The signals returned by the moving averages are 67.86% bullish. This bullish trend is reinforced by the strong signals currently being given by short-term moving averages. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : Moving Average 50

Type : Bullish

Timeframe : 1 hour

Moving Average bullish crossovers : MA20 & MA50

Type : Bullish

Timeframe : 1 hour

An assessment of technical indicators shows a strong bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

RSI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : 1 hour

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 11.700 | 12.149 | 12.212 | 12.273 | 12.316 | 12.421 | 12.491 |

| Change (%) | -4.67% | -1.01% | -0.50% | - | +0.35% | +1.21% | +1.78% |

| Change | -0.573 | -0.124 | -0.061 | - | +0.043 | +0.148 | +0.218 |

| Level | Major | Intermediate | Minor | - | Intermediate | Minor | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 12.024 | 12.086 | 12.140 | 12.202 | 12.256 | 12.318 | 12.372 |

| Camarilla | 12.161 | 12.172 | 12.182 | 12.193 | 12.204 | 12.214 | 12.225 |

| Woodie | 12.019 | 12.084 | 12.135 | 12.200 | 12.251 | 12.316 | 12.367 |

| Fibonacci | 12.086 | 12.131 | 12.158 | 12.202 | 12.247 | 12.274 | 12.318 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 12.033 | 12.161 | 12.235 | 12.363 | 12.437 | 12.565 | 12.639 |

| Camarilla | 12.254 | 12.272 | 12.291 | 12.309 | 12.328 | 12.346 | 12.365 |

| Woodie | 12.006 | 12.148 | 12.208 | 12.350 | 12.410 | 12.552 | 12.612 |

| Fibonacci | 12.161 | 12.238 | 12.286 | 12.363 | 12.440 | 12.488 | 12.565 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 12.178 | 12.366 | 12.466 | 12.654 | 12.754 | 12.942 | 13.042 |

| Camarilla | 12.487 | 12.513 | 12.540 | 12.566 | 12.592 | 12.619 | 12.645 |

| Woodie | 12.134 | 12.344 | 12.422 | 12.632 | 12.710 | 12.920 | 12.998 |

| Fibonacci | 12.366 | 12.476 | 12.544 | 12.654 | 12.764 | 12.832 | 12.942 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 68.37 | |

| MACD (12,26,9): | 0.0180 | |

| Directional Movement: | 22.122 | |

| AROON (14): | 78.571 | |

| DEMA (21): | 12.259 | |

| Parabolic SAR (0,02-0,02-0,2): | 12.259 | |

| Elder Ray (13): | 0.032 | |

| Super Trend (3,10): | 12.223 | |

| Zig ZAG (10): | 12.277 | |

| VORTEX (21): | 1.2230 | |

| Stochastique (14,3,5): | 84.49 | |

| TEMA (21): | 12.281 | |

| Williams %R (14): | -16.81 | |

| Chande Momentum Oscillator (20): | 0.084 | |

| Repulse (5,40,3): | -0.0050 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0110 | |

| Courbe Coppock: | 1.27 |

| MA7: | 12.296 | |

| MA20: | 12.395 | |

| MA50: | 12.576 | |

| MA100: | 12.649 | |

| MAexp7: | 12.266 | |

| MAexp20: | 12.240 | |

| MAexp50: | 12.236 | |

| MAexp100: | 12.260 | |

| Price / MA7: | -0.19% | |

| Price / MA20: | -0.98% | |

| Price / MA50: | -2.41% | |

| Price / MA100: | -2.97% | |

| Price / MAexp7: | +0.06% | |

| Price / MAexp20: | +0.27% | |

| Price / MAexp50: | +0.30% | |

| Price / MAexp100: | +0.11% |

News

Don't forget to follow the news on CAD/MXN. At the time of publication of this analysis, the latest news was as follows:

Add a comment

Comments

0 comments on the analysis CAD/MXN - 1H